For crypto investors, June is the cruelest month ever and the pain just won't go away.

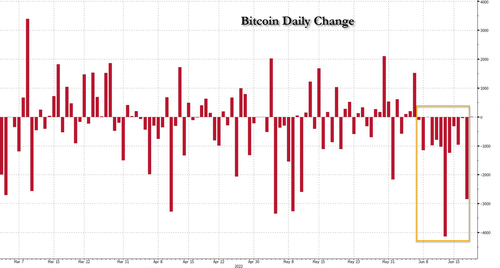

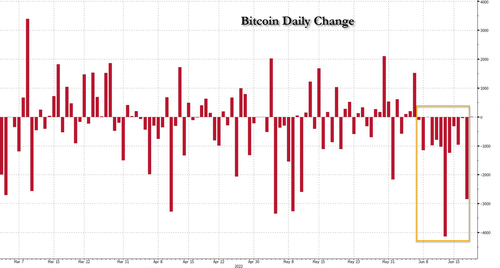

Bitcoin, and the broader crypto sector, are getting crushed - again - for a record 12th day in a row...

...

with the largest token tumbling below $20,000, below $19,000 and even

below $18,000, tumbling as low as $17,629 on Saturday afternoon, having lost nearly 50% of all its value in just the past two weeks and

plunging 75% from an all time high of $67,734 in November, taking out

support after support, even the most important of all: the $19,511 high

from the previous bull cycle (throughout its brief, 12-year trading

history, Bitcoin has never dropped below previous cycle peaks... until

today).

...

as cascading liquidations become self-reinforcing and prompt wholesale

deleveraging of the entire crypto sector, pushing Bitcoin to the most oversold weekly level in history!

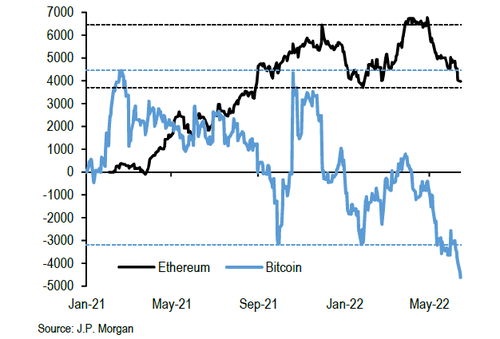

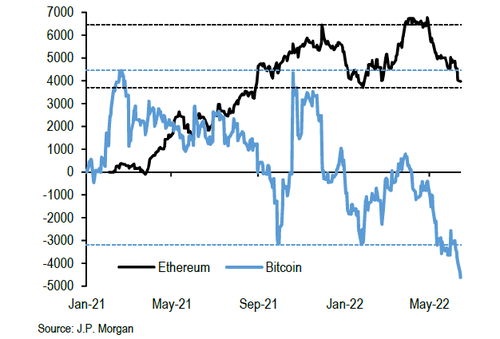

Bitcoin's

closest peer, Ethereum, broke below $1,000 for the first time since

January 2021 and tumbled 19%, to a low of $884 before modestly reversing

losses. According to data from Coinglass, total liquidations in the

crypto market were $435 million in the past 24 hours, with Bitcoin and

Ether at around $202 million and $144.5 million respectively. Altcoins

also suffered the brunt of soured investor appetite, with every token on

Bloomberg’s cryptocurrency monitor trading in the red. Cardano, Solana,

Dogecoin and Polkadot recorded falls of between 12% and 14%, while

privacy tokens such as Monero and Zcash lost as much as 16%.

The

selloff which started in earnest about a month ago, when the collapse of

the the Luna currency which was used to back up the value of Terra’s

UST stablecoin, wiped out $60 billion in market cap and launched an

unprecedented deleveraging shockwave within the crypto DeFi sector,

accelerated last Sunday when the crypto shadow bank Celsius

Network suspended withdrawals from depositors who had been drawn by the

company's ridiculously high interest rates which, as always when someone

offers double digit rates in a time of ZIRP, were too good to be true.

By Friday, Hong Kong digital-asset lender Babel Finance also

froze withdrawals; more are sure to follow.

And

while both firms have scrambled to reassure clients, they are also

quietly working with restructuring advisors to avoid a complete collapse

and getting margin called into oblivion: according to research firm

Kaiko Celsius is drowning in what research firm Kaiko called a

“Lehman-esque” position. As Bloomberg's Michael Regan notes, just like

Lehman Brothers 14 years ago, Celsius’s woes showed how interconnected

big players in this financial system are and how fast contagioncan

spread, making this week’s drama the sequel to last week’s and the

prequel to next week’s.

