A fundamental question about AI from Sam Harris.

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Sunday, September 29, 2019

Can we build AI without losing control over it? by Sam Harris (Ted Video)

A fundamental question about AI from Sam Harris.

Saturday, September 28, 2019

AI view of humans (Weekend Humor)

What will we look like to advanced AI with our weak brains and slow interface?

Monkeys running around doing "stuff"? Not worth communicating with but in need of oversight less we become a nuisance?

Monkeys running around doing "stuff"? Not worth communicating with but in need of oversight less we become a nuisance?

How to escape education's death valley by Sir Ken Robins (TED Video)

An extraordinary dissertation about education!

This is indeed where everything starts. As we are getting closer to developing true artificial intelligence, we should at the same time invest more into people's education, not less. Machines will be our tools for years to come but only provided we are able to use them and create value in doing so. For this to happen, we do not need 'more' but better education exactly as described in this talk. Enjoy!

Greta Thunberg is not the new Jeanne d'arc!

Ignoring the shriek calls of Greta Thunberg, the litany of what is wrong with mankind is growing by the day and will soon put the Moore law for semiconductors to shame.

If I had a choice, I would put the precipitous decline of flying insects at the top of the list. This is a very recent and extremely swift phenomenon. I still remember that 20 years ago, a 200 km trip on the highway would fill the windscreen with splotches of diverse sizes, enough to require a regular clean-up at the gas station. Not anymore! Either insects have learned to avoid our roads, which seems very unlikely, or there are just not "there" anymore. Considering their role at the base of the food chain, essential for pollination and soil formation, it is definitively a crisis in need for an urgent answer. But flies and bees are not whales and rhinos. Apparently not cute enough to care in spite of the urgency.

Our mistreatment of the sea should come second. From heavy metals to plastics, the oceans of the world have become our ultimate garbage can. The most remote beaches of the Pacific are now covered with trash of all sorts. Coral Reefs are under assault everywhere and not just from global warming. In many places, there are simply covered and built upon. In other places, overwhelmed by alga explosions triggered by agricultural or urban effluvia. But for most people, the sea is far and vast. It can wait another day. Out of sight, out of mind.

Our terrible land use should come third because it is a slow motion crisis although we have been relentless on this one for the past hundred years. From destroying the rain forest to paving over a growing share of available land. Industrial farming and stock feeding, the assault is multi-faced and extremely destructive, especially in developing countries where population growth easily overwhelm whatever remediation efforts local people may think about.

But these issues are complex to understand, encompass multiple factors and often hard to mobilize people around. Who wants to save mosquitoes or weeds? Ugly deep sea fishes and far away atolls? And what can you do anyway, stuck in the rain in a traffic jam in Stockholm?

CO2, That's the enemy! The reason why Venus is so hot! The obvious culprit of global warming, shrinking ice, rising seas. The one issue among so many on which we should focus! Never mind that it will bankrupt us because energy is by far the most expensive infrastructure we have built and the very last one we want to mess with less the whole edifice of our civilization comes crashing down.

In spite of what we are told, the science behind CO2 and global warming is still very flimsy because the models on which cataclysmic predictions are made, are just that, models, with an almost infinite number of variables. Change any, and the behavior of the systems, the atmosphere but not only, find other equilibriums which are mostly unpredictable whenever they diverge from past behavior.

And that unfortunately is our worst enemy: The past! When it comes to "models" it tells us absolutely nothing at all! The reason here too is complicated but mostly relates to the fact that we do not understand the past. This sounds like a bold assumption but it is a fact.

We can look at tree rings, lake sediments and especially ice cores and reconstruct past climates. This gives us a rather good estimate of what the weather was like at any given time in a specific place. But these measurements are points in space and time, usually not enough to give us more than a fuzzy image of what conditions were like then. But far more importantly, this gives us almost no information on the so important transition periods which would validate or not the models. We are in the dark like the famous scientists variously describing an elephant by looking at its parts. The whole is more than the sum!

So are the models showing us that global warming is an unavoidable consequence of rising CO2 wrong? Maybe not. I don't know and at this stage, nobody really knows. Or at least nobody knows enough to commit all of us to invest trillions of dollars to transform our energy sources from known solutions to unproven and extremely expensive alternatives. From wind and solar which are unreliable energy sources which will oblige us to double the size of the energy infrastructure and treble the price to pipe dreams like fusion, far too complex to become affordable in a reasonable horizon, we have no real, large scale solutions available, except using less energy.

