What happens when almost every data is false? Well, we're about to find out.

One of the great advance of the 20th Century was the invention of macro economic data. Indicators which although often uncertain would nevertheless give us information about the economy in general and trends in particular.

Then politicians slowly realized the impact of the data. It was not really the economy driving itself but the mood of the investors and consumers and this mood could be indirectly controlled with... data!

It then took a few decades from understanding the data to controlling the data. Not, mind you, with sensible economic and social policies, that was complicated, time consuming and expensive. But the intricacies of statistics were far more accessible.

What is "inflation"? Well, it's complicated and the definition can vary. You have to aggregate prices. But before that you need to chose skillfully the price of what. Food and energy goes up and down so you need to smoother out the highs and lows. Technology tends to improve over time so how do you input a more powerful hard disk into inflation? A better designed door handle is invisible inflation-wise.

Still, from a political point of view having high inflation and reporting a lower number creates an irresistible bonus: Free money! If you report 2% inflation and actually have 4%, that's almost 2% of the money supply available for free. Invisible inflation which is there but unreported.

It took many years and innovations of statistical engineering to create new, very convenient concepts like hedonistic adjustment factors. Which in real life means calculating the progress of technology as an adjustment factor which allows you to understate inflation. So a cheaper computer is of course -10% that you can compute in your index directly. But even when the price stays the same, you still have these 10% available thanks to better technology (= -10%). Genius. And so convenient. More free money. About 1 to 1.5% per years! The end result is that in the past people would be benefiting from technology with lower prices and improved purchasing power. Not anymore.

This is just an example but almost ALL the data has been corrupted one way or the other. The result is that for most people in the West, although income has doubled, real income has been divided by two. In the 1960s, it was easy for a family to live on one salary. Now, it is difficult to break even with two.

And that's just inflation. Employment has been likewise corrupted as explained below. So in the end, although it appears that Central Banks and Governments are controlling the economy better, in reality they are running on fumes of their own making. False statistics to support voodoo economics and wishful policies.

What could go wrong?

Authored by Elliott Middleton via 'End Times Meditation' Substack,

The BLS is reporting the March unemployment rate down slightly to 3.8 percent, nowhere near the 4.5 percent that it will take to trigger a collapse of confidence.

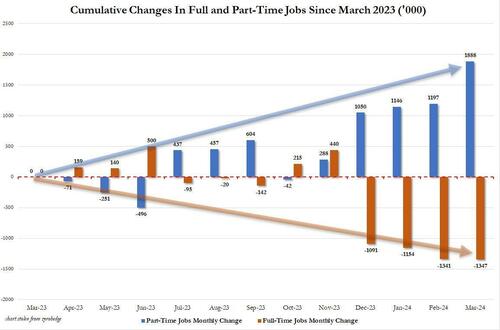

ZeroHedge has detailed how fake the BLS’s numbers have become in a series of recent posts (yesterday’s highlights are here and here).

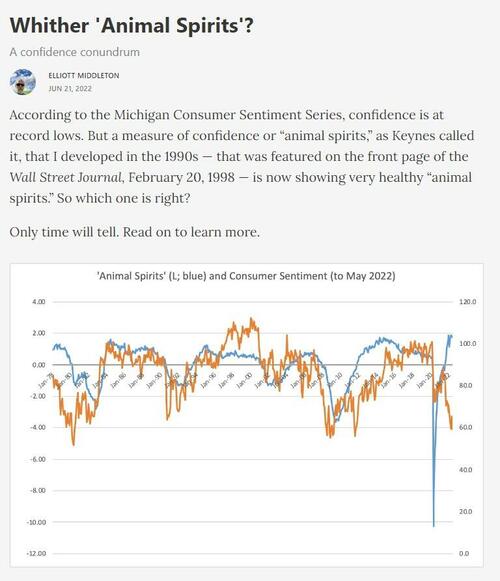

When I was in academics, my research program was on the application of psychology to economics, especially the fundamental psychological law of sensitivity to adaptation level.

Back in the 1990s, I was featured in a front-page article in the Wall Street Journal on “animal spirits” or confidence levels.