The crypto drama only ramped up last

Wednesday with an alarming tweet that confirmed speculation which had

been swirling around one of the most influential hedge funds in the

crypto space, Three Arrows Capital. “We are in the process of

communicating with relevant parties and fully committed to working this

out,” one of the firm’s co-founders wrote, without revealing any details

about what exactly the “this” was that it was working out.

On Friday, the WSJ reported that

3AC was considering asset sales and a bailout among its options.

However, without a Fed to bailout out insolvent shadow banks and

brokers, we wouldn't hold our breath.

What is notable is that behind all three recent implosions appears to be exposure to staked Ethereum.

As

Bloomberg notes, analysts have pointed to problems that Celsius was

having with an Ethereum-linked token called staked ETH, or stETH - a

coin designed to be a tradable proxy for Ether that’s widely used in

decentralized finance. The derivative token is designed to provide

liquidity for those who put their Ether holdings in Ethereum’s new

proof-of-stake protocol for high yields but still want to be able to

sell their tokens before the network’s transition is complete and the

lock-in period expires. However, sharp Ether price declines and a

rout in the broader crypto market have prompted stETH holders to sell

and send the token’s price lower than Ether.

Research

firm Nansen also identified Celsius as one of the parties involved when

the UST stablecoin lost its peg to the dollar in May. The episode with

that token, which was driven largely by algorithms and untenable yields

of 19.5% for depositors in the Anchor Protocol, triggered the loss of

tens of billions dollars in the spectacular implosion of the Terra

blockchain.

Nansen’s analysis confirmed that Terra’s Anchor

program had been an important source of yield for Celsius, according to

commentary from crypto exchange Coinbase. “In our view, this likely begged the question of how Celsius could fulfill its obligations without that 19.5% yield,” wrote

the institutional team at Coinbase. That firm, by the way, said this

week it will lay off 18% of its previously fast-growing workforce,

joining other pink-slip-issuing crypto startups such as Gemini and

BlockFi that are struggling amid a relentless plunge in asset prices.

Three

Arrows, too, was a casualty of both the stETH woes and Terra’s

collapse. The fund had bought about $200 million in the Luna currency

used to back up the value of Terra’s UST stablecoin, according to the

Journal. Luna, which sold for more than $119 in April, is now worth

about $0.000059.

Then, over the weekend, more bad news sent

Ethereum tumbling well below $1000 amid speculation of another margin

call liquidation. According to Axios,

over the last few days, crypto watchers have been captivated by two

large linked wallets - positions which supposedly are owned by a major

Chinese entrepreneur transacting on the app Meitu-

that contain $181 million in ether (ETH). They also have collateral in

loans that are right on the edge of solvency. Most of the debts are on

the money market Aave (152,098.98 ETH worth $166 million at the time of

writing, but the rest is on Compound (14,316.90 ETH). This matters

because as the price of ether falls further, the odds are rising that

these debts will be liquidated, unleashing a fresh flood of ether onto

the market, which will drive the price of ether down even further.

The wallets in question are 0x493F and 0x7160. For the first wallet, scroll down to Aave v2

and see the largest loan. Furthermore, these wallets appear to be

related, because they can be seen making larger transfers of ether, from

the former to the latter, here and here, prior to topping up collateral on Compound loans

But can't those traders just close out the loans? Well, no, because the wallets are levered long: the

owner has deposited ETH, borrowed stablecoins, bought more ETH, and

deposited that to borrow more stablecoins to do it again. And so on. ZoomerAnon of the team at DeFi analytics company Uniwhales,

explained that you can see the wallet repeatedly taking stablecoins

liked USDT and USDC, sending it to Binance, and withdrawing thousands of

ethers. Early January, multiple transactions like this could be seen

using Etherscan.

Of course, such leveraged transactions are

nothing new and traders lever long when they believe an asset's price

will go higher. If it does, they can withdraw enough to repay their

loan, withdraw their collateral and come out of the trade with more of

the underlying asset. Of course, all of that only works if the asset's

price goes up. Which it no longer is... meanwhile the wallets were

making bets that ether would go up further back in January, when it was

trading at over $3,300. Today it's barely holding $1,000. "He borrowed 96,040 ETH prior to borrowing any money," ZoomerAnon told Axios.

