Where will the first black swan strike? It is of course impossible to guess. A little like trying to know which grain of sand will break the pile. But statistically, just as for earthquakes, we can pinpoint rather accurately when it will show up and unfortunately the time is just about now!

The Western world has just reached the edge of the financial precipice and consequently what breaks the camel's back is irrelevant as it is just about to break.

This is why each and every conflict in Ukraine, Israel or the China Sea is about to take a life of its own. Facing economic defeat, it will suddenly look like a good idea to someone, somewhere to upturn the economic game board.

Expect the unexpected and prepare for the worst. We're about to enter choppy waters.

Sacre bleu!!

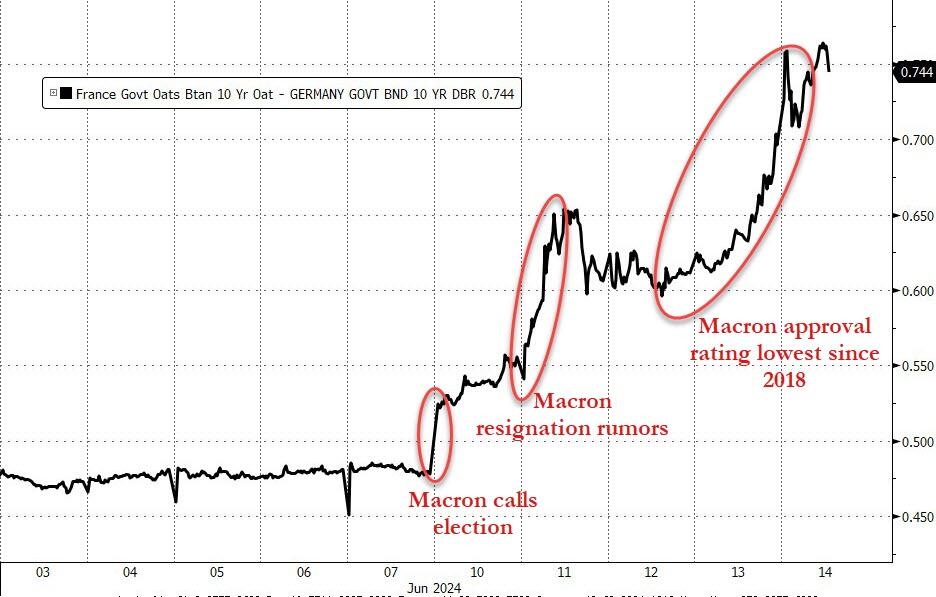

The implications of French President Macron's shock announcement of snap legislative elections after sustaining a hammering from the far-right Rassemblement National in European elections are starting to show up in some much more worrying systemic signals for the EU overall.

The OATS Spread (the gap between the yields of 10-year bonds issued by France, known as OATS for obligations assimilables du Trésor, and German bunds) is back at the center of discussion ...

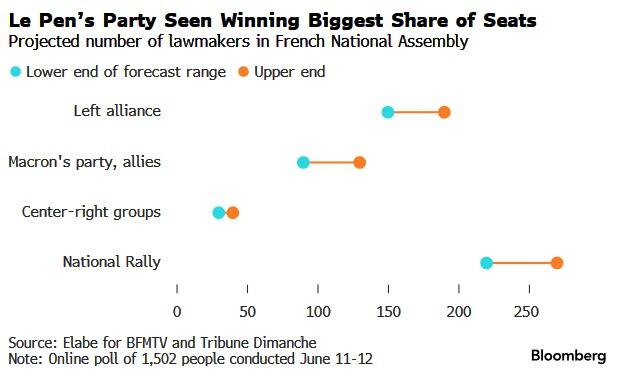

Complicating the situation further is the news that left-leaning political parties in France sealed an alliance to join forces in the upcoming legislative election, with polls showing it can win the second-biggest bloc behind Marine Le Pen’s National Rally.

