The business model of the Internet was to make money, not to offer you a good deal. And so it started with the deals but come on, you did not think that was going to be the future, right?

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Thursday, April 18, 2024

The Internet is starting to Break - Here's Why.

BRICS - The Project Of The Century

While the world is on the brink of Armageddon, the BRICS move on step by step.

Be certain that at some stage, the project will be interfered with by the G7. This is unavoidable.

In the meantime here's a very complete assessment of the BRICS' project and where they are going.

Authored by Peter Hanseler via VoiceOfRussia.com,

The Western media are prioritizing the Ukraine conflict, the green revolution and the woke revolution. In the shadow of this media coverage, BRICS is changing the world.

We bring you the latest figures and place them in the current geopolitical environment. – An analysis.

Introduction

One of the main topics of this blog is BRICS. We have written numerous articles, followed and analyzed the development of this organization. Significantly, the first independent post on this blog was dedicated to BRICS on November 18, 2022 “The unstoppable rise of the East“.

Our last dedicated BRICS-only article from 24 September 2023 “BRICS will change the world – slowly” gave an overview of the development and summarized the results of the BRICS summit in South Africa in August 2023. This article was published by ZeroHedge, the GloomBoomDoom report by Dr. Marc Faber and Weltwoche (print and online).

From the density of our coverage, it is clear that we ascribe paramount importance to BRICS for the geopolitical and geo-economic development of the world. Based on the facts, we have come to the conclusion that BRICS will change the world more than all other developments of the last 100 years put together. The developments around BRICS have already triggered a tectonic shift in the geopolitical balance of power; the Ukraine conflict and the accelerating crisis in the Middle East are merely pieces of the mosaic by comparison.

The Western media are setting their priorities differently and focusing on topics that we believe are of lesser importance: Mortal enemy Russia, wokeness and green ideology.

Reporting on BRICS in the West, if it takes place at all, is limited to portraying BRICS either as an instrument of China to achieve world power – as the Financial Times put it,

«How the BRICS nations risk becoming satellites of China»

FINANCIAL TIMES – 26 JULY 2023

or to trivialize the success of BRICS – according to the NZZ,

“We explain in the video why this extension only promises limited success.”

NZZ, 14 DECEMBER 2023

Preliminary remarks on the figures

We proceed as we always do and develop a fact-based foundation for a discussion.

Membership doubled as of January 1

Since January 1, Saudi Arabia, Iran, the United Arab Emirates, Egypt and Ethiopia have joined the existing members (Brazil, Russia, India, China and South Africa) as new members.

Argentina not participating

In August 2023, Argentina was invited to become the sixth member. However, the new president of Argentina, Javier Milei, decided not to accept this invitation and to rely on the USA and Donald Trump to rescue his economy.

It is impossible to judge at this point whether this decision will prove to be the right one. For the second largest country in South America, which was once one of the richest countries in the world, it is to be hoped that Milei can pull the cart out of the deep mire. Milei is fighting against the establishment in Argentina, which has driven the country economically to the wall. These former rulers are serious opponents who are fighting for sinecures that Milei must wrest from them if he wants to save Argentina. We hope that Javier Milei can prevail and wish him every success and good luck. The first signs of success appear to be emerging: The country was able to report a positive budget for the first time last month. It seems to be heading in the right direction.

Saudi Arabia

According to Western media reports, Saudi Arabia is not yet fully on board. South African Foreign Minister Naledi Pandor is reported to have told Reuters that “Saudi Arabia has not yet responded to the invitation to join BRICS. It is still being considered”.

Saudi Arabia, or rather the ruling Saud family, has been an ally of the USA since the end of the Second World War, and this relationship has been further strengthened since the agreement of the ” Petrodollar” in 1974.

Since President Biden has been in power, the relationship with the USA has suffered massively, while at the same time cooperation with China and Russia has strengthened to an unprecedented level.

The problem that Saudi Arabia now has is the gigantic investments that the state and private individuals have made, particularly in the USA and the UK. Government investments in the USA alone amount to over USD 35 billion and investments in the UK are said to be around USD 75 billion. Due to the geopolitical situation in the world and the West’s aggressive sanctions policy, the concerns of Saudi Arabia that these investments could be confiscated in the event of a BRICS accession are definitely justified. As Saudi Arabia is important to BRICS and China has overtaken the US as Saudi Arabia’s largest trading partner, we expect Saudi Arabia to join BRICS as soon as China might make commitments to the Saudis in the event of Western expropriation.