And this should indeed be our focus and it will be until people realize that in the end, having to go on holidays on your bicycle is just downward mobility and a tremendous lowering of living standards. Especially when the Chinese collectively decide that they prefer to keep their cars, Thank you very much!

So what is this new Jeanne d'Arc telling us?

That we are destroying the planet?

(Well, that much we already know, this has not started yesterday!)

And the future of "her" generation?

(polarizing opinions is very much the tune of the day although Trump does it best!)

That we must do something "now"?

(We have heard this for the last 50 years! We have usually from 2 to 10 years to act less doom and darkness fall upon us!)

Whatever the price?

(Replacing fossil fuel by "other" energies will be THE most expensive endeavor of any generation. Probably expensive enough to throw most people into poverty if it is not done properly!)

It is a good thing that most people do not think much beyond what their are fed 24/7 on their screens or they would realize how skewed the message is!

It is true that we are destroying most of the ecosystems on which we rely and that we must do something about it less we face global collapse at some point in the not too distant future. We have known this since the Club of Rome published its rather detailed and far reaching predictions in 1972.

But the very last thing we should focus on first are our energy sources because whatever we decide to do, we will need a lot of energy to achieve it.

Phasing out plastics and replacing them with biodegradable alternatives should not be very difficult but it is not happening because the alternatives are more expensive. Just a little but enough to be non competitive in our market based economies.

Using less land, water and other resources should be a priority too because we are very fast approaching real physical limits and consuming at an accelerated pace whatever is available. This is the well known water lili and pond example where a week before the end, the water lili which double its size every day occupies little more than one per cent of the pond whatever the size. But how do you change "habits" and cultures short of a major shock which in the end obliges people to behave differently?

In reality, it is the very foundations of our consumer society that we need to transform, understanding how intertwined our lives are to the complex ecosystems we are depending on. We cannot live without insects, fishes and animals and these likewise cannot live in degraded environments. So we need to focus on these issues first and foremost. And use whatever energy is needed to transform our behavior. THEN and only then should we focus on transforming our energy sources, less we reduce our ability to adapt as the cost of energy rises.

Whatever fossil fuels are still available, the cleaner the better of course, should be used to facilitate our social transition and change our behaviors first. Atmospheric temperatures rising while we do this will be of little consequences. Nature is resilient. Most species will survive a few degrees more. They have in the past. What they cannot survive is business as usual: The human population explosion, destruction of habitat, over exploitation of resources. Compared to this, CO2 is unimportant.

We do not have 2 years left, nor 10 or 20. We are already overdue for major transformations. The momentum of human society is such that we can only nudge our direction towards a better future. The wrong choices or turns instead of improving out lot could very well mean collapse. There are already signs that we are close to actual limits in many respects. Over fishing, aquifer depletion, soil degradation, etc...which are directly impacting insects, corals and other important part of the earth ecosystems.

We know that in the past, civilizations which were not wiped out by others, crumbled due to over-exploitation of resources or carelessness with their environment (such as Easter Island) or due to climate fluctuations (such as the Maya and the Anasazi, ancestors of the Pueblo people in the South West US) So can we be the first one to show signs of collective intelligence and do, mostly, the right things at the right time?

I tend to be pessimistic on this subject so I am not sure at all. Now is the time for alarm but not for panic. Because the time to do "something" is long gone, we have paradoxically time in front of us. But we must choose wisely. We will need energy to run faster, a lot of it. If all we have is wind power, the boat of out civilization will be over-run by the ecological tsunami we have engendered. This is our collective choice. It is great to listen to the little Nordic Jeanne d'Arc but we need only listen to the warnings, which we should anyway have done long ago. As for the solutions, let's forget about her, she has no clue nor understanding of the complex issues involved, different in developed and developing countries.

In this respect, I think that for once, technology could help us manage the problems is has created. We will need artificial intelligence to understand better how the planet works, build better models and seek complex solutions compatible with human prosperity. That, more than anything else should be the focus of our attention for the years to come so that when time for action comes, we understand better how the global ecosystem can be reoriented and pushed on the right path.

The best image we can use is that of an asteroid coming our way. The sooner we act the better but because we must know what to do less we increase the risk by splitting the asteroid and doubling the effects, we must think very carefully about our actions and their consequences. A shrieking child voice is the very last thing we need to make decisions.

Saturday, September 21, 2019

Are we on the edge of a recession?

Are We on the edge of a recession?