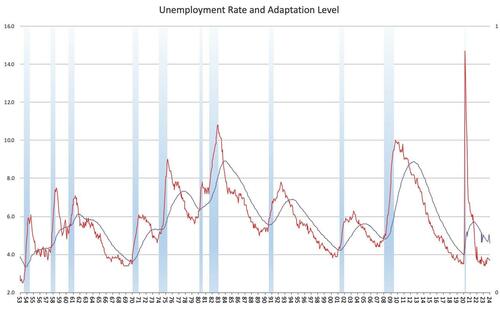

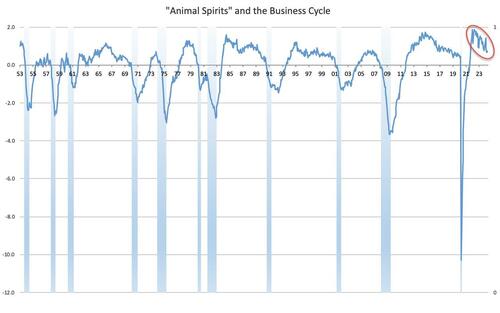

I discovered that when the unemployment level rises above a 4-year exponential moving average of the unemployment rate (in which more recent observations are weighted more heavily), confidence collapses, the unemployment rate skyrockets upward, and economic activity contracts sharply.

This event marks the end of the business cycle.

While the economy has been stagnating for most people recently, we have not experienced this signal event, the collapse of confidence that occurs when the recession begins.

The post below describes my intellectual journey and was published in ZeroHedge on June 21, 2022, and is highly recommended if you haven’t read it already.

We can expect laughable unemployment reports for the rest of the year. Meanwhile, private industry sources keep track of announced layoffs.

Via intellizence.com:

Leading Companies Announcing Layoffs And Hiring Freezes in 2024

The following is the list of major layoffs, job cuts, and hiring freezes announced by leading companies in 2024.Since January 1st, 2024, 151,943+ companies have announced mass layoffs.

[Last update: April 01, 2024]. [emphasis added]

The Biden administration is aware of my work and apparently will do anything to prevent the reported unemployment number from climbing to 4.5 percent before the election, which would trigger a collapse of confidence.

The adaptation level is currently at 4.53 percent. Look at the graph below.

There is still a gap of 4.53 - 3.8 = 0.73 unemployment percentage points, too wide for people to feel that “things are getting worse than what we’re used to.”

The difference between the unemployment rate and the adaptation level can be flipped to be presented as a confidence level. By this metric, confidence is still quite high (though trending lower).

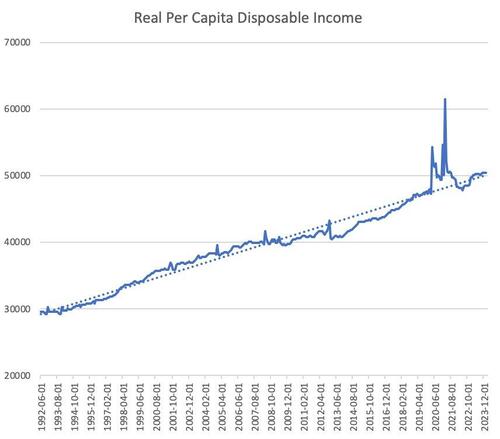

Real per capita personal income is almost exactly on trend for the past 30 years.

Consumers may have a lingering COVID-bubble-stimmy-checks-induced feeling of wealth as well, having recovered from a dip in 2022.

The recent experience has been nothing like the years following the Great Financial Crisis.

Unfortunately, more fake data from the BLS coming on top of all the fake data from the FDA and CDC over the past four years will only further extinguish any confidence the American people have in their government’s statistical releases. Or in their government in general.

Perhaps the BLS will simply stop reporting an unemployment number. This is what the Chinese did with their youth unemployment series.

Or perhaps they’ll issue a report with all the data redacted like the FDA did with their myocarditis analysis. Every page was redacted.

The “strong” report this morning suggests that rates will stay higher for longer than many expect. Note in the chart below, showing the inflation rate and the 3-month T-bill rate, that the peak in short-term interest rates came a year after the peak in inflation, the last time the Fed was battling with inflation during the 1980-1982 recessions.

With the WEF Cabal pursuing their goal of global famine by destabilizing oil production in the Middle East, thereby especially starving China of the means to run its economy and feed its population, a global oil shock appears to be in the making.

Crunch coming. Will there even be an election?

We are approaching maximum uncertainty.

No comments:

Post a Comment