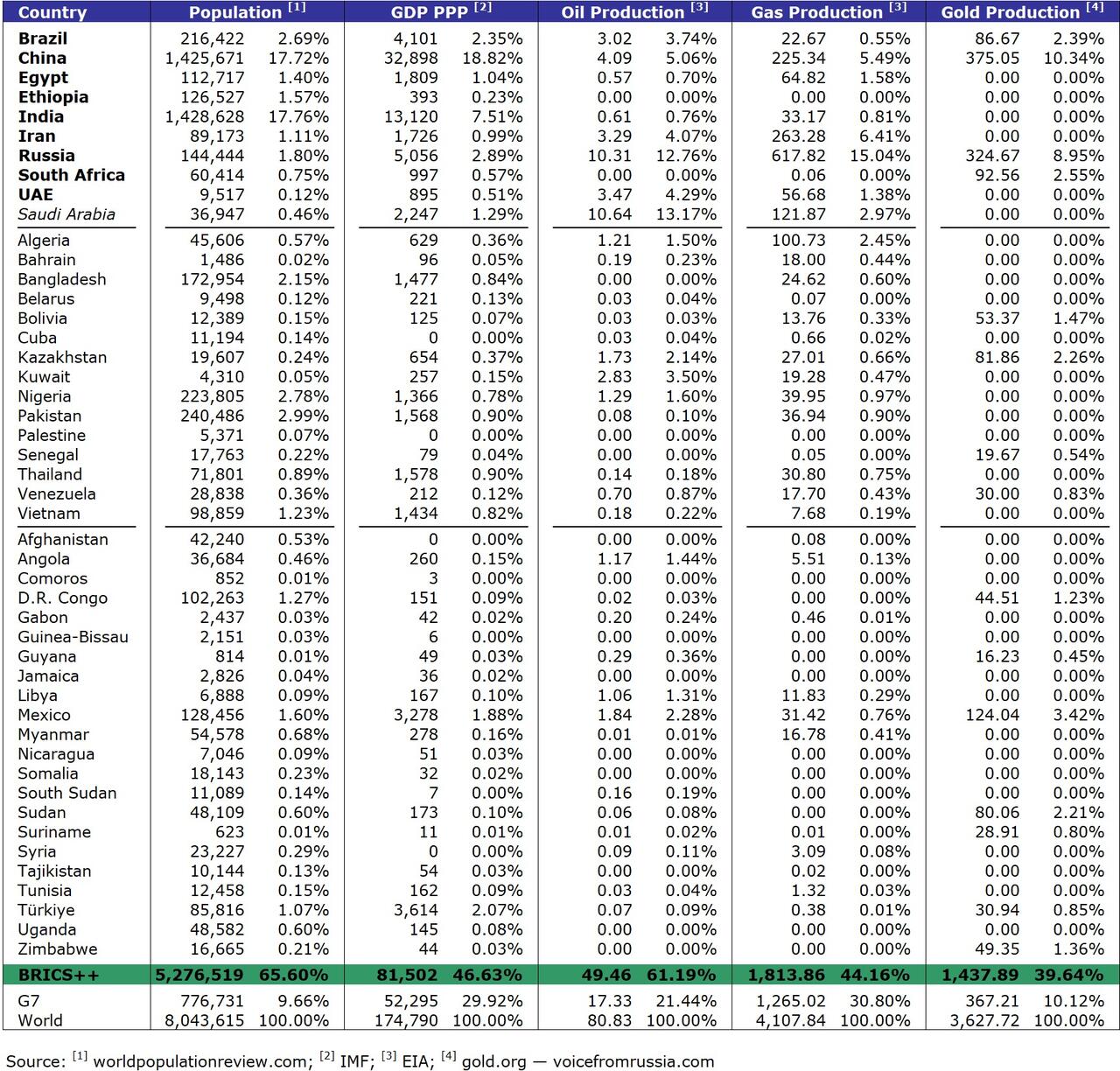

BRICS-10 in numbers

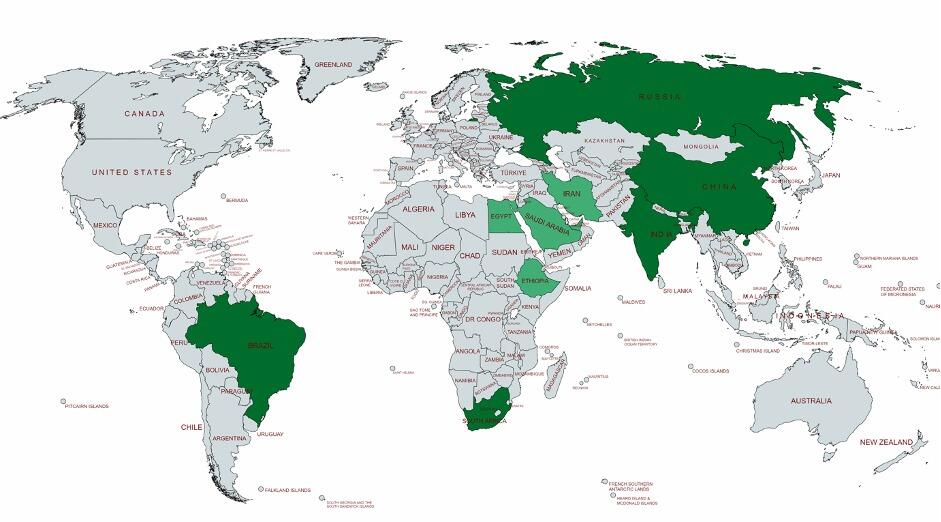

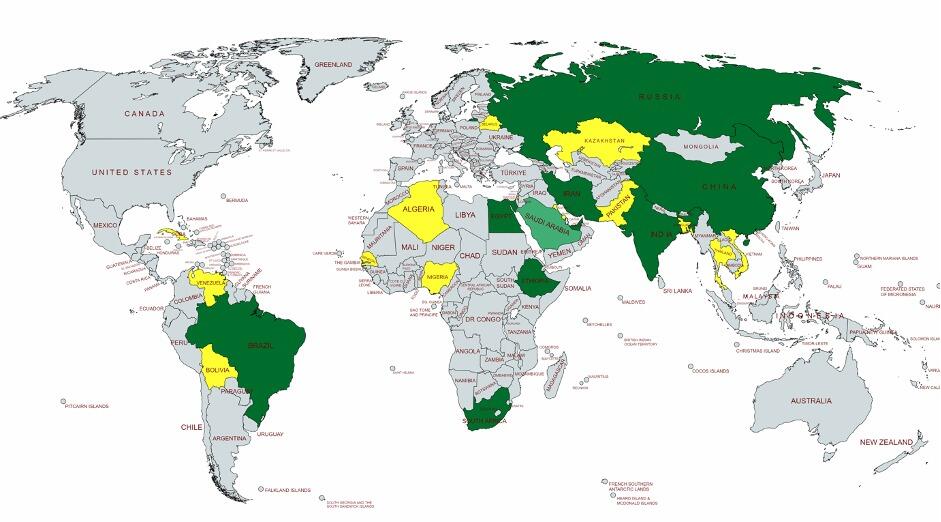

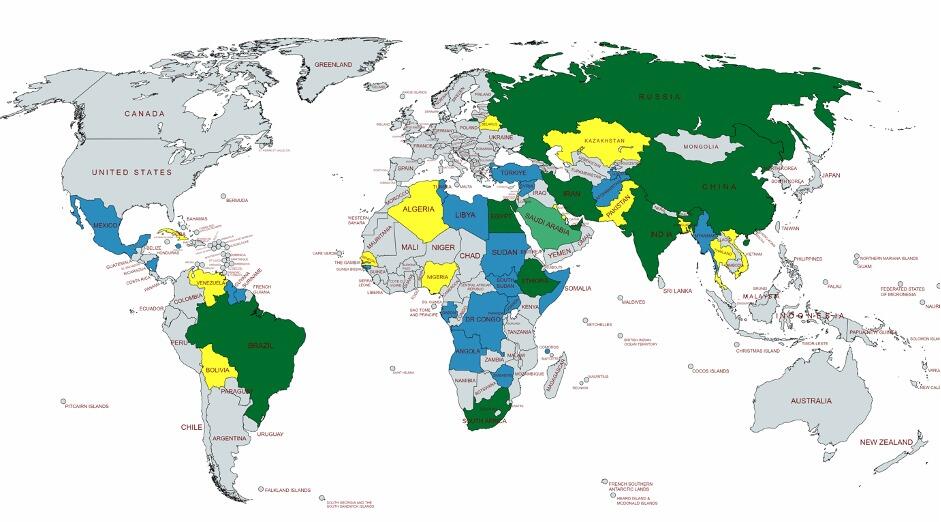

Map

Dark green BRICS until August 2023 – light green – the new BRICS members – Source: VoicefromRussia

