How cool would it be if we all had a portable fusion reactor in our home, jetson's like and unlimited energy available? Although nobody will entertain such fantasies nowadays, talking about renewables in similar glowing praise is not only still possible but encouraged, so much so that voicing doubts about the potential of renewables is frowned upon. With the risk of sounding like an heretic after mass, the limits of green energy are nevertheless getting clearer, even while the real costs are obfuscated and hidden behind the curtain of "clean" which most are not.

The reality as this article makes clear with detailed numbers, is that the future of our current society cannot be "green", and if it is, it will be a rather dark future, sliced with intermittent brown-outs and horrendously expensive electricity. (The two most likely options when you read between the lines.) Of all subjects, energy is the one which does least tolerate "ideology" and short-cuts. Physics guaranties that the road to really green energy will be a long one which will require a complete re-engineering of our society, the way we live and the way we think. That social crisis will therefore arrive long before we have invested the 30 to 50 years of effort necessary for green technological development. We most certainly could have invested the hundreds of billions of dollars used for nuclear weapons over the last 70 years into energy but that option never was on the table. Now, we are facing our growing needs for energy with dwindling fossil resources, while our population is still exploding and all these not-so-clean green energies remain marginal...

Authored by Gail Tverberg via Our Finite World,

We

have been told that intermittent electricity from wind and solar,

perhaps along with hydroelectric generation (hydro), can be the basis of

a green economy. Things are increasingly not working out as planned,

however. Natural gas or coal used for balancing the intermittent output

of renewables is increasingly high-priced or not available. It is

becoming clear that modelers who encouraged the view that a smooth

transition to wind, solar, and hydro is possible have missed some

important points.

Let’s look at some of the issues:

[1]

It is becoming clear that intermittent wind and solar cannot be counted

on to provide adequate electricity supply when the electrical

distribution system needs them.

Early modelers did not

expect that the variability of wind and solar would be a huge problem.

They seemed to believe that, with the use of enough intermittent

renewables, their variability would cancel out. Alternatively, long

transmission lines would allow enough transfer of electricity between

locations to largely offset variability.

In practice, variability

is still a major problem. For example, in the third quarter of 2021,

weak winds were a significant contributor to Europe’s power crunch.

Europe’s largest wind producers (Britain, Germany and France) produced only

14% of installed capacity during this period, compared with an average

of 20% to 26% in previous years. No one had planned for this kind of

three-month shortfall.

In 2021, China experienced dry, windless weather so

that both its generation from wind and hydro were low. The country

found it needed to use rolling blackouts to deal with the situation.

This led to traffic lights failing and many families needing to eat

candle-lit dinners.

In Europe, with low electricity supply, Kosovo has needed to use rolling blackouts. There is real concern that the need for rolling blackouts will spread to other parts of Europe,

as well, either later this winter, or in a future winter. Winters are

of special concern because, then, solar energy is low while heating

needs are high.

[2] Adequate storage for electricity is

not feasible in any reasonable timeframe. This means that if cold

countries are not to “freeze in the dark” during winter, fossil fuel

backup is likely to be needed for many years in the future.

One workaround for electricity variability is storage. A recent Reuters’ article is titled, Weak winds worsened Europe’s power crunch; utilities need better storage.

The article quotes Matthew Jones, lead analyst for EU Power, as saying

that low or zero-emissions backup-capacity is “still more than a decade

away from being available at scale.” Thus, having huge batteries or

hydrogen storage at the scale needed for months of storage is not

something that can reasonably be created now or in the next several

years.

Today, the amount of electricity storage that is available

can be measured in minutes or hours. It is mostly used to buffer

short-term changes, such as the wind temporarily ceasing to blow or the

rapid transition created when the sun sets and citizens are in the midst

of cooking dinner. What is needed is the capacity for multiple months

of electricity storage. Such storage would require an amazingly large

quantity of materials to produce. Needless to say, if such storage were

included, the cost of the overall electrical system would be

substantially higher than we have been led to believe. All major types

of cost analyses (including the levelized cost of energy, energy return

on energy invested, and energy payback period) leave out the need for

storage (both short- and long-term) if balancing with other electricity

production is not available.