The simple answer to this question based on economic macro data and market indexes is a straightforward 'yes' as we predicted earlier this year and as confirmed by the analysis of David Hay below. But the more complex answer is that our financial system is now leveraged to the point that Central Banks cannot allow a recession to take place less we start our descent into a depression.

So what happens next?

This article is based on a market research recently published on Zero Hedge which can be found through the link below:

https://www.zerohedge.com/markets/deja-vu-2000-or-flashback-2007-part-2

Authored by David Hay via Evergreen Gavekal blog,

and partly copied for its most relevant aspects after the article.

and partly copied for its most relevant aspects after the article.

In the short term, nothing much above the waterline. Volatility will stay high and markets will go nowhere. That is until the prophetic black swan strikes and exposes the gigantic financial house of cards we have constructed over the last 20 years. But below the waterline, we are already in crisis management. In the US, the Fed will not repeat the mistake of 2008 and is ready to flood the market with liquidity on short notice as was displayed last week in the Repo market.

Japan has been in this "zombie economy" state for the last 30 years. In and out of recession every other month while it's economy shrank from 18% of the world economy in 1994 to just above 5% now! This process has been imperceptible in Tokyo where growth is concentrated but devastating the further away from the capital you go with smaller local cities shrinking into nonexistence especially on the Japan sea coast, Tohoku and Shikoku areas.

Europe has been more contrasted although the financial dislocation has been deeper lately with negative rates affecting most countries. The damage of these rates cannot be overstated as government debt crowds out investment and therefore growth in the long term as surely as in Japan.

What is left now to avoid a global recession is the American consumer and the Chinese investment bubble. The later has been slowing down markedly over the last 2 years with the trade dispute intensifying and the former leveraged to the hilt is heading towards a rather gloomy year-end.

So however you look at it, the recession that cannot happen less we find that everyone was swimming naked is approaching fast. Massaging employment figures and other macro-economic data has become a habit nowadays with hedonistic adjustment skillfully added to minimize inflation and employment data that a communist apparatchik could second guess months in advance. (They are then restated with real data a year later, usually lower but by then who cares!)

What Central Banks have discovered over the years is not financial wisdom in managing carefully money creation but that economic cycles are mostly amplified by psychological factors and that consequently to avoid panics, the back-mirrors indexes on which they focus must stay bright whatever the road ahead, which they have few tools to assess, looks like.

And here we are at the end of 2019, on the edge of the precipice, with shrinking international trade, 75% of the most important interest rates in Europe negative, an inverted yield curve in the US which means that you should stay as liquid as possible and invest 'another day', waiting for a black swan, hoping that an approaching election is the US will prevent a maverick president to rock the boat and that anyway should 'anything' happen, The Fed, ECB, BOJ and BOC will know what to do! Good luck with that!

Today, people are concerned with global warming and other long term social issues. In a year of so, economic priorities will be on top of their list once again. Did you say Paradigm Shift?

Update 23 Sep 2019

Korea is one of the earliest country to publish its trade data every month.

These are 'real' numbers unlike other composite 'estimates' like employment and they are not pretty! We are probably already in a recession!

-

Exports to China -29.8%;

-

Exports to U.S. -20.7%;

- Export to EU -12.9%;

-

Exports to Japan -13.5%

Deja-Vu 2000 Or Flashback 2007? (Part-2)

“The experience in Japan, Europe, or even the US, is that

once you get into a near-zero interest-rate regime, it’s kind of a black hole.

The economy tends to be pulled in, and once there, it’s difficult to escape.” -

Larry Summers, former US Secretary of the Treasury.

“The US economy is in far worse shape than the Q2 GDP

data suggest. Only the consumer is preventing a recession at the moment, and

that is only happening because of stepped-up credit usage and a corresponding

dip in the savings rate.” - David Rosenberg.

“The best signal of a recession is not an inverted yield

curve. It’s the inversion occurring and then going away.” - DoubleLine Funds

lead portfolio manager, Jeffrey Gundlach

SUMMARY

- Evidence, such as the yield curve inversion, is mounting that later this year, or in the first half of 2020, the US could find itself in the midst of a recession.

- However, it’s fair to note that not all US recession indicator warnings are lit up.

- The planet’s banks are facing a trifecta of troubles from zero and sub-zero rates, generally inverted yield curves, and tight credit spreads.

- The eradication of interest rates is also the kiss of death for insurance companies, pension plans, and retired investors.

- In our view, a window of opportunity has opened up with certain high-yield equities that are in out-of-favor industries.