Numbers

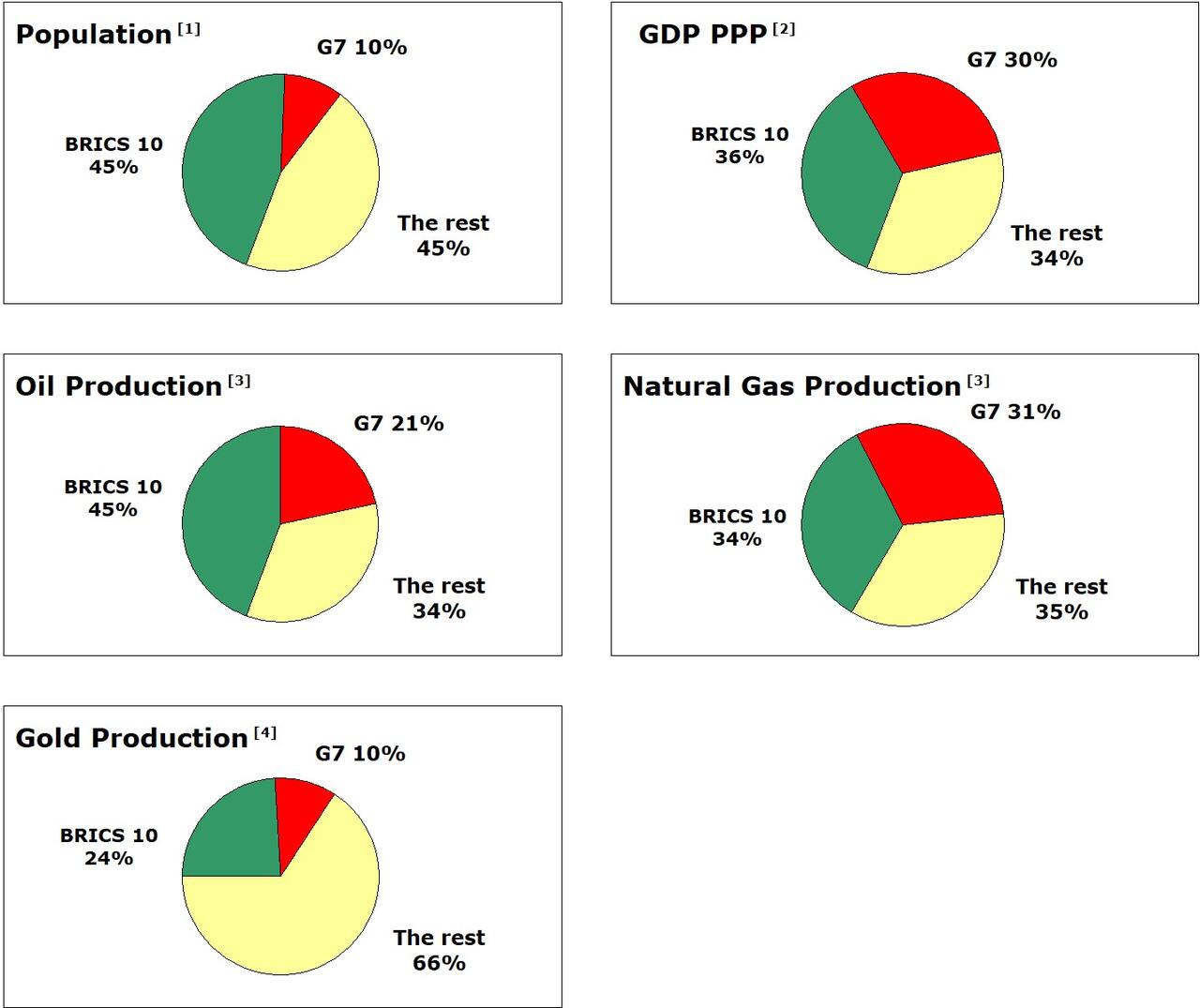

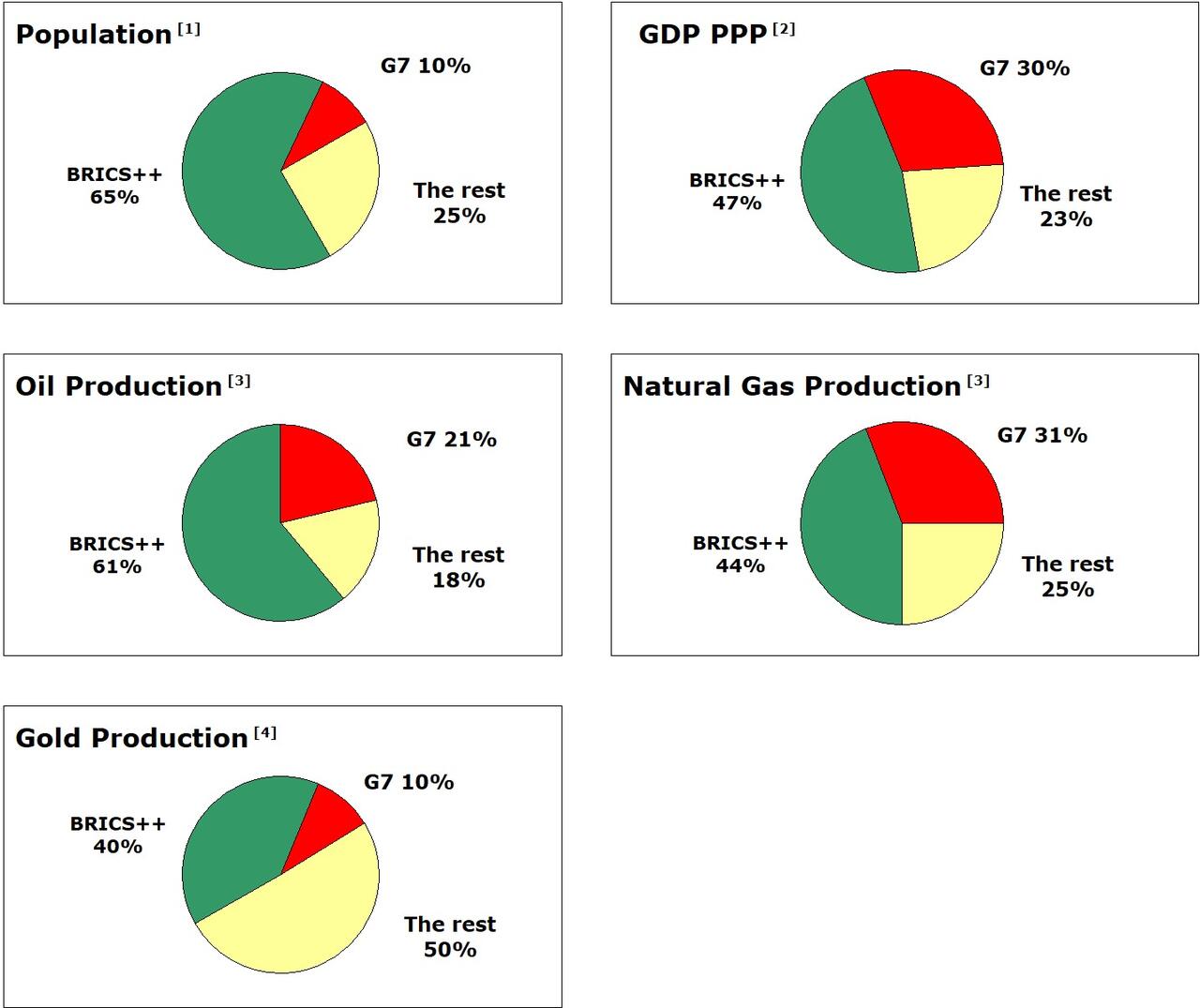

In our figures, we compare the BRICS-10 with the G7 and the world as a whole to give you a feel for the ratios. The parameters we use are population, GDP (adjusted for purchasing power), oil production, gas production and gold production.

We show the gross national product adjusted for purchasing power. If you use the US dollar as a measure of GDP, the economic power of a country is distorted: if you want to measure financial strength realistically, it makes a big difference whether, for example, a Big Mac in US dollars costs twice as much in one place as elsewhere. The so-called Big Mac Index is reason enough to use purchasing power-adjusted figures when comparing GDP figures. The reason why Western media use the unadjusted figures is pure marketing to disguise the devaluation of the US dollar and make it appear stronger than it is.

Charts

Graphical representation of the figures – Source: VoicefromRussia.

Interim result

All factors show that the BRICS 10 far outstrip the G7 and it seems incomprehensible that the West is simply suppressing this fact. A look beneath the surface reveals facts that reinforce the impression of the bare figures.

Assessment of these figures

Oil production

The following additional facts should be taken into consideration when evaluating the oil production figures:

Firstly, although the USA is still the largest oil producer in the world, accounting for around 18% of global production, it also consumes the most oil, with a share of over 20%. This means that the USA is currently not even able to cover its own consumption. This fact alone is a compelling reason for the US to pressure Saudi Arabia not to join BRICS.

Secondly, the major oil-producing members of BRICS have a great deal of influence or even control over OPEC. As BRICS thus also controls OPEC and therefore controls the price and distribution of a large proportion of oil, BRICS can be said to have an (indirect) monopoly position.

Thirdly, the production costs for US oil are around 2.5 times higher than the production costs for Saudi oil.

These factors therefore further strengthen the BRICS’ position of power with regard to oil.

Natural gas

With regard to natural gas, it should be noted that with Iran’s accession to BRICS, the two largest natural gas producers in the world are joint members of BRICS: Russia and Iran.

The largest non-BRICS gas producer is Qatar, which is (still) allied with the USA. BRICS is therefore also a real center of power when it comes to natural gas.

Gold

With regard to gold, it should be briefly mentioned that China and Russia are number 1 and 2 in global gold production respectively. I mention gold here because there is a good chance that gold will again play an important role in future monetary systems at some point – more on this below.

Russia holds the BRICS chairmanship in 2024

Over 220 BRICS conferences will be held in Russia over the course of 2024. The topics are diverse: science, high technology, healthcare, environmental protection, culture, sport, youth exchange and civil society.

President Putin’s statements at the beginning of the year at the opening event of BRICS 2024 in Moscow were interesting. He mentioned several times the closer cooperation between the members on security issues. It seems that BRICS will therefore not only focus on economic aspects, but also on security-related aspects more and more. The apparent coordination of the BRICS states in connection with the Middle East conflict at the UN in New York clearly indicates close cooperation on non-economic issues.

Various non-official sources have reported that the SCO (Shanghai Cooperation Organization) is moving closer to BRICS and may even merge with it. In addition to China, India, Kazakhstan, Kyrgyzstan, Pakistan, Russia, Tajikistan and Uzbekistan, Iran has also been a member of the SCO since July 2023.

This is extremely important due to the heightened geopolitical tensions and the two major conflicts in Ukraine and the Middle East. If these two organizations were to merge, there would be a new counterweight to NATO. NATO is already increasingly being characterized by experts as a mere chattering club, particularly due to its performance in the Ukraine conflict, which was not a success. As a result, NATO has almost lost its threatening potential. If the BRICS-SCO merger becomes a reality, NATO would finally degenerate into an empty shell.