If no solution to inadequate

electricity supply can be found, then demand must be reduced by one

means or another. One approach is to close businesses or schools.

Another approach is rolling blackouts. A third approach is to permit

astronomically high electricity prices, squeezing out some buyers of

electricity. A fourth balancing approach is to introduce recession,

perhaps by raising interest rates; recessions cut back on demand for all

non-essential goods and services. Recessions tend to lead to

significant job losses, besides cutting back on electricity demand. None

of these things are attractive options.

[3] After many

years of subsidies and mandates, today’s green electricity is only a

tiny fraction of what is needed to keep our current economy operating.

Early modelers did not consider how difficult it would be to ramp up green electricity.

Compared

to today’s total world energy consumption (electricity and

non-electricity energy, such as oil, combined), wind and solar are truly insignificant.

In 2020, wind accounted for 3% of the world’s total energy consumption

and solar amounted to 1% of total energy, using BP’s generous way of

counting electricity, relative to other types of energy. Thus, the

combination of wind and solar produced 4% of world energy in 2020.

The

International Energy Agency (IEA) uses a less generous approach for

crediting electricity; it only gives credit for the heat energy supplied

by the renewable energy. The IEA does not show wind and solar

separately in its recent reports. Instead, it shows an “Other” category

that includes more than wind and solar. This broader category amounted to 2% of the world’s energy supply in 2018.

Hydro

is another type of green electricity that is sometimes considered

alongside wind and solar. It is quite a bit larger than either wind or

solar; it amounted to 7% of the world’s energy supply in 2020. Taken

together, hydro + wind + solar amounted to 11% of the world’s energy

supply in 2020, using BP’s methodology. This still isn’t much of the

world’s total energy consumption.

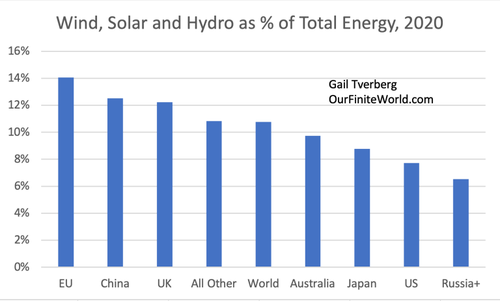

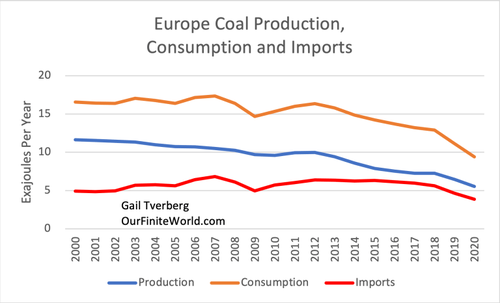

Of course, different parts of

the world vary with respect to the share of energy created using wind,

hydro and solar. Figure 1 shows the percentage of total energy generated

by these three renewables combined.

Figure

1. Wind, solar and hydro as a share of total energy consumption for

selected parts of the world, based on BP’s 2021 Statistical Review of

World Energy data. Russia+ is Russia and its affiliates in the

Commonwealth of Independent States (CIS).

As expected, the

world average is about 11%. The European Union is highest at 14%;

Russia+ (that is, Russia and its Affiliates, which is equivalent to the

members of the Commonwealth of Independent States) is lowest at 6.5%.

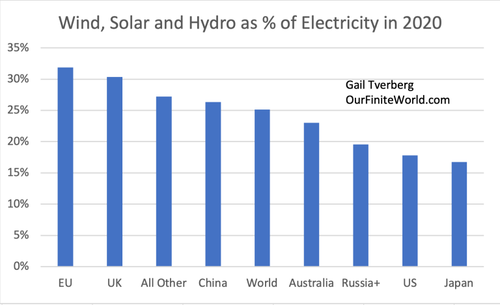

[4] Even as a percentage of electricity, rather than total energy, renewables still comprised a relatively small share in 2020.

Wind and solar don’t replace “dispatchable”

generation; they provide some temporary electricity supply, but they

tend to make the overall electrical system more difficult to operate

because of the variability introduced. Renewables are available only

part of the time, so other types of electricity suppliers are still

needed when supply temporarily isn’t available. In a sense, all they are

replacing is part of the fuel required to make electricity. The fixed

costs of backup electricity providers are not adequately compensated,

nor are the costs of the added complexity introduced into the system.

