What will the ides of March bring us?

Another more pointed question is: Is the current financial crash managed?

The Central Bankers are not imbeciles. They understand better than anybody that raising interest rates will devastate the banks so the extinction of smaller banks has to be part of their plan.

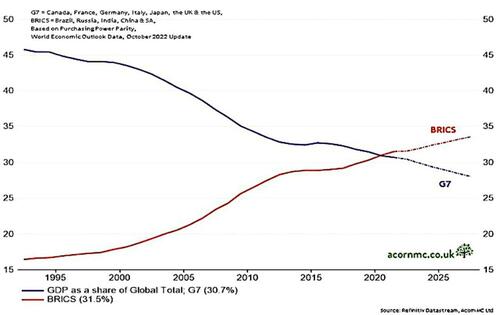

But they are not all powerful either. The current high level meetings between Xi Jinping and Putin are not about Ukraine. They know perfectly well that any plan favorable to Russia will be shot down by the US faster than a skud missile. But building up a viable exchange mechanism between Russia, China and the rest of the world may be a valid reason for the Chinese leader to jump on a plane accompanied by hundreds of civil servants and business men in short order. Likewise, it is very unlikely that so many African heads of state decided to visit Moscow to enjoy an early March Spring.

Clearly time is running short. Covid bought a couple of years under the pretense of reflating the economy to counter the terrible effects of the lock-downs. But no virus of UFO will save the financial system this time. We are not talking about a few trillions dollars or Euros here and there as for Covid but a concerted effort including guaranties of 20, maybe 50 trillion dollars. In other words, a full takeover of the financial system based on CBDC. Nothing less!

Authored by Daisy Luther via The Organic Prepper blog,

There’s

absolutely no doubt that our financial system is in flux right now.

We’re watching a storm approach, and it’s about to envelop the entire

nation in chaotic conditions. If you think things are crazy now, just

hang on to your halo…it’s about to get a whole lot worse.

Remember

how we talked about CBDCs a few weeks ago, and lots of people in the

comments said never, no way, and heck no? Well, unfortunately, it’s

being rolled out and soon.

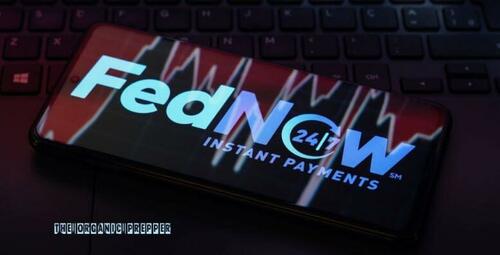

Of course, they’re not calling it CBDCs. Not yet.

It’s under another name, and it’s not quite a federal digital currency. I’m sure this, too, will be called a conspiracy theory,

but the Federal Reserve is launching FedNow, an instant digital payment

system. This in itself is not a Central Bank Digital Currency, but it

puts into place the framework needed to make the idea a reality.

FedNow will be launched in July, according to a press release from the Federal Reserve.

What is FedNow?

On March 15th, in the midst of the banking collapses, the Federal Reserve issued a press release detailing

a new instant payment system that will be launched in July. That system

is called FedNow. Here’s what they said about it.

The

first week of April, the Federal Reserve will begin the formal

certification of participants for launch of the service. Early adopters

will complete a customer testing and certification program, informed by

feedback from the FedNow Pilot Program, to prepare for sending live

transactions through the system.

Certification encompasses a

comprehensive testing curriculum with defined expectations for

operational readiness and network experience. In June, the Federal

Reserve and certified participants will conduct production validation

activities to confirm readiness for the July launch.

“We couldn’t

be more excited about the forthcoming FedNow launch, which will enable

every participating financial institution, the smallest to the largest

and from all corners of the country, to offer a modern instant payment

solution,” said Ken Montgomery, first vice president of the Federal

Reserve Bank of Boston and FedNow program executive. “With the launch

drawing near, we urge financial institutions and their industry partners

to move full steam ahead with preparations to join the FedNow Service.”

Many

early adopters have declared their intent to begin using the service in

July, including a diverse mix of financial institutions of all sizes,

the largest processors, and the U.S. Treasury.

This

has all the hallmarks of a government strategy. First, they offer it as a

“convenience” or a “safety measure.” Lots of people will jump on board

in order to take advantage of this.

Of course, we’ve heard this song before.

Next,

it will be pushed harder, and those who don’t adopt it will be mocked,

thought of as backward, and treated with suspicion. After that, it’ll be

darn near impossible to do anything without it. Sound familiar?

The

Federal Reserve Banks are developing the FedNow Service to facilitate

nationwide reach of instant payment services by financial institutions —

regardless of size or geographic location — around the clock, every day

of the year. Through financial institutions participating in the FedNow

Service, businesses and individuals will be able to send and receive

instant payments at any time of day, and recipients will have full

access to funds immediately, giving them greater flexibility to manage

their money and make time-sensitive payments. Access will be provided

through the Federal Reserve’s FedLine® network, which serves more than

10,000 financial institutions directly or through their agents.

You can find more of the Fed’s sales pitch at FedNowExplorer.org.

This is NOT the digital dollar…yet.

So

let me be perfectly clear. This, in itself, is not the implementation

of CBDCs. Instead, it’s the payment network needed to implement CBDCs.

An infrastructure, in a manner of speaking.

There’s a clear

benefit to the system that will make people want to participate,

especially those who do business online or who transfer large amounts of

money. Who wouldn’t want the proceeds from the sale of their home to be

instantly available?

This is just the system that allows payments

to be made via a federal government network using existing banks.