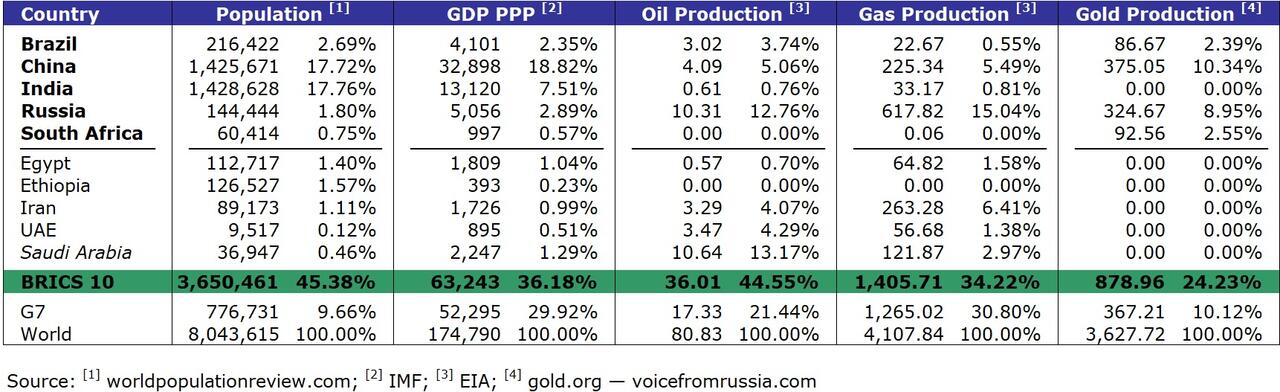

Formal applications for admission – BRICS+

Candidates

Algeria, Bahrain, Bangladesh, Bolivia, Kazakhstan, Cuba, Kuwait, Nigeria, Pakistan, Palestine, Senegal, Thailand, Venezuela, Vietnam and Belarus have formally applied for membership.

Green: BRICS 10 (light green Saudi Arabia) – Yellow: formal membership applications

Figures

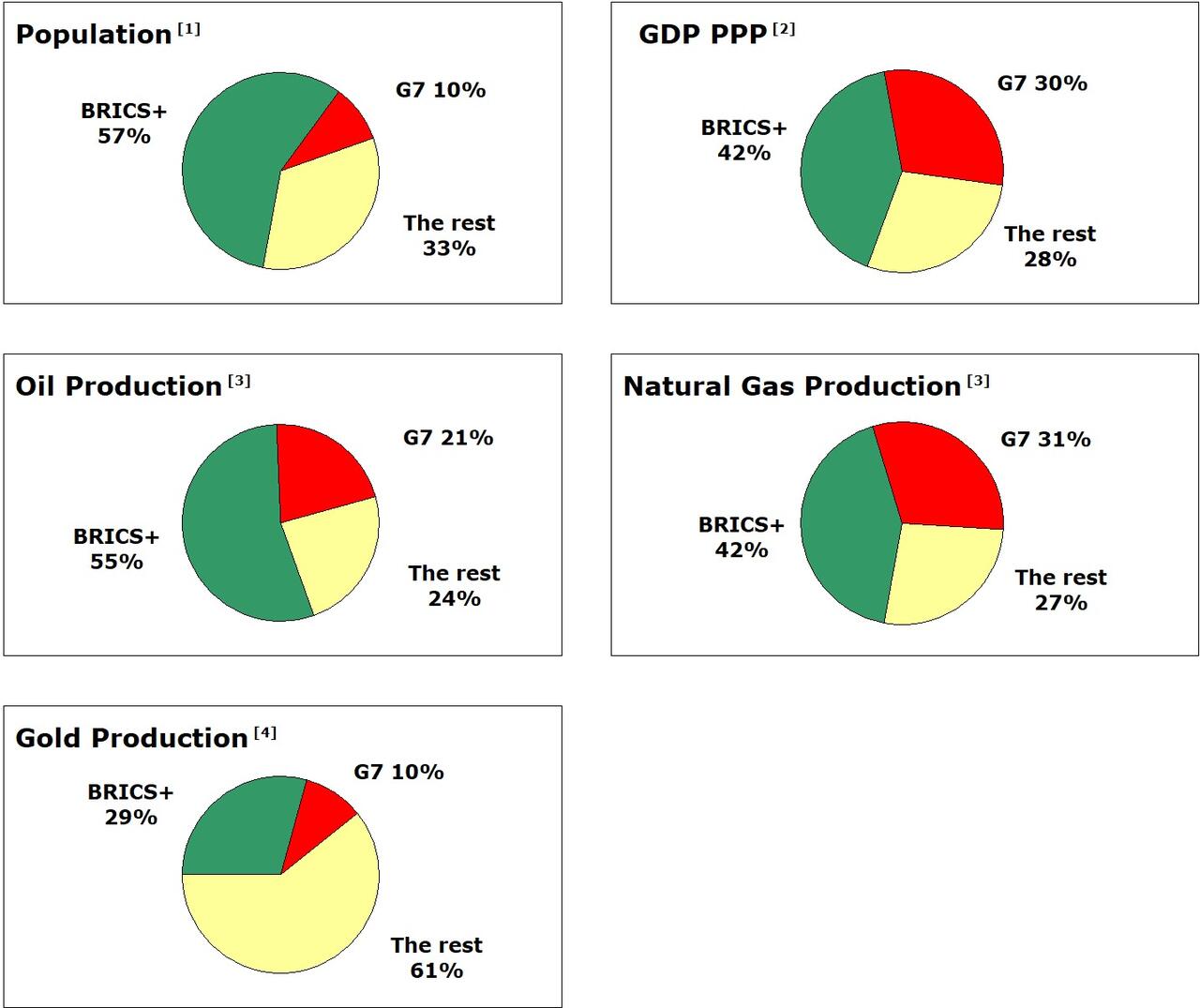

Charts

Assessment

It should be noted in this list that the formal applicants will probably not all be admitted in 2024. This illustration shows the maximum and the broad formal interest in this organization. The applications for admission from some countries harbor great potential for conflict with the USA.

In my opinion, the greatest potential for conflict from an American perspective is the possible accession of Mexico, Cuba and Venezuela. Mexico’s membership would be seen by the USA in the same way as the Soviet stationing of nuclear missiles in Cuba in 1962 – “enemy on the doorstep of the USA”. This is probably also the reason why it was reported on March 3 that Mexico had not submitted a formal application for membership. Fear is breathing down the necks of the Mexicans and the USA is exerting pressure in the background.

In Venezuela, the country with the

world’s largest oil reserves, the US has been trying for years to

overthrow President Maduro and install a puppet.

Last August, it was not enough to gain admission and

the USA will do everything in its power to prevent this oil giant from

joining. However, the USA has a losing hand with the Venezuelan

population, as it is imposing sanctions on the beleaguered country to

bring about a collapse and accepting that the Venezuelan people are

suffering from hunger.

The list of formal applications for admission could therefore change considerably between now and October, when the decisions on who will be invited to Kazan are made. What is certain, however, is that the G7 – especially the United States – is devoting huge energies to slowing down the development of BRICS. In my opinion, however, this organization is already too powerful to be weakened by the West.

BRICS turns its back on the US dollar

The petrodollar – US dollar as a reserve currency

The greatest danger of this ever stronger community is to the USA. We have discussed many times that the Petrodollar is the real foundation of American supremacy and not the American armed forces.

It is of existential importance for the USA that international trade, especially commodity trade, is conducted in US dollars. We explain why.

The US dollar as a global trading currency means that practically all countries have to hold US dollars in reserve in order to be able to settle their trade invoices. This makes the US dollar a reserve currency.

However, central banks do not hold the US dollar in cash, but in US government securities in order to earn interest. This makes the world’s central banks the biggest buyers of US government securities, regardless of whether they think they are a good investment. As a result, the US can refinance its debt on terms that are not based on the strength of the US economy, but on these systemic purchases. French President Giscard d’Estaing rightly described the petrodollar in the 1970s as an “exorbitant privilege”, as it leads to the automatic refinancing of the USA.

Abuse of this exorbitant privilege

However, the USA has been abusing this privilege for decades. Whenever a country implements something that the US does not like, it is cut off from the US dollar. The US can implement this without any problems, as all US dollar transactions go through the US. The consequences for the country concerned are catastrophic, as it is effectively banned from the commodities trade.