If

analysts give wind and solar full credit for replacing electricity, as

BP does, then, on a world basis, wind electricity replaced 6% of total

electricity consumed in 2020. Solar electricity replaced 3% of total

electricity provided, and hydro replaced 16% of world electricity. On a

combined basis, wind and solar provided 9% of world electricity. With

hydro included as well, these renewables amounted to 25% of world

electricity supply in 2020.

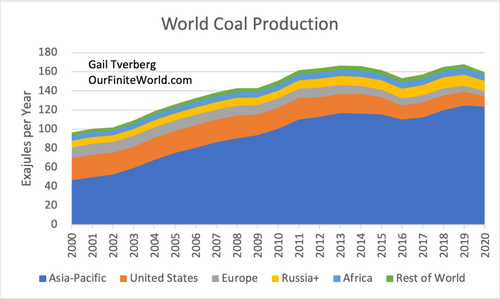

The share of electricity supply

provided by wind, solar and hydro varies across the world, as shown in

Figure 2. The European Union is highest at 32%; Japan is lowest at 17%.

Figure

2. Wind, solar and hydro as a share of total electricity supply for

selected parts of the world, based on BP’s 2021 Statistical Review of

World Energy data.

The “All Other” grouping of countries

shown in Figure 2 includes many of the poorer countries. These countries

often use quite a bit of hydro, even though the availability of hydro

tends to fluctuate a great deal, depending on weather conditions. If an

area is subject to wet seasons and dry seasons, there is likely to be

very limited electricity supply during the dry season. In areas with

snow melt, very large supplies are often available in spring, and much

smaller supplies during the rest of the year.

Thus, while hydro is

often thought of as being a reliable source of power, this may or may

not be the case. Like wind and solar, hydro often needs fossil fuel

back-up if industry is to be able to depend upon having electricity

year-around.

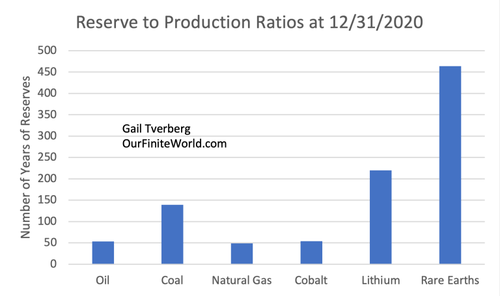

[5] Most modelers have not understood that

reserve to production ratios greatly overstate the amount of fossil

fuels and other minerals that the economy will be able to extract.

Most

modelers have not understood how the world economy operates. They have

assumed that as long as we have the technical capability to extract

fossil fuels or other minerals, we will be able to do so. A popular way

of looking at resource availability is as reserve to production ratios.

These ratios represent an estimate of how many years of production

might continue, if extraction is continued at the same rate as in the

most recent year, considering known resources and current technology.

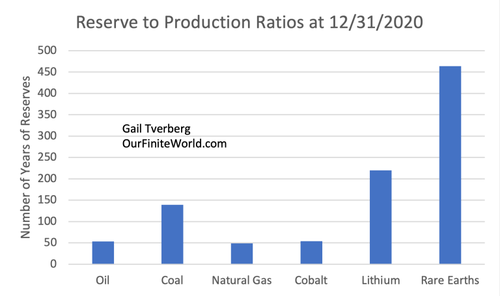

Figure 3. Reserve to production ratios for several minerals, based on data from BP’s 2021 Statistical Review of World Energy.

A

common belief is that these ratios understate how much of each resource

is available, partly because technology keeps improving and partly

because exploration for these minerals may not be complete.

In

fact, this model of future resource availability greatly overstates the

quantity of future resources that can actually be extracted. The problem

is that the world economy tends to run short of many types of resources simultaneously. For example, World Bank Commodities Price Data shows

that prices were high in January 2022 for many materials, including

fossil fuels, fertilizers, aluminum, copper, iron ore, nickel, tin and

zinc. Even though prices have run up very high, this is not an

indication that producers will be able to use these high prices to

extract more of these required materials.

