This is a market article so the emphasis is of course "market" although this is by far the least important aspect of what is going on between the West and China.

The truth of the matter is that China has now become an existential threat for Europe and the US which will now use the full might of their economic power to reign in the rising giant.

Unfortunately what did work for Japan will not work for China as relegating the country forever to a "middle range" power status would condemn China to economic ruin. This is therefore existential for China too and the Chinese government can therefore not let it happen. This means full economic war in the months ahead and actual war soon after. At this stage, this is almost unavoidable.

This didn't have to happen. The integration of China in the Western sphere of influence could have been wide enough to make room for the country. The reality is that this was never the plan. Hegemony doesn't share, it rules. The role offered to Russia was that of a second rate "gas station" or more broadly, provider of cheap raw materials. Would the Russians become reluctant with this second fiddle role, the alternative was to break up the country using the Ukraine war as a wedge. As for China, the perpetual status of also-ran provider of cheap plastic goods was seen as good enough for another 50 years. Too bad that the Chinese worked harder for longer than expected and that they had the brainpower to transcend the figurative role the Western elites offered them in their woke Hollywood B movie!

Tit-For-Tat Responses From Beijing To Trade Restrictions May Bring About A Full-Blown Trade War

By John Liu, Zhu Lin and Abhishek Vishnoi, Bloomberg Markets Live reporters and strategists

China’s most-promising industries are facing a growing threat of trade restrictions from Western governments, blurring the outlook for stocks that have the potential to fuel the nation’s market growth.

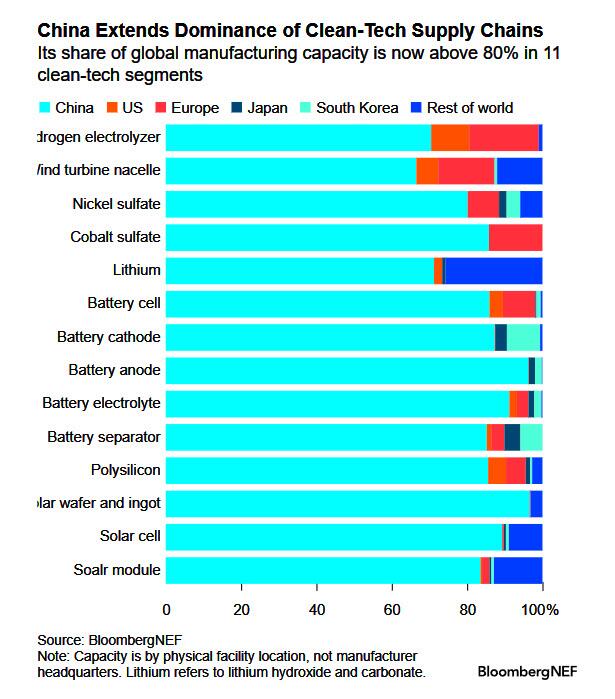

The sectors under scrutiny by Europe and the US are as wide-ranging as electric vehicles, wind and solar projects, medical devices and chips, but have one thing in common: they are of strategic importance to President Xi Jinping’s bid for leadership in the global race toward green transition and high-tech development.

The rising tensions come at an inopportune time. Stocks were starting to emerge from a multi-year slump as investors bought into China’s efforts to build new growth engines and achieve self-sufficiency along key supply chains. A materialization of those threats can hinder China’s global expansion, while tit-for-tat responses from Beijing may bring about a full-blown trade war that would drastically alter the investment landscape.

“Geopolitical pressures will only rise — any exports can be targeted since it’s no longer really about trade fairness,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “It dampens the export growth drivers for China’s economy.”

China’s CSI 300 Index has climbed about 3% this year, regaining some footing after a third-annual loss. Performances among leaders in the green and high-tech industry have been mixed as geopolitical risks add to concerns over oversupply and price competition.

Battery giant Contemporary Amperex Technology Co. Ltd has jumped nearly 17% onshore this year while EV leader BYD Co. has advanced 6%. Longi Green Energy Technology Co. and Semiconductor Manufacturing International Corp. have lost about 20% each.

The biggest Chinese firms that get at least a fifth of their revenue from exports command more than a 14% weight in the CSI 300, with many of them including CATL and BYD trading at a higher price-to-earnings ratio than the benchmark, according to data compiled by Bloomberg.

While trade spats have become a permanent feature in China-Western relations under Xi, recent months saw tensions worsen. The European Union has joined US-styled protectionist moves as a complex mix of national security concerns, economic and political considerations play out.

President Joe Biden’s call for tariffs as high as 25% on some Chinese steel and aluminum products shows how China-bashing will ratchet up in a presidential election year. In Europe, policymakers are responding to growing complaints from local manufacturers that China’s industrial overcapacity is crowding them out.

The range of targeted products largely overlap with Xi’s industrial priorities labeled “new productive forces.” Investors had been hunting for stock winners since the phrase was listed on Beijing’s top agenda in early March, triggering a brief rally in shares from robotics companies to chip makers.

“While the new productive forces may have policy tailwinds, these may be somewhat offset by rising geopolitical tensions, particularly in an election year where noise will likely increase,” said Marvin Chen, a strategist at Bloomberg Intelligence.

The focus is now on which sector will end up next in the crosshairs. EVs have so far been a key target, with Gavekal Research pointing to the EU’s worsening trade balance with China in the industry.

“The cyclical positioning of Europe and China points to the trade balance tipping in China’s favor,” Gavekal analysts Cedric Gemehl and Thomas Gatley wrote in a note dated April 15. European domestic demand is strengthening, which should spur more purchases of Chinese goods, while EU exports to China are likely to flat-line at best on weak demand, they said.

Shen Meng, director at Chanson & Co. in Beijing, expects lithium battery makers to face growing pressure. The industry falls under the category of clean tech and has been a top driver of China’s export growth in past years, he said. Key players include CATL, Eve Energy Co. and Gotion High-Tech Co.

In some sense, there’s a bright side to the tensions as they can help accelerate China’s industrial upgrade. A technical breakthrough by Huawei Technologies Co., which is not listed and faces US sanctions, has spurred a surge in the shares of its suppliers.

“While immediate impacts of such geopolitical tensions might constrain certain sectors temporarily, the long-term outcome could favor Chinese companies that innovate and adapt to changing regulatory and market dynamics,” said Tareck Horchani, head of prime brokerage dealing at Maybank Securities Pte.

The various restrictions mulled will also take time to deliver. A planned probe by Europe into Chinese medical devices procurement has sent stocks like Shenzhen Mindray Bio-Medical Electronics Co. plunging following the report, but most have since partially recovered their losses.

All things considered, the unpredictable nature of geopolitical tensions increases the risk of investing in Chinese stocks, an asset class that many were already avoiding due to regulatory uncertainties and a slowing economy.

“Any future EU protectionist moves against China will further impede trade and capital flows into the Chinese economy and add to the already heavy downward pressure on its stock market,” said Han Piow Liew, fund manager at Maitri Asset Management Pte. “What all these means is that investing in Chinese stocks in such an environment is an arduous endeavor requiring razor-like focus on stocks.”

No comments:

Post a Comment