Theft of Russian central bank reserves

However, by blocking the foreign currency reserves of the Russian central bank in March 2023, the US has overstepped the mark, because now the entire Global South is afraid to hold US dollars, as they may suffer the same fate. Although every legal expert declares that the freeze was already carried out without an international legal basis, the West is about to go one step further and prepare the confiscation. This is the unequivocal statement made by Janet Yellen on February 27:

“I also believe it is necessary and urgent for our coalition to find a way to unlock the value of these immobilized assets to support Ukraine’s continued resistance and long-term reconstruction.”

JANET YELLEN AT THE PRESS CONFERENCE BEFORE THE G20 ON FEBRUARY 27, 2024

The EU under Ms. von der Leyen and even exponents in Switzerland are preparing to put this planned raid into practice and thus not only continue to block these funds, but to steal them.

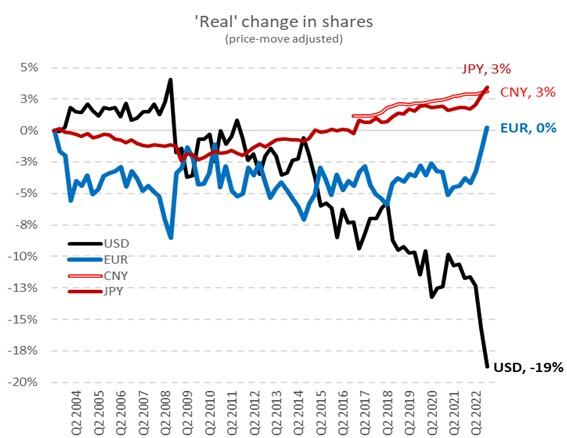

De-dollarization is already here

Until 2022, Russia conducted 80% of its trade in USD and EUR, 50% in US dollars. Today it is only 13%.

In the same period, Russia’s trade activity in roubles and yuan rose from 3% to 34% for both currencies.

These figures are clearly the result of the sanctions against Russia. However, it is a declared goal of all BRICS countries to no longer trade with each other in US dollars, but in the respective local currencies.

If you look at the current size of BRICS – 36% of global GDP – this will herald a tectonic development away from the US dollar; if you add the formal applicants, this figure rises to 42% of global GDP.

According to Bloomberg, the use of the US dollar as a reserve currency is collapsing.

Source: Bloomberg

Consequences for the US

De-dollarization poses an existential threat to the USA, as it will result in the loss of buyers of US government bonds and thus the USA’s ability to refinance its highly deficit-ridden national budget. As US government bonds are a product like any other, whose price is determined by supply and demand, a collapse in demand also leads to a collapse in the price of US government bonds. As the interest rate on bonds moves inversely to the price, the interest rate on bonds and therefore inflation will rise.

Debt in the USA is currently accelerating at an unprecedented rate. Debt currently amounts to over USD 34 trillion. It will soon take just one month to accumulate the next trillion in debt – apocalyptic. When President Reagan was in power, the total US debt amounted to less than one trillion. It therefore took just under 200 years to build up the first trillion in debt; soon this amount of debt will be a reality within a month.

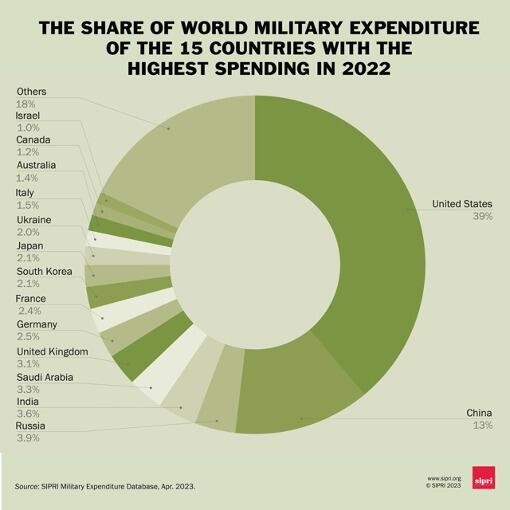

One of the reasons for this is that the USA will already have to pay one trillion US dollars (1,000,000,000,000) in interest payments on its own debt this year alone. This is more than the USA spends on its entire military expenditure, which is gigantic in itself, as the USA spends more money on its military than the next 13 countries combined.

Source: Wikipedia

If the willingness of the countries of the Global South, and in particular the BRICS members, to buy decreases, the USA will sooner or later find itself in an existentially dangerous situation.

BRICS’ own currency

Trading currency

There is a lot of talk about a new currency that would serve as a payment and financing instrument for the BRICS. There were voices – including James Rickards – who were convinced last August that a BRICS single currency would be created as early as 2023. We were skeptical about this timing and took the view that it would take longer, and we were right. However, this does not mean that James Rickards was wrong, he was just a little early.

We have seen above that the BRICS countries are in fact hardly using the US dollar among themselves any more, instead using their local currencies.

Use of local currencies

The consequence of this is that the BRICS members accumulate currencies of their trading partners over the course of a trading year if they sell more goods than they buy. Example: Russia and India use Roubles and Rupees in their trade. Since Russia sells more to India (especially raw materials) than India sells to Russia, the Russians are sitting on large amounts of Rupees at the end of the year. This problem arises regularly throughout the BRICS region among the various members in bilateral trade when deficits or surpluses build up.

Settlement with gold

I believe that the bilateral use of national currencies will continue for the time being, but that the first step will be to look for a mechanism to balance these surpluses or deficits at the end of a trading year.

Gold is an obvious choice here, not gold calculated in US dollars, Rupees or Roubles, but gold in units of weight. The trade differences at the end of a year or month would be settled in gold (kg or tons). Whether in this case the gold is actually physically delivered or merely recorded in a ledger depends on the trust between the parties. I also assume that in such a case, gold warehouses would be opened in various locations in the BRICS region, where the member countries would store their gold and their holdings would be confirmed by a BRICS auditing company.

A final issue would then be to determine the exchange rate of the local currencies. This seems to be one of the major sticking points so far.

Indications that the trend is towards gold

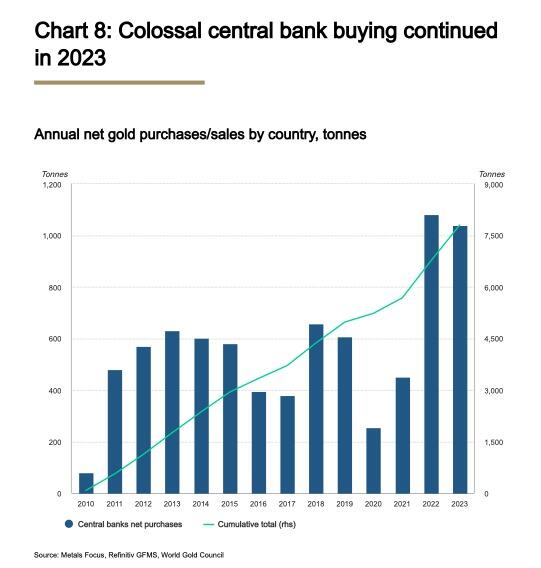

Evidence always comes from the facts. The world produces around 3,000 tons of gold per year.

According to the World Gold Council, central banks have been net buyers of gold since 2010 and the trend in gold purchases has increased steadily in recent years.

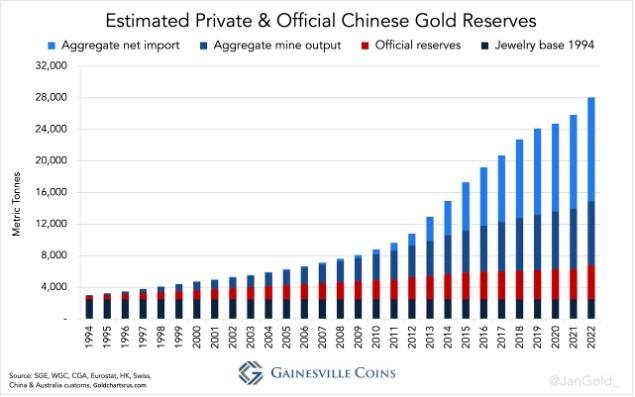

The Chinese bought the most gold (225 tons).