The FT warns that Macron’s centrist alliance could be facing a wipeout in snap parliamentary elections after France’s leftwing parties struck a unity pact.

New projections suggested only around 40 of Macron’s MPs would qualify for the second round vote on July 7, in run-off races that would predominantly be fought between candidates fielded by the far right or the leftwing bloc for the 589-strong assembly.

The market's response should not be a surprise as the prospect of the far-left getting a sway over policy has rattled investors in the past.

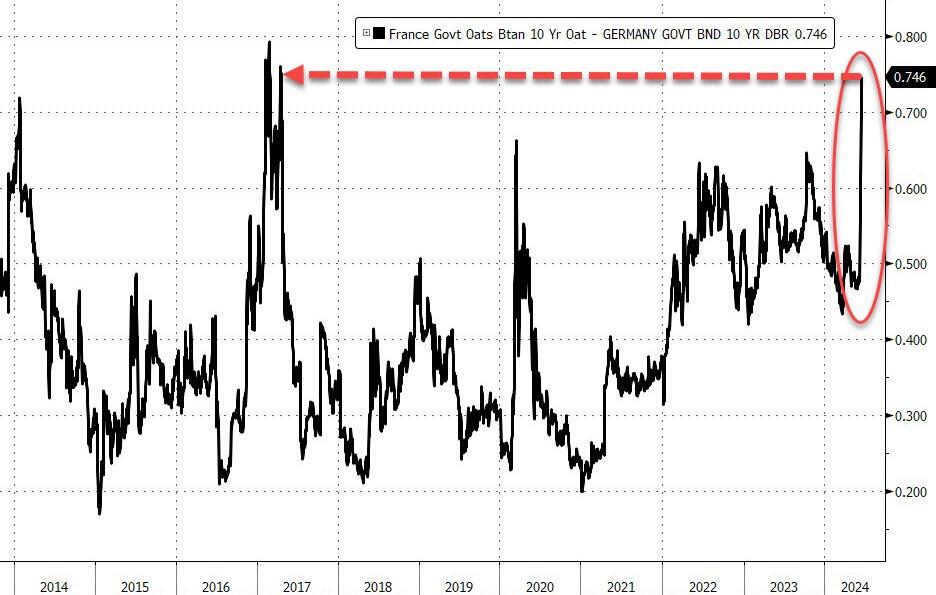

When polls in 2017 showed the presidential election could end up as a head-to-head between Le Pen and Melenchon, French debt sold off sharply, quadrupling its premium over safer German peers in a matter of months.

France’s CAC 40 index erased its gains for the year, with banking shares such as BNP Paribas SA and Societe Generale SA among the biggest losers.

“It’s hard to ignore the parallels between our current situation and the time of the sovereign debt crisis, as there’s that familiar focus on election results, sovereign bond spreads and debt sustainability,” said Jim Reid, an analyst at Deutsche Bank AG.

That’s “coupled with no obvious sign about where things are headed next.”

Of course, as we noted on X, what Macron's decision has done is merely pull back the curtain on the reality that nothing is fixed in Europe...

“It’s a risk-off tone with concerns over France driving the markets,” said Mohit Kumar, chief economist for Europe at Jefferies International. “Particularly going into the weekend, investors would be taking some positions off the table.”

And today, as Bloomberg reports, we see further implications as funding markets freeze up, as a French public development bank has delayed the sale of a green bond...

SFIL SA postponed the offering of a green bond on Friday, without giving a specific reason, according to a person familiar with the matter.

The delay was due to volatility in the French market, said another person with knowledge of the offering, asking not to be identified as the matter was private.

A day earlier, SFIL had mandated six banks to arrange the sale of a five-year note, with the aim of raising at least €500 million ($535 million).

The question of whether he was crazy to call a snap election was posed to him directly by Le Figaro earlier this week.

His response: “Not at all, I can confirm.”

When he was asked about it again by reporters at the G-7, he said that other leaders had described his actions as “courageous.”

Merde alors...

No comments:

Post a Comment