FedNow could quickly lead to FedCoin and it wouldn’t take much effort at

all.

There is a precedent for federal payment networks turning into federal digital currency.

Just last week, Marie wrote about the

digital identity service that is funded by the US and is being used in

Ukraine. It’s a mechanism of digital control, plain and simple, being

portrayed as something to make the lives of Ukrainians easier.

But

that’s not the only digital program out there we need to be concerned

about as a precedent. A writer for the website BeinCrypto reported several other incidences that could show us our future:

According to global data,

the instant payments ecosystem was valued at $100 trillion in 2021. And

Asian countries like India and China are leading the sector, with the

U.S. slightly late to join the club.

India employs a payment infrastructure based on the Immediate Payment Service (IMPS) and Unified Payment Interface (UPI)

to offer instant payment services to customers and merchants. Global

data show India is the most active market, with transaction volume

hitting $39.8 billion in 2021. With that, India has expanded its e-rupee

pilot as part of its CBDC trials.

China, which ranks second in

that category, has widely used Alipay and WeChat for instant mobile

payments. The nation has also pushed to adopt a digital yuan as its centrally-backed digital currency.

So, to be clear…they instituted instant payment services, then a federal digital currency followed shortly thereafter.

Infrastructure.

Introduction.

It’s a pattern.

Here’s what The Department of the Treasury says about CBDCs.

The

Department of the Treasury has a “CBDC Working Group” exploring the

feasibility of the project. It is coming. And they’re being completely

open about it. Here’s some information from the Dept. of Treasury website:

CBDC

is one of several options for upgrading the legacy capabilities of

central bank money. Another is real time payment systems: The Federal

Reserve has indicated that it expects to launch the FedNow Service this

year, which will be designed to allow for near-instantaneous retail

payments on a 24x7x365 basis, using an existing form of central bank

money (i.e., central bank reserves) as an interbank settlement asset.

In contrast, a CBDC would involve both a new form of central bank money

and, potentially, a new set of payment rails. Both real time payment

systems and CBDCs present opportunities to build a more efficient,

competitive, and inclusive U.S. payment system.

In the United

States, policymakers are continuing to deliberate about whether to have a

CBDC, and if so, what form it would take. The Fed has also emphasized

that it would only issue a CBDC with the support of the executive branch

and Congress, and more broadly the public.[3] Even

as policy deliberations continue, the Fed is conducting technology

research and experimentation to inform design choices so that it is

positioned to issue a CBDC if it were determined to be in the national

interest.

The entire article bears reading. You will have no further doubt this is the plan when you do.

They also mentioned that this will help us to do business with other countries that have CBDCs.

…jurisdictions

around the world are exploring CBDCs. According to the Atlantic

Council’s tracker, 114 countries, representing over 95 percent of global

GDP, are exploring CBDC. 11 countries have fully launched CBDCs, while

central banks in other major jurisdictions are researching and

experimenting with CBDCs, with some at a fairly advanced stage. The

Bank of England (BOE) and HM Treasury (HMT) recently published a

consultation paper assessing the case for a retail CBDC and outlining a

proposed technological model.[12]

BOE and HMT now are entering the design phase of their work, estimated

to take two to three years, after which the BOE and the UK government

will decide whether to build a “digital pound.” In addition, there are

multiple cross-border CBDC pilots, which involve central banks,

international organizations such as the Bank for International

Settlements, and private financial institutions.

Global currency, anyone?

Here’s what has to happen to make this widely accepted.

The

banking crisis of the past few weeks feels like part of the plan to me.

While I know we had many poor economic decisions that have led us to

this point, pulling the plug now seems rather timely.

To make CBDCs widely accepted and even welcome, a few things have to happen first.

1.) Cryptocurrency has to fail. Several

of the banks involved in this crisis have been highly invested in

crypto. Silvergate, which hasn’t been mentioned as much, advertises itself as having “industry-leading banking and payments solutions for innovative digital currency and fintech companies.” The banking crisis is devastating cryptocurrency, which is one of the most anonymous and regulation-free payment methods in the modern world. Anything outside of government control has to go. This video talks more about “killing crypto.”

2.) Inflation has to continue. Keeping

the “value” of digital dollars stable would be a way to “fight

inflation.” Do you want to buy a box of mac and cheese for $3 cash? Or

would you rather pay 1 FedCoin instead? Making a FedCoin an option that

“fights inflation” would get a lot of people to adopt it voluntarily.

3.) People have to be desperate. If

your bank account was suddenly emptied and you had nothing left – no

retirement fund, no savings, no checking, nothing – what would you agree

to in order to restore it all? What if you were offered a bailout but

it was in the form of a different kind of dollar – a CBDC to replace the

dollars you lost, but that you can only use digitally? I’d say yes, and

I think that most of us would. We’ve got bills to pay, we owe on our

mortgages and our taxes, we need groceries, our kids have tuition

due…hell, yes, we’d nearly all say “yes” no matter how grudgingly.

If

those three things happen, we’re in a perfect position for CBDCs to be

forced upon us. It could very likely turn into our only legal tender, as

I’ve written before.

Steve Forbes shares his rather terrifying

thoughts on the potential abuses in a country based on CBDCs, calling it

a “formula for tyranny.”

And if it’s our only legal tender, we’re looking at a cashless society and all the controls that such a thing allows. I wrote about it here.

It would affect nearly every facet of our everyday lives, and every

dime we spend would be subject to surveillance. The potential for abuse

of power and lack of privacy is breathtaking. The government would

literally hold a monopoly on money and financial transactions.