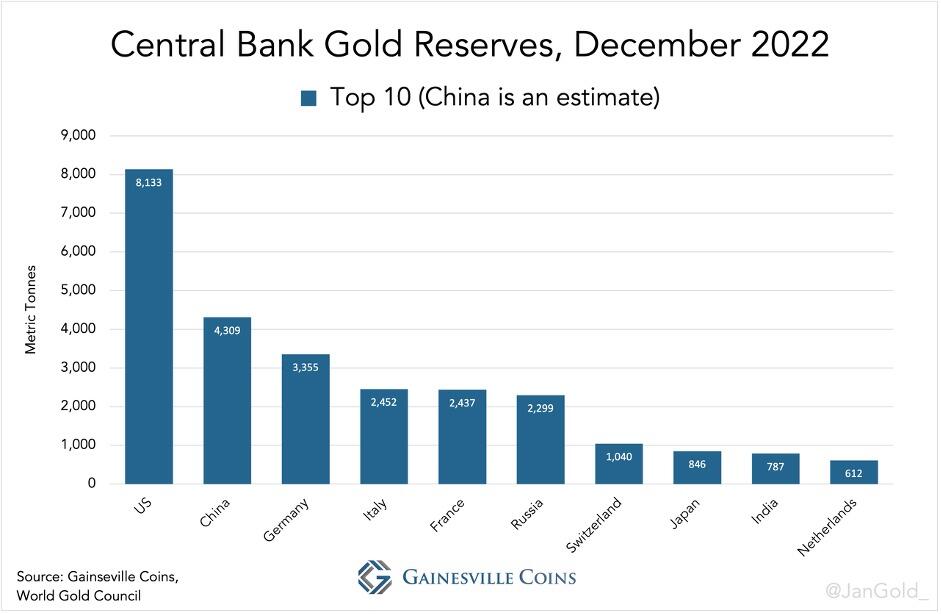

Caution is advised with regard to the official reported gold reserves.

It is very possible – and in my opinion probable – that the gold reserves of China and Russia are much larger than officially reported.

It is clear that central banks are buying more gold than they have since the 1960s. This is an indication that they are not only arming themselves against inflation, but also for the settlement of commodities.

It will be interesting to see what exactly will happen this year, but I assume that at the next BRICS summit, which will take place in Kazan in October, announcements will be made that will surprise the West. In addition to new members, I believe that a trade clearing system as described above or even more is within the realm of possibility.

Future of BRICS – many new members

Preliminary remarks

Looking to the future, BRICS has the potential to unite many countries of the Global South and completely eclipse the Collective West.

We have compiled the data of those countries that are interested in joining. This is for the future, but in times of geopolitical tensions and military conflicts, history teaches us that a lot can happen in a short time, especially after decades, without major changes. For this reason, we are merely providing a framework below and are not making any predictions regarding the timeline, but rather letting the figures speak for themselves and refraining from commenting at this stage.

Map

Green: BRICS 10 – Yellow: formal requests for membership – Blue: countries that show interest

Numbers

Charts

Conclusion

After BRICS became BRICS-10 last August by doubling its membership and thus far outstripping the previous economic colossus G7, the current year is set to continue in giant strides. The gap to the G7 will definitely widen further at the BRICS summit in Kazan. It is still uncertain which of the formal applicants will actually be invited and thus become new members on January 1, 2025.

In my opinion, however, one thing is already a fact: the hegemony of the USA will come to an end as a result of de-dollarization. The combination of astronomical debts, rampant new borrowing and the fact that more and more countries in the Global South are turning away from the US dollar is accelerating the demise of the hegemon that ascended to the throne in 1945 and is increasingly harming itself through its aggressive geopolitics.

No world power has ever left voluntarily and peacefully. The aggressive stance of the USA towards Russia and China and its adherence to the alliance with Israel are de facto proof of the aggressive behavior of the sick hegemon.

This attitude could lead to a war between Russia and NATO in Ukraine, where a local conflict is still taking place, all the more so as the Americans have so far been on the way to inciting France, Great Britain and Germany to wage war against the giant empire.

In the Middle East, the attitude is downright perverse. In order not to alienate the Jewish lobbies in the USA, which traditionally have a major influence on presidential elections, the USA is supporting a genocide that has been clearly designated as such by the International Court of Justice. In addition to purely electoral considerations in the USA, the USA also supports Israel in order not to lose its last power base in the Middle East. These two ends obviously justify the means – and the means is genocide. The Israeli attack on Hezbollah in Lebanon has already begun and so there is ever less in the way of a burning Middle East.

Finally, they are also trying to provoke a conflict over Taiwan – a conflict that would be fought between Chinese and would therefore be a civil war. China’s intention to reach a diplomatic agreement with Taiwan in the next 20 to 30 years – that was the plan – is in jeopardy due to Washington’s aggressive stance.

The behavior of the US is unfortunately typical – the downfall is predetermined, the facts and figures in this article prove it. Whether the smouldering fires already blazing in American society will bring about a change and whether they will be aggressive or more balanced cannot yet be guessed. We will have to wait for the presidential elections in the USA, but a lot can still happen between now and November.

For a geopolitician, the world could hardly be more exciting – but for humanity, a little less tension and pressure would be a blessing. After all, people under pressure, especially politicians, have a tendency to make big mistakes.

WW3! (Or just not yet?)

As we have been documenting over the last couple of years, the world was slowly heading towards WW3 as an unavoidable consequence of the financial disaster of the last 30 years. The brazen attack of the Iranian Embassy in Syria followed by the retaliation bombing of Israel marked an acceleration of the slide. The bombing of Iran just now will probably be the threshold towards actual war. (Or just another step. It makes little difference. War is a process, not an event. History will decide later which were the significant "events".)

To be continued!

Update-1: The air space over Iran is now closed. Bombing has been confirmed over several sites.

Update-2: Damage control. All "drones" intercepted... A bombing without consequences, just for the sake of it?

To be continued!

Futures Tumble, Oil And Gold Soar On Reports Of "Huge Explosions" In Central Iran, Israeli Airstrikes In Iraq And Syria

And just like that, Israel - having once again ignored Biden's pleadings not to escalate the already tense situation - is retaliating against Iran's weekend strike, which was itself a retaliation against Israel bombing Iran's embassy in Syria on April 1.

Moments ago futures dumped, oil prices spiked, and treasury yields slumped amid social media reports and Reuters headlines that there have been three "huge explosions" near the central Iran cities of Natanz (location of an Iranian nuclear power plant) and Isfahan (location of the Iranian Nuclear Technology Center which is suspected of being the center of Iran's nuclear weapons program), as well as simultaneous explosions in Iraq and Syria, where the Israel air force appears to be targeting pro-Iranian militias.

IRANIAN MEDIA: 3 HUGE EXPLOSIONS WERE HEARD IN ISFAHAN, SOUTH OF TEHRAN

JERUSALEM POST: SIMULTANEOUS EXPLOSIONS REPORTED IN IRAN, SYRIA, AND IRAQ ACCORDING TO INITIAL REPORTS

IRAN'S FARS NEWS AGENCY SAYS EXPLOSIONS HEARD IN CENTRAL ISFAHAN AIRPORT, REASON UNKNOWN

ISRAELI MISSILES HIT IRAN SITE, US OFFICIAL SAYS: ABC

Neom - The Line - The Rise and Fall of Saudi Arabia's Linear City (Video - 32mn)

If you've never heard about Neom, you've lost nothing!

It is an amazingly absurd project actually being built in Saudi Arabia. (it Won't!)

But if you'd like to know more about the project, here's a factual and rather funny description.

That's what money does: Make you believe your own hype and waste a fortune chasing shadows or mirage here since we are in the desert.

Orwell's 1984 book was surprisingly prescient.

War is Peace

Freedom is Slavery

Ignorance is Strength

Are we there yet? Not quite but getting closer fast!

Mainstream Media is dying!

This on the one hand is a good news: People now realize that Western Media are little more than propaganda for the government and public relations for big corporations. The less good news is that as people scramble over the Internet to find alternative news sources, the governments the world over scramble to control and limit these sources to the best of their abilities.