DÉJÀ VU 2000 OR FLASHBACK 2007? (PART II)

Let’s return to one of the most pressing questions facing

investors right now, one we also discussed last week: Namely, how probable is a

recession this year or next? The renowned David Rosenberg, who was one of the

handful of economists to predict the 2007 downturn, thinks the US may be in one

now. Evergreen doubts that, but the evidence is mounting that perhaps later

this year, or in the first half of 2020, we could be in the midst of one (a

topic I’ll return to at the close of this “Bubble 3.0” chapter).

Moreover, just this week the man considered the new King

of Bonds, Jeff Gundlach, made the bold call that he believes there is a 75%

chance of a US recession prior to next year’s presidential election. This is

despite a growing chorus in the financial media lately singing the tune that

the global economy is reviving. (Presumably, per his quote at the top of page

1, the reason he believes an “un-inversion” is problematic is that these happen

when the Fed is panicking and furiously cutting rates to stave off a

recession.)

Again, returning to the inversion of the yield curve, a

striking aspect is how virtually the entire curve is flipped, which is a rare

occurrence. As David Rosenberg wrote two weeks ago in his daily Breakfast

with Dave (a must read, in my opinion, for any serious investor),

the Fed pays the most attention to the 3-month T-bill versus the 10-year

T-note. As well they should; when that has stayed inverted for at least

three straight months, a recession has occurred 100% of the time. Guess what just

happened?

As David wrote on August 26th, “When it (the curve) was

only flattening a year ago, the bulls said ‘it’ll never invert.’ When it began

to, the bulls said “only 2s/10s matter.’* When that inverted, the bulls said,

‘it’s different this time’. Good grief.”

Senior Fed officials have been right in there with the

no-worries consensus on the inverted yield curve but at least one of them is

breaking with their complacent ranks. St. Louis Fed-head James Bullard recently

insisted that our central bank’s main priority should be normalizing the yield

curve. He added that he has no interest in hearing any of his colleagues’

rationalizations about why this time is different, perhaps because he’s laser-focused

on the chart above showing the 3-month/10-year inversion.

As David Rosenberg further wrote in his 8/26 Breakfast

with Dave missive, “…the reality is that it is a very rare

circumstance when the ENTIRE yield curve is inverted from the Fed funds to the

30-year Treasury bond…So we have 50 years’ worth of data and nine periods where

the entire yield curve…inverted. I’m sure it’s always different to some, but of

these nine episodes (where a full inversion occurred), we had eight recessions

to follow.”

Similarly, my great friend Grant Williams recently wrote

that the New York Fed’s treasury spread monitor has had a flawless recession

forecasting record since 1960. This is most ironic since the Fed itself has

missed every one, not just over the last 60 years but going all the way back to

the end of WWII.

Source: Things That Make You Go Hmmm

As you likely surmised, the New York Fed’s indicator is

strictly a function of the yield curve. Consequently, James (No Bull) Bullard’s

appraisal on the urgency of normalizing the yield curve is certainly logical.

The way in which the Fed would try to get the curve

uninverted is to slash interest rates fast and hard. It might also seek to

“twist” the yield curve, as it has done in the past, by selling longer term

securities (thereby driving their prices down and yields up) and buying shorter

maturities (pushing their rates down).

*The inversion of the 2-year vs the 10-year treasury

notes.

Regardless, the majority of commentators continue to diss

the yield curve’s message. Frankly, I would have more sympathy for this view if

it wasn’t for the swelling body of evidence indicating this expansion is close

to fork-sticking time. Past EVAs have often discussed the

Chicago National Activity Index because it is the broadest of all US economic

measures, consisting of 85 different components. This index has eroded in seven

of the past eight months. This isn’t proof-positive of a looming contraction

but it’s a serious alarm bell. Additionally, the closely-watched US

ISM (Institute of Supply Management) manufacturing index was reported earlier

this month and it was a dismal 49.1 (below 50 signifies contraction). Worse

yet, the forward-looking New Orders sub-index was a very weak 47.2.

The stock market is clearly sniffing this out. The

cyclical elements of the S&P 500 were recently down 17% from their peak

levels, not far from actual bear market territory, defined as falling more than

20% from a zenith point. (This week has seen a partial reversal of this

decline.)

As we’ve often noted in these pages, the shining star of

this expansion has been the jobs market. But as we’ve also been observing in

earlier EVAs, labor market conditions are fraying. Lately, that’s

turned into an outright rip. The Bureau of Labor Statistics recently announced

a 500,000-job downward revision through this past March.