Surely

at some point the pain will end, and yes it will - one researcher

calculated that the largest position, on Aave, will be liquidated at a

$982 ETH price. Uniwhales put the liquidation price at $870. With

ETH having plunged to that level, crashing as much as 20% on Saturday

alone, it is safe to say that the entire position has been margined out

and liquidated, and the selling pressure will finally ease, if only for

the time being.

Alas, as this problem found its terminal

solution, a new one emerged: Bloomberg reports that MakerDAO, a

long-established decentralized autonomous organization that supports the

stablecoin DAI, has suspended the token from being deposited and minted

in Aave’s crypto lending platform, in what may be a response to the

abovementioned liquidation.

The organization cast the vote to

disable the DAI Direct Deposit Module on Aave, which effectively

prevents traders from borrowing the stablecoin against stETH (there's

that staked ether again), citing adverse market conditions in a post

Friday.

“The reason we believe this is risky is because out of

200 million DAI borrowed on Aave Ethereum v2, 100 million DAI is being

borrowed by Celsius and collateralized mostly by stETH.” Primoz, a

member of the Risk Core Unit Team at MakerDAO said in the Maker Forum.

According to Bloomberg,

Aave, which has a decentralized lending platform where traders can use

arbitrage in transactions while borrowing or lending in the protocol,

earlier proposed a different measure to MakerDAO. The proposal suggested

to freeze the stETH market and increase the token’s liquidation

threshold from 81% to 90% to mitigate the risks from stETH. However,

MakerDAO described the measure as “unacceptable risk” and came up with

its own plan to disable DAI’s deposit on Aave.

In

any case, just as Bear Stearns’s hedge funds were among the first to

reveal problems from the subprime mortgage crisis, Three Arrows is

likely not alone. The “cockroach theory” springs to mind: If you see one

of those nasty bugs scurrying across the floor, chances are there are

plenty more roaches are behind the fridge or under the sink.

Many

in the space would welcome such a cleansing: “What we’re seeing is more

liquidations driving prices and sentiment lower, which triggers more

liquidations and negative sentiment - some flushing-out needed still,

but this will at some stage exhaust itself,” said Noelle Acheson, head

of market insights at Genesis. However, before we get to the full

liquidation phase, there is more deleveraging ahead. According to some,

the hot trade in crypto now is no longer pumping coins “to the moon”

with tweets full of rocket-ship emojis, but trying to find where those

"roaches" are hiding. Some crafty traders have dispatched bots to prowl

blockchains in search of highly leveraged positions in danger of forced

liquidation because the value of their collateral is no longer enough to

back up their loans. If successful, they get a 10% to 15% cut of the

collateral sale -- incentives paid out by automated protocols that are

meant to protect them from insolvency.

Of course, the Fed's recent

"surprise" decision to hike by 75bps (instead of 50bps as Powell

initially said), has not helped sentiment, eased funding stress, or

slowed the margin call onslaught slamming the crypto space.

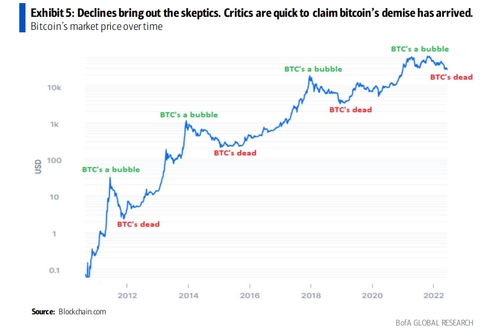

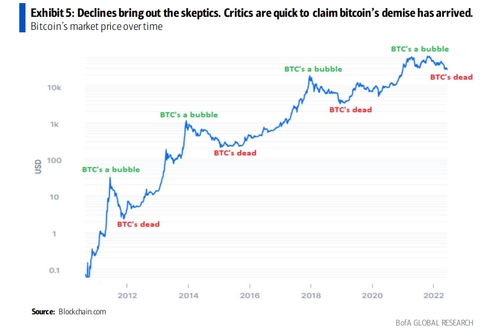

And

while some are quick to declare bitcoin's time of death (it won't be the

first time, as 99 Bitcoins calculates there have been hundreds of bitcoin obits in

the past decade), others see the upside beyond the current deleveraging

episode. In a note published on Friday, Alkesh Shah, head of crypto and

digital assets strategy at Bank of America, said that "investors are

continuing to position defensively following last year’s

liquidity-driven digital asset bull market. Although painful, removing

the sector’s froth is likely healthy as investors shift focus to

projects with clear road maps to cash flow and profitability versus

purely revenue growth."