The control of information over YouTube and Facebook is already Orwellian but is only the beginning. We can expect an almost complete ban on alternative news within the next couple of years with the help of AI. At that stage, we'll probably need new ways to communicate, Bitcoin-like using distributed systems...

Senate Can Stop Expansion Of Government Surveillance

To some extent, this article shows that the US is not yet completely lost for the purpose of individual freedom. This said, as for democracy, it is more and more empty words and shenanigan. Freedom from the state is not a right but something that must be fought for and maintained thereafter. Long periods of peace make people weak and complacent. The enlightenment of the late 17th century was a fight to wield power away from the monarch to the people or their representatives. Quickly these representatives represented only the most wealthy segment of the population becoming the new aristocracy: The capitalists and robber barons of the 19C. The oil based prosperity of the 20C re-balanced the power towards the people thanks to higher salaries giving rise to the middle class of the 1960s and 1970s although most of the gains were rolled back during the "free market" revolution of the 1980s and 1990s.

The 21C started with a bang literally on 9/11 in New York and the Patriot Act completely dismantled the rights of the average American. It took a little longer in Europe but eventually, law after law, individual freedoms were rolled back one at a time. What's left now is the right to anonymity, movement and communication. These rights will probably not survive the 2020s.

I find it amazing to remember that one of the grievances of the French Revolution was the ability of the King to open your mail. Today you would probably need to send a rather highly encoded mail to make sure that the NSA or other such agencies in the world can't read your message. 200 years for nothing?

Authored by Bob Goodlatte & Mark Udall via RealClear Wire,

When the U.S. House passed the Reforming Intelligence and Securing America Act (RISAA), which reauthorizes the FISA Section 702 surveillance authority, it overlooked something big – an amendment that would drive the greatest expansion of government surveillance authority in recent history. The Senate has time to correct this and restore balance between the needs of national security and the safeguarding of Americans’ civil liberties.

Section 702 of the Foreign Intelligence Surveillance Act is a legal authority enacted by Congress to enable the surveillance of foreign threats located abroad. But it has increasingly become a means of surveilling Americans located within the United States whose communications are often caught up in the government’s global trawl of data. Section 702 authority has been used millions of times in recent years to query, or target, Americans’ communications. In the House, reformers proposed an amendment to add a warrant requirement before the government can query a U.S. person’s data. That amendment, which failed in a tie vote, was the primary focus of debate on the bill.

As RISAA comes to the Senate, attention is now being cast on another amendment – one from the House Permanent Select Committee on Intelligence (HPSCI) that many have come to call the “Everyone’s a Spy” provision. This measure was portrayed as a “narrow” definitional change to the law concerning electronic communications service providers – big telecom and Internet companies – which obligated them to cooperate with NSA surveillance. These big companies can be compelled to spy for the government, and then be subject to gag orders, forbidding them from telling customers they have been surveilled.

The new expanded definition of the Everyone’s a Spy provision is much broader than what many members of Congress thought. It would give the government the right to similarly compel millions of small businesses that provide Wi-Fi, or have access to routers or other ordinary communications equipment, to act as the government’s partners in surveillance. They, too, would be bound not to tell their customers about this surveillance.

The HPSCI amendment achieves this by including any service provider who has access to equipment that transmits communications. After critics complained that digital loungers in hotel lobbies and coffeehouses would have their data hoovered up by the government, the authors of this amendment provided carve-outs for hotels, restaurants, dwellings, and community centers. This was a good PR move. But this measure still applies to most everyone – owners and operators of any facilities (other than the exempted categories) that house equipment used to store or carry data.

If this became law, millions of American small business owners would have a legal obligation to hand over data that runs through their equipment. These small businesses could be forced to give the NSA direct access to their equipment, or else they might just copy messages en masse and turn them over. And when they’re done with doing their part in mass surveillance, these small businesses would then be placed under a gag order to hide their activities from their customers.

Small businesses are just waking up to what is about to be done to them by the Everyone’s a Spy amendment. Customers are sure to be outraged when they learn that the businesses they patronize are potentially spying on them. All U.S. business might suffer, as this law is sure to also widen the wedge between the United States and European Union on the contentious issue of spying and data privacy. Meanwhile, U.S. consumers and businesses would have no legal way to resist these intrusions. It is easy to see why Sen. Ron Wyden of Oregon (pictured) calls this expansion of government surveillance “terrifying.”

The intelligence community is pressing the Senate to act before this authority lapses on April 19. But the agencies have already secured permission from the FISA Court to continue conducting Section 702 surveillance in its current form until April 2025. So the Senate has plenty of time to act with deliberation. It can boldly strike this toxic Everyone’s a Spy amendment. And considering the popularity of adding a warrant requirement for searching for and accessing Americans’ communications caught up in Section 702 databases, it should do that as well.

Wednesday, April 17, 2024

Ex-Mossad Chief Says Hitting Iran's Nuclear Facilities 'On The Table'

Make no mistake, we are on the very edge of a world war. We may dodge the bullet a little longer but eventually confrontation will happen.

The West is weaker, challenging countries are growing stronger, while the will to compromise is dwindling. If there is a Murphy law for international relations then what could go wrong most probably will.

Several statements were issued by Iranian leaders on Wednesday as they attended a military parade at a base north of Tehran which featured displays of attack drones and ballistic missiles, just days after Iran's unprecedented Saturday night attack on Israel.

The head of Iran's military, Maj. Gen. Abdolrahim Mousavi, addressed the army gathering saying, "Currently, we are in a state of readiness to deal with possible evils, and what we displayed throughout the country today was a small part of our capabilities," as cited in state media.

President Ebrahim Raisi was also present at the same annual military parade. He warned that even the "tiniest invasion" or attack by Israel will result in a "massive and harsh" response.

Shortly after Raisi's firm warning, an interview was published by Sky News in which a former Israeli Mossad intelligence chief declared that as part of Israel's retaliation currently being mulled by the Netanyahu government, striking Iranian nuclear facilities "is on the table."

The former director of the spy agency, named Zohar Palti, described that he has "no doubt" that PM Netanyahu could "attack sensitive facilities" in Iran as some cabinet ministers are urging it.

Palti further said the question of deciding the timing of Israel's retaliation operation is "still ongoing" and that some officials are urging Netanyahu to attack "as soon as possible." However, others in Tuesday's war cabinet meeting argued for getting international backing especially from Western partners.

While Tehran boasts of having "changed the equation in terms of establishing deterrence, The Wall Street Journal aptly describes the current state of things, and the possibility of miscalculation, as follows:

Israel’s military has long followed a clear policy: When enemies strike, hit back so hard they won’t do it again. That deterrence is no longer working.

Iran, after launching a massive missile-and-drone attack on Israel over the weekend, is threatening to strike again if Israel retaliates. Lebanese militia Hezbollah fires at Israeli forces almost every day despite frequent poundings by Israel. And Hamas continues to launch rockets at Israel even after being bludgeoned following its Oct. 7 attacks, which killed 1,200 people, according to Israeli officials.

With no side willing to compromise for fear of showing weakness and all players seeking greater deterrence, the risk of stumbling into a regional war increases.

Meanwhile, the UK, France, and Germany have sent top-ranking diplomats to Israel in order to urge de-escalation of the crisis. The Biden administration is also said to be not be on board with Israel directly striking back on the Islamic Republic. Netanyahu has affirmed 'we will make our own decisions' on security.

German Foreign Minister Annalena Baerbock said after closed-door talks with Netanyahu that "Everyone must now act prudently and responsibly."

"A spiraling escalation would serve no one, not Israel’s security, not the many dozens of hostages still in the hands of Hamas, not the suffering population of Gaza, not the many people in Iran who are themselves suffering under the regime, and not the third countries in the region who simply want to live in peace," she added.

Are We On Japan's Path Of Stagnation?

Very interesting article if only to remind us what Japan was and has become over the last 30 years. Unfortunately the experience of Japan offers no lesson whatsoever to the US as managing the downfall of a reserve currency will be very different to the consequence of a real estate bubble.