In order to produce more

fossil fuels or more minerals of any kind, preparation must be started

years in advance. New oil wells must be built in suitable locations; new

mines for copper or lithium or rare earth minerals must be built;

workers must be trained for all of these areas. High prices for many

commodities can be a sign of temporarily high demand, or it can be a

sign that something is seriously wrong with the system. There is no way

the system can ramp up needed production in a huge number of areas at

once. Supply lines will break. Recession is likely to set in.

The

problem underlying the recent spike in prices seems to be “diminishing

returns.” Such diminishing returns affect nearly all parts of the

economy simultaneously. For each type of mineral, miners produced the

easiest-t0-extract materials first. They later moved on to deeper oil

wells and minerals from lower grade ores. Pollution gradually grew, so,

it too, needed greater investment. At the same time, world population

has been growing, so the economy has required more food, fresh water and

goods of many kinds; these, too, require the investment of resources of

many kinds.

The problem that eventually hits the economy is that

it cannot maintain economic growth. Too many areas of the economy

require investment, simultaneously, because diminishing returns keeps

ramping up investment needs. This investment is not simply a financial

investment; it is an investment of physical resources (oil, coal, steel,

copper, etc.) and an investment of people’s time.

The way in which the economy would run short of investment materials was simulated in the 1972 book, The Limits to Growth, by

Donella Meadows and others. The book gave the results of a number of

simulations regarding how the world economy would behave in the future.

Virtually all of the simulations indicated that eventually the economy

would reach limits to growth. A major problem was that too large a share

of the output of the economy was needed for reinvestment, leaving too

little for other uses. In the base model, such limits to growth came

about now, in the middle of the first half of the 21st century. The

economy would stop growing and gradually start to collapse.

[6]

The world economy seems already to be reaching limits on the extraction

of coal and natural gas to be used for balancing electricity provided

by intermittent renewables.

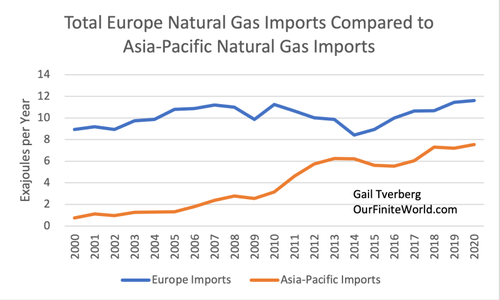

Coal and natural gas are

expensive to transport so, if they are exported, they primarily tend to

be exported to countries that are nearby. For this reason, my analysis

groups together exports and imports into large regions where trade is

most likely to take place.

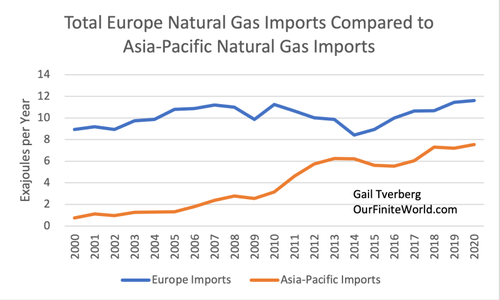

If we analyze natural gas imports by

part of the world, two regions stand out as having the most

out-of-region natural gas imports: Europe and Asia-Pacific. Figure 4

shows that Europe’s out-of region natural gas imports reached peaks in

2007 and 2010, after which they dipped. In recent years, Europe’s

imports have barely surpassed their prior peaks. Asia-Pacific’s

out-of-region imports have shown a far more consistent growth long-term

growth pattern.

Figure

4. Natural gas imports in exajoules per year, based on data from on

data from BP’s 2021 Statistical Review of World Energy.

The

reason why Asia-Pacific’s imports have been growing is to support its

growing manufacturing output. Manufacturing output has increasingly been

shifted to the Asia-Pacific region, partly because this region can

perform this manufacturing cheaply, and partly because rich countries

have wanted to reduce their carbon footprint. Moving heavy industry

abroad reduces a country’s reported CO2 generation, even if the

manufactured items are imported as finished products.