He goes on to note that "the digital asset

ecosystem is an emerging high-growth speculative asset class with

tokens that are exposed to similar risks as tech stocks" and as such,

"upside is likely capped until risks associated with rising rates,

inflation and recession are fully discounted." Which is correct: the

next catalyst will be the Fed admitting it screwed up again and

unleashing another massive easing cycle some time in late 2022/early

2023 which will send cryptos to new all time highs, in line with Shah's

laconic summary of the bitcoin lifecycle: "Declines bring out the skeptics. Critics are quick to claim bitcoin’s demise has arrived."

Somewhat

unexpectedly, it is none other than JPMorgan quant Nick Panagirtzoglou

who has turned surprisingly bullish on the crypto space. In his latest

"Flows and Liquidity" note published late last week, he looks at the

recent action in the crypto space, where he finds that even bitcoin

futures are now pointing towards extremely oversold territory...

...

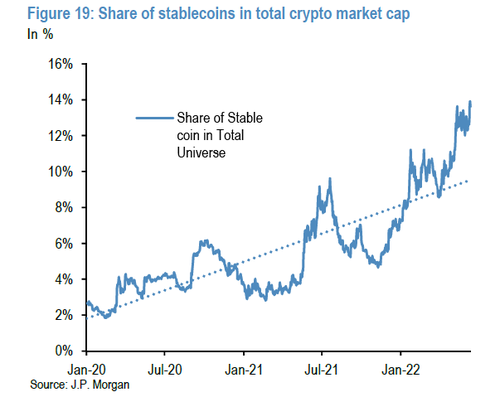

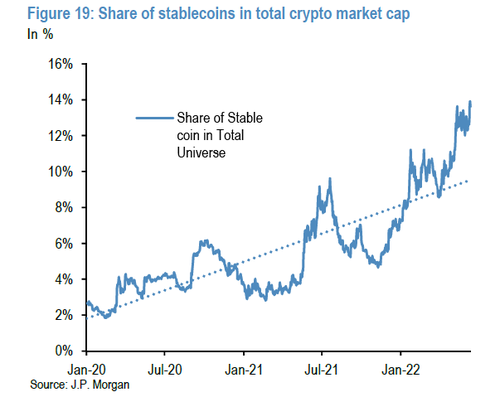

before turning his attention to stablecoins. Reminding readers that in a

previous note he pointed to the high share, of almost 10% at the time,

of stablecoins in total crypto market cap as a catalyst for further

upside for crypto markets at the time, he next asks given the recent

TerraUSD collapse, by how much has the share of stablecoins changed, and

answers "Figure 19 updates the share of stablecoins for the most recent

days. This share currently rose to above 14%, a new historical high

which brings it to well above its trend since 2020." In other words, the

JPM quant concludes, "the share of stablecoins in total crypto

market cap looks excessively high pointing to oversold conditions and

significant upside for crypto markets from here" (the full note is available to ZH professional subs).

While

it remains to be seen if the JPM strategist is correct and this is the

bottom, the pain for crypto investors is compounded by the fact that

unlike traders in "traditional finance", or TradFi, who at least get to

enjoy the weekend ahead of another turbulent week, and get to turn their

machines off on Saturday and Sunday to get some sleep, as the crypto

winter descends upon a three-day holiday weekend with forecasts for

sunny skies in New York, those with heavy exposure to digital assets

will remain glued to their screens, where crypto winter’s deadly

blizzard shows little sign of letting up.

Here, one final comparison between TradFi and crypto traders: in the past decade, even a modest drop in stocks has always, without

fail triggered the Fed to bail out markets and coddle an entire

generation of bulls described aptly by Rabobank's Michael Every as

currently being "in a ball hugging their knees in the corner, shaking their heads and staring into space." On

the other hand, so far in its brief history bitcoin has survived three

70% drawdowns in its history - this will be the fourth one - and it has

always come out stronger on the other side without the Fed's help (in

fact quite the contrary, as the Fed has traditionally done everything it

can to terminally crush fiat alternatives). This time won't be any

different, and once the dust settles, Powell capitulates and the

liquidity firehose goes into overdrive again, a few years from today

everyone will again be asking why they did not take advantage of today's

buying opportunity...