Make Job Creation Great Again

Source: Bureau of Labor Statistics, Danielle DiMartino

Booth

Speaking of revisions, and returning to the earnings

theme, there was a recent momentous recalculation by the government that has

received little notice outside of these pages, Charles Schwab’s Liz Ann

Sonders, David Rosenberg and another friend of mine, Danielle DiMartino Booth. This

revision had the effect of erasing all pre-tax profit growth for Corporate

America back to—are you ready for this—year-end 2011.

For some reason, when the perma-bulls briefly concede

this point, they invariably say since 2016. While that’s technically true, what

they fail to mention is that the earlier earnings recession in 2015 brought

profits back to where they were at the end of 2011. Note that this is on a

pre-tax basis for both public and private companies, so it excludes the steroid

effect of the Trump corporate tax cut and also the ultimate

performance-enhancing drug of share buy-backs. There’s little doubt that the

Fed’s eight-year suppression of interest rates, before it belatedly tried to

raise them back to “normal”, was the great enabler of the stock repurchase

mania. (Note that it was only able to raise up to 2 3/8% on the fed funds rate

before the market started cracking; this is the first time since the 1930s, by

the way, that such a miniscule interest level caused a stock market seizure.)

It’s fair to note that not all US recession indicator

warnings are lit up. The

Index of Leading Economic Indicators (LEIs) still looks reasonably robust, as

does consumer spending (though the latter has been goosed lately by rising

borrowings and falling savings). Moreover, credit spreads (the yield difference

between US government and corporate bonds) remain tight. These often begin to

widen materially before serious economic and market dislocations occur.

However, in last year’s traumatic fourth quarter, credit spreads seemed to

follow the stock market rather than lead it, a most unusual development.

But there might be another message from both the yield

curve and credit spreads that the never-say-die crowd is missing. In a

recent riveting interview, Donald Amstad of Aberdeen

Standard makes the critical point that the banking industry’s profitability is

driven by three key factors: high interest rates (at least well above zero),

steep yield curves (deposit rates low and further-out lending rates well above

those), and wide credit spreads (because banks are essentially spread

investors, borrowing at near government bond rates and lending out, usually, at

higher yields to at least somewhat risky borrowers, like companies and

consumers).

Consequently, the planet’s banks are facing a trifecta of

troubles from zero and sub-zero rates, generally inverted yield curves, and

tight credit spreads.

Undoubtedly, those profit-sucking factors are why European bank stocks recently

broke below their global financial crisis lows. Think about that for a moment:

eurozone banking shares hit a lower low last month than was seen during the

worst financial panic since the Great Depression.

Source: Bloomberg, Evergreen Gavekal

It’s not a lot better in the rest of the developed world,

even in the US which, at least for now, still has positive interest rates,

notwithstanding the inverted yield curve in the States. The chart of American

banks looks a lot better than their European counterparts but it’s not great.

And neither is the trading pattern of Japan’s banking sector.

Source: Bloomberg, Evergreen Gavekal

Of course, as noted in prior EVAs, the eradication of

interest rates is also the kiss of death for insurance companies, pension

plans, and the retired, or soon to be, investor class, a point vehemently made

in last month’s Guest EVA, “The Disaster of Negative Interest Policy”. John

Maynard Keynes, the progenitor of both Keynesian economics and the term

“euthanasia of the rentier*” must be grinning from ear-to-ear these days from

wherever his soul resides. The mega-problem, though, is that it’s nearly

impossible to have a healthy economy without a healthy banking system.

As we know, minimal to non-existent interest rates have

done the double prop-up duty of pushing older investors into stocks (more to

follow on this shortly) and providing corporations with cheap financing with

which to repurchase their own shares. These are certainly two key reasons why the S&P 500

has been remarkably resilient despite a long and growing list of risks, some of

the mega-variety (like the escalating trade war). This is why US stocks trade

at one of the most generous multiples of overall corporate earnings ever seen,

outside of the last few years of the tech bubble.

Stocks Very High Verses Overall Corporate Profits

Source: Ned Davis Research, August 28th, 2019

*Rentier is a synonym, in this case, for lender or

investor.

Despite the big downward revision to pre-tax profits,

after-tax earnings per share remain quite lofty, though they are clearly

eroding. Thus, the US stock market is elevated even compared to what are likely

to be top-of-the-cycle profits. In addition to the recent profits downshift,

the following chart from my friend Paban Pandey in his always interesting Hedgopia service shows

the growing gap (sorry) between GAAP (Generally Accepted Accounting Principle

earnings) and non-GAAP (earnings minus all the bad stuff companies want you to

ignore). This growing differential is a classic sign the end is

nigh for this particular profits bull market.