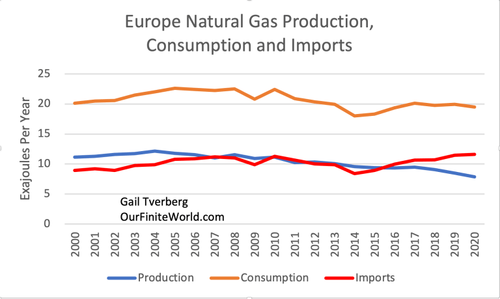

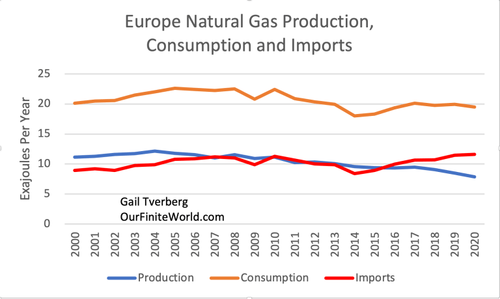

Figure 5

shows that Europe’s own natural gas supply has been falling. This is a

major reason for its import requirements from outside the region.

Figure

5. Europe’s natural gas production, consumption and imports based on

data from BP’s 2021 Statistical Review of World Energy.

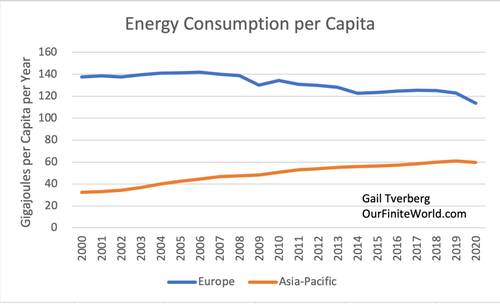

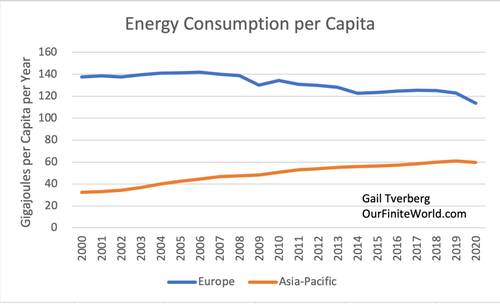

Figure

6, below, shows that Asia-Pacific’s total energy consumption per capita

has been growing. The new manufacturing jobs transferred to this region

have raised standards of living for many workers. Europe, on the other

hand, has reduced its local manufacturing. Its people have tended to get

poorer, in terms of energy consumption per capita. Service jobs

necessitated by reduced energy consumption per capita have tended to pay

less well than the manufacturing jobs they have replaced.

Figure

6. Energy consumption per capita for Europe compared to Asia-Pacific,

based on data from BP’s 2021 Statistical Review of World Energy.

Europe

has recently been having conflicts with Russia over natural gas. The

world seems to be reaching a situation where there are not enough

natural gas exports to go around. The Asia-Pacific Region (or at least

the more productive parts of the Asia-Pacific Region) seems to be able

to outbid Europe, when local natural gas supply is inadequate.

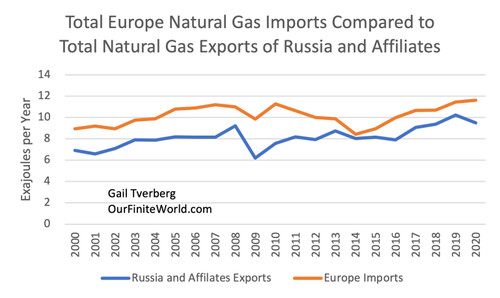

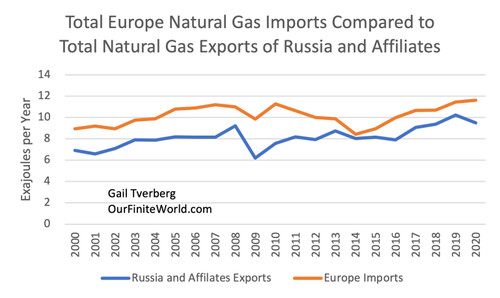

Figure

7, below, gives a rough idea of the quantity of exports available from

Russia+ compared to Europe’s import needs. (In this chart, I compare

Europe’s total natural gas imports (including pipeline imports from

North Africa and LNG from North Africa) with the natural gas exports of

Russia+ (to all nations, not just to Europe, including both by pipeline

and as LNG)). On this rough basis, we find that Europe’s natural gas

imports are greater than the total natural gas exports of Russia+.