Conversely and interestingly, Japan do offers some clues to China as China will in the coming years have to manage it's own real estate bubble. There are nevertheless huge differences between the two bubbles. The Japanese bubble was financial and represented over-valuation. The Chinese bubble is more a problem of glut and over supply although for the banks who financed it, it will feel eerily similar:The debtors can't pay back their loans with their deflated assets. In the end, either through deflation, like the Japanese, or through inflation, the Chinese people will have to absorb the cost of the bubble. They will therefore be much less rich than they expected. That is, provided no other shock comes to muddy the picture... A rather unlikely prospect in the current conditions of the world.

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

We recently wrote Japan’s Lost Decades to appreciate better why Japan’s GDP is smaller than it was in 1995 and why it took 35 years for its stock market to set its recent record high.

Many pundits claim the U.S. is following Japan’s path. The path includes a stagnant economy, massive government debt, and a central bank that must dominate financial markets to keep the economy and financial markets afloat.

There is merit to that opinion. The U.S. government has excessive debt and is increasingly negligent in managing its budget. Also, the nation’s economic growth rate has been trending lower for thirty years, and fiscal dominance is becoming the norm, not the exception.

While we may be on a similar path as Japan, we are not nearly as far along. There are many differences between Japan and the United States worth considering.

All Asset Bubbles Are Not Alike

At the heart of Japan’s current problems were its massive real estate and stock bubbles that popped in 1989.

To appreciate the enormity of their bubbles, consider the following from Ben Carlson’s article The Biggest Asset Bubble In History.

From 1956 to 1986 land prices in Japan increased by 5000% even though consumer prices only doubled in that time.

By 1990 the Japanese real estate market was valued at 4x the value of real estate in the United States, despite being 25x smaller in terms of landmass and having 200 million fewer people.

Tokyo itself was on equal footing with the U.S. in terms of real estate values.

The grounds on the Imperial Palace were estimated to be worth more than the entire real estate value of California or Canada at the market peak.

There were over 20 golf clubs that cost more than $1 million to join.

In 1989 the P/E ratio on the Nikkei was 60x trailing 12-month earnings.

Japan made up 15% of world stock market capitalization in 1980. By 1989 it represented 42% of the global equity markets.

From 1970-1989, Japanese large cap companies were up more than 22% per year. Small caps were up closer to 30% per year. For 20 years!

Stocks went from 29% of Japan’s GDP in 1980 to 151% by 1989.

Japan was trading at a CAPE ratio of nearly 100x which is more than double what the U.S. was trading at during the height of the dot-com bubble.

The aftershock could have been dealt with in many ways, but at its core, it came down to whether to pay a dear price over a short period or draw out the costs over decades. They elected the latter, saving their banks and relying on massive government spending to insulate the economy.

Over the last 25 years, the U.S. dot com and subprime bubbles have popped. While economically costly, the bubbles were minor compared to Japan’s. Accordingly, when they popped, the economic and financial consequences paled compared to Japan’s.

Banking Sector

The real estate and stock bubbles were supported with massive leverage via bank loans. When the asset values plummeted, the debt supporting them was often worthless. The banking system would have collapsed if the banks had written off the bad loans. The government aimed to keep the banking system out of harm’s way. Essentially, the banks didn’t have to recognize the losses. However, the non-performing loans were still on their books, significantly impeding their lending capabilities.

Further crippling the banks were the BOJ monetary policies which pinned interest rates at zero and below zero for long periods. The result was a flat yield curve. In addition to having a limited ability to lend, BOJ policies severely reduced the financial incentive to lend. Japan’s private sector economy could not contribute to growth nearly as much as possible if the banking sector were healthy and incentivized to lend.

Conversely, U.S. banks are healthy and well-capitalized. Additionally, the Fed is very in tune with the amount of reserves in the banking system and stands ready to provide more when needed. Reserves are the fodder banks require to make loans.

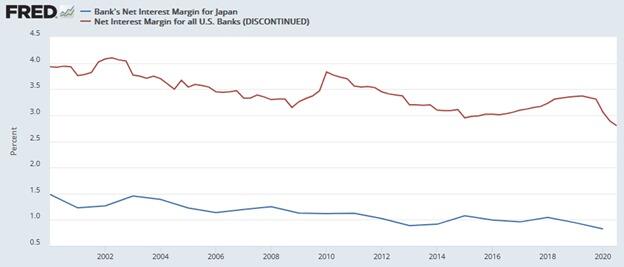

The graph below compares the net interest margin for Japanese and American banks to show how much more financial incentive to lend versus their Japanese competitors.

Barring a significant financial crisis, there is no reason to expect U.S. banks to be as restricted as Japanese banks have been.

State-Led Capitalism

As noted in the prior section, Japanese banks have had a minimal ability to lend for much of the last 35 years. As a result of their zombie-like status, the government was heavily obligated to promote economic growth. Accordingly, the government played a much more significant role in managing the economy than is typical in a capitalistic economy.

A key tenant of capitalism states that when the free market sets prices based on the supply and demand for goods and services, it can most efficiently allocate resources to their most productive uses. Commonly, the most productive use of resources benefits economic growth and allows for higher wages and a broad distribution of wealth. Government interference reduces capitalism’s value as capital is often not put to its most productive uses.

Post-World War II Policies

Following World War II, Japan followed a path of capitalism, but it was state-led. Such was probably necessary in the decade or two after the war as the country was physically and emotionally devastated. Japan benefited immensely from the government’s push for rapid industrialization and economic development. But through loose monetary policy, financial deregulation, tax incentives, and infrastructure spending, its policies played a crucial role in inflating the real estate and stock bubbles.

After the bubble, the government was called upon to stimulate the economy. Their interference ultimately resulted in the unproductive allocation of resources, which, in the long term, likely reduced economic activity, thereby prolonging their weakness.

The United States form of capitalism is not as pure as it could be, but it is not nearly as dictated to the same degree as Japan. The Fed and government do reduce the value of capitalism and certainly foster speculation and leverage. But, they have yet to create policies that induce bubbles to the degree Japan saw in the 1980s.

The Yen Versus The World’s Reserve Currency

The U.S. dollar is the world’s reserve currency, and enormous rewards and complications come with it. In our article, Our Currency The World’s Problem we discuss the value of the reserve currency to the U.S.

Foreign nations accumulate and spend dollars through trade. They keep extra dollars on hand to manage their economies and limit financial shocks. These dollars, known as excess reserves, are invested primarily in U.S.-denominated investments ranging from bank deposits to U.S. Treasury securities and a wide range of other financial securities. As the global economy expanded and more trade occurred, additional dollars were required. As a result, foreign dollar reserves grew and were lent back to the U.S. economy.

Making the world even more dependent on the dollar, many foreign countries and companies issue U.S. dollar-denominated debt to better facilitate trade and take advantage of America’s liquid capital markets.

The bottom line is that the U.S. has a constant source of capital to fund our debts, support our asset markets, and buoy the economy. The Japanese Yen provides no such benefits to Japan.

Other Factors

In Japan’s Lost Decades, we discuss Japan’s demographic challenges. To summarize, Japan has an aging population with low birth rates and a meager immigration rate. These factors and others have resulted in a declining population, which weighs on economic growth. While the United States also faces demographic headwinds that are and will negatively impact economic growth, they are not nearly as pronounced as those in Japan.

The United States has a much larger and more diverse economy. This is in part because we are rich in natural resources. The U.S. economy encompasses a wide range of industries, including technology, finance, manufacturing, agriculture, and services. In contrast, Japan’s economy focuses heavily on manufacturing and exports.

Various cultural differences also shape economic policies and affect consumer and corporate behaviors. The business culture in Japan is characterized by lifetime employment contracts and close relationships between corporations and banks (keiretsu). Japan’s population emphasizes consensus and harmony. In contrast, the United States has a more competitive culture centered more on the individual than the nation.

Summary

Fiscal dominance, whereby the Federal Reserve must help the Treasury fund their debts at reasonable costs, is upon us. Japan has relied on fiscal dominance for 35 years. This is one of a few clues that the U.S. is on Japan’s path.

However, as we have written, our nations have significant differences. While we may be on a similar path as Japan, our paths will differ. Since we have not traveled as far on the path as Japan, we have time to learn their lessons and fix them. Will this happen?

Trump Versus Xi: A Blow-by-Blow Analysis Of The US–China Trade War

However you look at it, the fight between the US and Chinese economies is unavoidable. The dollar dominance is approaching its end and i...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...

.jpg)