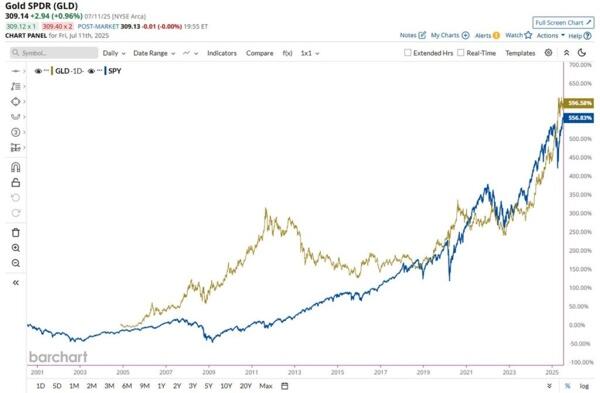

This is not about Germany. The country is simply following the same scrip that ALL countries have followed in the past and present when confronted with a slowing economy and dwindling fiscal revenues. Germany is just the latest domino to fall. Short term expediency has always been preferred to long term prudence which promises little but harsh times ahead. Here we'll get a much worse outcome but later which is perfect for all politicians at any time in history. The old time French nobility was talking in jest of burning the furniture and the timber frame of the castle to keep warm a few more days! Germany will now follow the lead of France, Italy and Belgium in Europe. Japan in Asia although the debt structure of Japan is different since it is mostly owned by Japanese and can therefore be repressed with low returns to a much greater extend. And of course the US which having access to the main world currency also benefit, for now, of less strict conditions. (Until investors start fleeing the dollar. We are getting close but we are not there yet.)

So what comes next, then? History is telling us that first we'll get punishing interest rates, then restrictions on foreign exchange and investment. Once these measures are in place, interest rates will become controlled, voluntarily or not. War bonds for example. At each stage, history will accelerate. When the Europeans are telling us that they expect to be at war with Russia by 2027, they are indirectly telling us that they expect to be bankrupt by that time and that consequently war will be used to have restrictions accepted by the population. I believe that they would be very lucky if all this profligacy can last another two years. But who knows, maybe two years. Just remember that this is an upper limit. Any black swan before that and the budgets are toast!

The European Disease: Germany Enters The Debt Spiral

by Thomas Kolbe

Germany is on a path to losing its reputation as a fiscally responsible state. Through unchecked spending, the federal government is steering the country into stormy waters.

On Thursday, Handelsblatt reported a new budget gap. By 2029, previously unfunded additional debts are expected to grow from €144 billion to €150 billion, according to several government sources. These are not part of the planned federal debt but come on top of it. Most recently, the coalition agreed to bring forward a planned pension supplement for mothers to 2027, adding another €4.5 billion in spending.

It must be said clearly: Under Chancellor Friedrich Merz, Germany has abandoned its last efforts at fiscal seriousness and conservative budgeting. The costs of a shaky coalition’s political consensus, designed to avoid conflict, are being offloaded onto taxpayers.

A Predictable Crash

These numbers are already alarming—but we are still in the calm before the storm. In 2025, the net new debt ratio is expected to reach 3.2% of GDP. This includes roughly €82 billion in new federal debt, €15 billion in additional borrowing from states and municipalities, and about €37 billion in federal “special funds”—off-budget shadow debt.

This forecast will collapse the moment the German economy sinks deeper into recession. Rising unemployment and falling tax revenues will put further strain on the federal budget and social welfare funds. While politicians still feel safe with public debt at 63% of GDP, once we include the €1 trillion debt program of the Merz government, debt levels could surpass 90% of GDP by the end of the decade.

Germany is now practicing a kind of fiscal policy most citizens are unfamiliar with. Mediterranean habits have arrived—but not in the form of sunny weather, rather in the mismanagement of public finances.

Tax Revenues Can No Longer Fill the Gaps

In a display of unprecedented hubris, German politics has kept its welfare state wide open for migration-driven poverty over the past decade—causing not only fiscal but also cultural and economic disarray. Added to this is the aging population and a self-inflicted economic crisis. All signs in the welfare system now point toward disaster.

By 2025, a combined deficit of over €55 billion is expected — foremost in statutory health insurance, which will run a record shortfall of nearly €47 billion. Long-term care insurance adds a further €1.6 billion in losses, and the pension fund faces a shortfall of roughly €7 billion.

Once touted as a system “fit for future generations,” Germany’s welfare model has become a bottomless pit. Federal bailouts, emergency loans, and ever-higher contributions now characterize a social state entering the early phase of collapse.

Vae victis — woe to the vanquished — and blessed are those who foresaw this descent and had the means to escape the welfare-state trap. The bill is now being paid by the quietly suffering workforce — the heroes who absorb the fallout from the reckless debt policies through their labor and lost time.

Social policy today is primarily a repair shop for damage caused by political interventionism. In trying to fuse artificial social glue into society, the state’s share of GDP has risen to 50%. Despite massive tax hikes—think CO2 levies, road tolls, property taxes, and cold progression—the gap between government spending and actual tax revenue keeps widening.

Since pre-lockdown times, public spending has jumped by around one-third, while real tax revenues have only increased by 14%. Even an economic illiterate could deduce that this mismatch requires structural correction—urgently.

The Crossroads Ahead

But there’s no sign of retreat in Berlin. The political competition among statist parties—including the CDU—produces only one outcome: larger social budgets, endless benefit promises, and deeper interference in the economy.

With dogmatic loyalty to climate policy and open-border ideology, the German state stumbles blindly toward a crossroads. Budgetary crises can’t be timed—they arrive when governments lose the ability to borrow on the capital markets. As Hemingway once said about bankruptcy: “First slowly, then suddenly.”

Once that moment comes—when bond markets say no—a society faces two paths: total statism or radical economic liberalism. In the former, both energy and capital markets fall under state control, as economic management turns authoritarian. This is the road Germany is currently on.

The alternative is the one Argentina has chosen under President Javier Milei—symbolized by his now-famous chainsaw. That route returns to a civilization based on limited government, confined to protecting internal and external security.

Europe as a Laboratory

Whether we like it or not, we are all part of a vast social experiment. The question is: Can Europe shed its degenerative socialism—the ideology that has inflicted so much harm on the continent and the world—or will we fall back into infantile patterns, refusing reform out of fear and sentimentality?

France’s budget debate and political paralysis offer a preview of our own future. The French state quota has climbed to 57%. Its open-border policies have failed. Its bloated welfare state has made the country ungovernable.

All this culminates in a permanent state of government crisis—translating into a collapse in public trust. Economic volatility, long suppressed by the welfare state, is now erupting as social unrest in the streets.