Figure

7. Total natural gas imports of Europe compared to total natural gas

exports from Russia+, based on data from BP’s 2021 Statistical Review of

World Energy.

Europe is already encountering multiple

natural gas problems. Its supply from North Africa is not as reliable as

in the past. The countries of Russia+ are not delivering as much

natural gas as Europe would like, and spot prices, especially, seem to

be way too high. There are also pipeline disagreements. Bloomberg

reports that Russia will be increasing its exports to

China in future years. Unless Russia finds a way to ramp up its gas

supplies, greater exports to China are likely to leave less natural gas

for Russia to export to Europe in the years ahead.

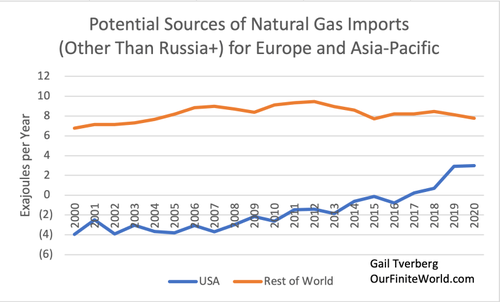

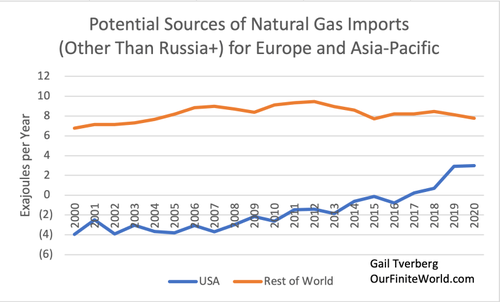

If we look

around the world to see what other sources of natural gas exports are

available for Europe, we discover that the choices are limited.

Figure

8. Historical natural gas exports based on data from BP’s 2021

Statistical Review of World Energy. Rest of the world includes Africa,

the Middle East and the Americas excluding the United States.

The

United States is presented as a possible choice for increasing natural

gas imports to Europe. One of the catches with growing natural gas

exports from the United States is the fact that historically, the US has

been a natural gas importer; it is not clear how much exports

can rise above the 2022 level. Furthermore, part of US natural gas is

co-produced with oil from shale. Oil from shale is not likely to be growing much

in future years; in fact, it very likely will be declining because of

depleted wells. This may limit the US’s growth in natural gas supplies

available for export.

The Rest of the World category on Figure 8

doesn’t seem to have many possibilities for growth in imports to Europe,

either, because total exports have been drifting downward. (The Rest of

the World includes Africa, the Middle East, and the Americas excluding

the United States.) There are many reports of countries, including Iraq

and Turkey, not being able to buy the natural gas they would like. There

doesn’t seem to be enough natural gas on the market now. There are few

reports of supplies ramping up to replace depleted supplies.

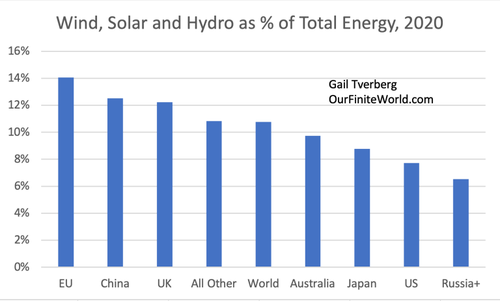

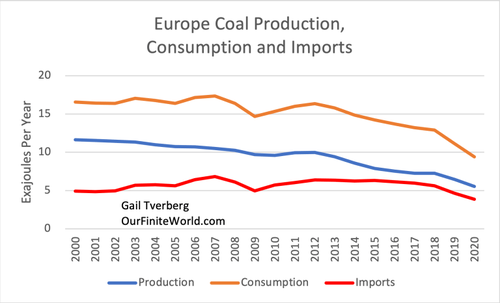

With

respect to coal, the situation in Europe is only a little different.