Note that the GAAP/Non-GAAP comparison really gapped

(there I go again) in 2007 right before the Great Recession. In fact, on a

percentage basis that one year was worse than any seen recently. However, the

persistence of the wide differential since 2016 is noteworthy. On a cumulative

basis, the spread between fact and fiction appears to be the greatest ever seen

prior to the onset of a recession and bear market over the last 30 years. Yet,

how often do you hear about this in the mainstream financial media? How about

almost never.

Once again, though, the market may have picked up the

scent. The S&P has risen just 5% from where it was in January of 2018,

despite this week’s rally (which, fortunately, has been led by the undervalued

part of the two-tier market we’ve been talking about). Coincidentally, I began

this “Bubble 3.0” series a month earlier, in December, 2017. The main focus of

my ire at the time was the biggest bubble in human history: Bitcoin and the

other crypto currencies. Since then, we’ve had a series of other bubbles such

as in pot stocks like Tilray, US new issues (IPOs), and allegedly high-growth

momentum stocks.

The rest of the article is less relevant to our point and can be found on:

or

https://www.zerohedge.com/markets/deja-vu-2000-or-flashback-2007-part-2

Thursday, September 19, 2019

Basics of AI - Backpropagation (Video)

This is a superb and very simple explanation of one of the basic concepts of AI. This should be included in most advanced math curriculum if only to demystify what AI really is. (PS: The explanation is technical but not very complicated and taking the example of a shower it shows that there is mathematics behind the things we do intuitively every morning! It also explains why AI can now distinguish dogs from cats or recognize individual faces, one of the most dangerous technology ever invented as we will see in future posts.)

Subscribe to:

Comments (Atom)

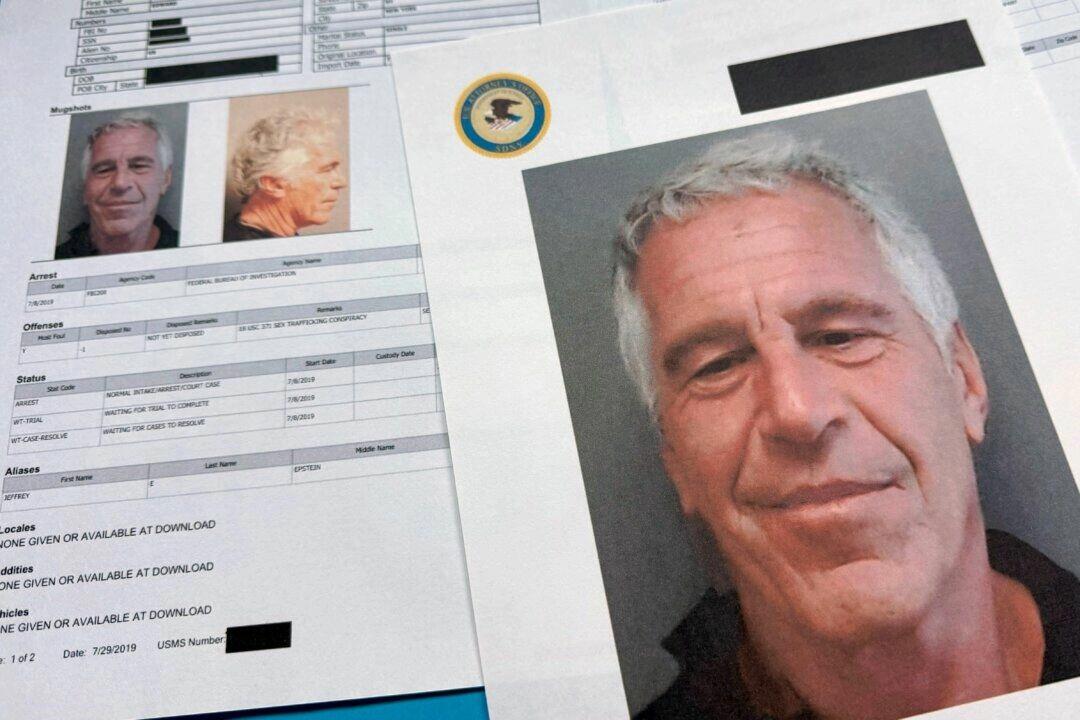

The Unsettling Truths The Epstein Files Reveal About Power And Privilege (Must read)

The article below is essential to understand what is at stake with the Epstein papers. This is not about a network of pedophiles and perv...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...