Figure 9 shows that Europe’s coal supply has been depleting, and imports

have not been able to offset this depletion.

Figure 9. Europe’s coal production, consumption and imports, based on data from BP’s 2021 Statistical Review of World Energy.

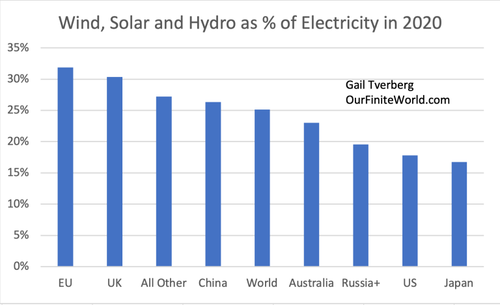

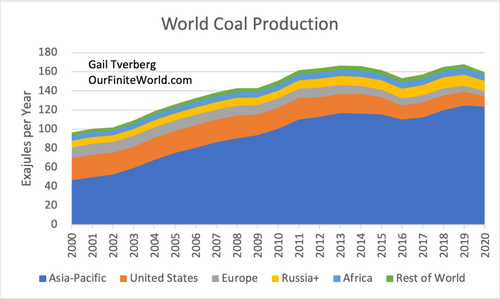

If a person looks around the world for places to get more imports for Europe, there aren’t many choices.

Figure 10. Coal production by part of the world, based on data from BP’s 2021 Statistical Review of World Energy.

Figure

10 shows that most coal production is in the Asia-Pacific region. With

China, India and Japan located in the Asia-Pacific Region, and high

transit costs, this coal is unlikely to leave the region. The United

States has been a big coal producer, but its production has declined in

recent years. It still exports a relatively small amount of coal. The

most likely possibility for increased coal imports would be from Russia

and its affiliates. Here, too, Europe is likely to need to outbid China

to purchase this coal. A better relationship with Russia would be

helpful, as well.

Figure 10 shows that world coal production has

been essentially flat since 2011. A country will only export coal that

it doesn’t need itself. Thus, a shortfall in export capability is an

early warning sign of inadequate overall supply. With the economies of

many Asia-Pacific countries still growing rapidly, demand for coal

imports is likely to grow for this region. While modelers may think that

there is close to 150 years’ worth of coal supply available, real-world

experience suggests that coal limits are being reached already.

[7]

Conclusion. Modelers and leaders everywhere have had a basic

misunderstanding of how the economy operates and what limits we are up

against. This misunderstanding has allowed scientists to put together

models that are far from the situation we are actually facing.

The

economy operates as an integrated whole, just as the body of a human

being operates as an integrated whole, rather than a collection of cells

of different types. This is something most modelers don’t understand,

and their techniques are not equipped to deal with.

The economy is

facing many limits simultaneously: too many people, too much pollution,

too few fish in the ocean, more difficult to extract fossil fuels and

many others. The way these limits play out seems to be the way the

models in the 1972 book, The Limits to Growth, suggest: They

play out on a combined basis. The real problem is that diminishing

returns leads to huge investment needs in many areas simultaneously. One

or two of these investment needs could perhaps be handled, but not all

of them, all at once.

The approach of modelers, practically

everywhere, is to break down a problem into small parts, and assume that

each part of the problem can be solved independently. Thus, those

concerned about “Peak Oil” have been concerned about running out of oil.

Finding substitutes seemed to be important. Those concerned about

climate change were convinced that huge amounts of fossil fuels remain

to be extracted, even more than the amounts indicated by reserve to

production ratios. Their concern was finding substitutes for the huge

amount of fossil fuels that they believed remained to be extracted,

which could cause climate change.

Politicians could see that there

was some sort of huge problem on the horizon, but they didn’t

understand what it was. The idea of substituting renewables for fossil

fuels seemed to be a solution that would make both Peak Oilers and those

concerned about climate change happy. Models based on the substitution

of renewables for fossil fuels seemed to please almost everyone. The

renewables approach suggested that we have a very long timeframe to deal

with, putting the problem off, as long into the future as possible.

Today,

we are starting to see that renewables are not able to live up to the

promise modelers hoped they would have. Exactly how the situation will

play out is not entirely clear, but it looks like we will all have front

row seats in finding out.