"In a hyper-financialized world", everything seems not to matter until suddenly it does! Japan is now learning the lesson with the painfully crashing Yen. Europe will be next with its unrealistic woke energy policies. As each country is slowly painting itself into a corner, eventually war will look more and more like an acceptable option as I predicted almost two years ago.

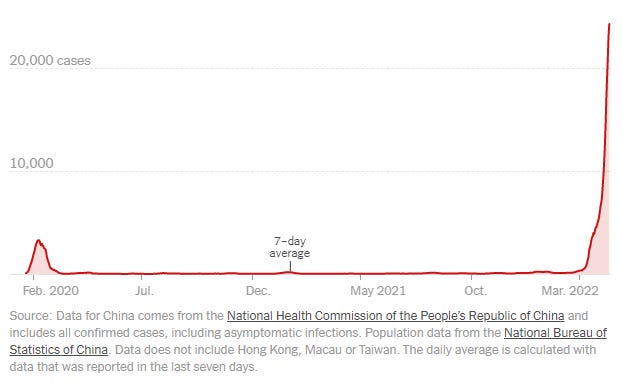

Anyway, by then democracy will be little but a vague afterthought so there won't be much left to defend. The Covid crisis and it's intolerance of dissent was the appetizer. Just as being pro-Putin will now get you punished in some European countries, being anti-whatever the government's decree of the day is, won't, can't be tolerated much longer. If you are not missing yet the good old days of 2019, you soon will!

Authored by Tom Luongo via Gold, Goats, 'n Guns blog,

“Energy makes energy anyhow

So spend yourself and get rich right now”

- Marillion “Rich”

This day has been a long time coming. From the moment, more than a decade ago, when it was finally admitted that Europe was destined to be an energy importer, we were going to see the climax of the showdown between the West and Russia.

Europe as energy importer always meant that time was on Russia’s side. All it had to do was draw the conflict out long enough, survive long enough, to force Europe into submission. Russia has the energy Europe needs, no one else can supply it, therefore the final decision will be to accept this fate.

No amount of financial wizardry, pathetic virtue signaling about Climate Change, malinvestment into inefficient and unsustainable ‘renewables,’ or military threats would ultimately change the outcome of this story.

Output off the North Slope has fallen off and Groningen’s gas fields are drying up faster than Hillary’s va-jay-jay with each twist of John Durham’s investigation into RussiaGate.

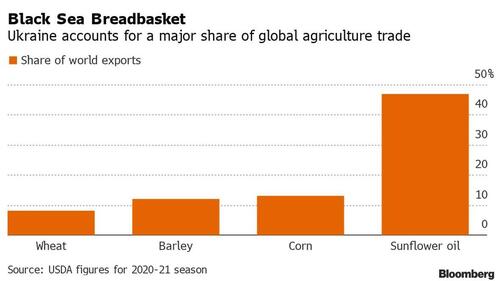

Every gambit to secure energy from Ukraine (Donbass coal, gas fields in the Sea of Azov) and the Middle East (Syria, EastMed Pipeline, Iran) have also failed.

This is the basic problem the EU faces in its quest for political hegemony.

How does it get around this basic fact without fomenting 1) a political crisis at home and 2) a war with Russia and the rest of the Global South who support her, it cannot win?

Force Majeure

Since the start of the war in Ukraine, a conflict created by EU complicity in NATO’s long-standing war on Russia, the EU has tried to play the victim of US/UK aggressiveness while happily going along with it for their own purposes.

That purpose is to advance their agenda of erecting a total surveillance state under the guise of a radical response to Climate Change. Their problem is they have no viable replacement for Russian energy, be it oil, coal or gas, that is capable of sustaining them in the interim.

All of their refusals were met with Russian intransigence. After gleefully going along with the theft of Russian foreign exchange reserves, as well as forcing the abandonment of Russian state assets like seizing Gazprom’s subsidiary in Germany, Europe still tried to say Russia had no legal right change the terms of payment for Russian energy.

It was hilarious to watch as EU sycophants tried to argue Russia had no legal right to claim to force majeure after the EU prohibited Gazprom from spending the euros they would be paid for its gas.

The Russian government responded with a demand for payment for all exports to legally-defined ‘unfriendly countries’ in either gold or Russian rubles. And the howls were heard all around the world.

Even though acts of war, including sanctions, are a typical clause in all Gazprom supply contracts:

So, after a couple of weeks of denying reality, of playing to the moral high ground about punishing Vladimir Putin the butcher of Bucha, the EU as always caved to reality.

Ruble Roulette

The EU finally figured out a way to avoid US sanctions to buy Russian energy in rubles.

Moscow has warned Europe it risks having gas supplies cut unless it pays in roubles. In March it issued a decree proposing that energy buyers open accounts at Gazprombank to make payments in euros or dollars, which would then be converted to rubles.

The Commission said earlier this month that the decree risked breaching EU sanctions since it would put the effective completion of the purchase – once the payments are converted to rubles – into the hands of the Russian authorities.

In an advisory document sent to member states on Thursday, however, the Commission said Moscow’s proposal does not necessarily prevent a payment process that would comply with EU sanctions against Russia over the Ukraine conflict.

This is their way out. As always, the EU will just define things however they need to in order to save face, while ultimately capitulating when forced to show their hole cards.

We watched this same pathetic display for more than three years over Brexit. And if not for a complicit, nee treasonous performance by Former Prime Minister Theresa May, Brexit negotiations would have been finalized in around six months.

All she had to do was set terms and walk away from these people. All she had to do was what Putin just did.

This isn’t to say Putin’s handling of this growing crisis has been perfect. His biggest fault as Russia’s leader has been his continued underestimating the duplicity and sheer evil emanating from the European Commission.

However, I also feel Putin knew that Russia’s best strategy was to be the best neighbor it could be despite the obvious provocations. It cost him politically for years. This is why he tried so hard for so long to find common ground with these folks, attempting where he could to make allies and create political leverage.

This is why Putin has refused to shut off the gas to the EU, even while they dragged their feet on paying in rubles. He always knew where this would end up, and if you asked the Eurocrats in Brussels quietly, so did they.

The political costs to Brussels for turning off the gas would be too high a price for them to pay.

This issue has caused fracturing in German’s fragile ruling coalition. It has harmed France’s Emmanuel Macron’s re-election chances in France. It will cost Mario Draghi his government next year. Of course, by then Draghi’s destruction of Italy as a country will be nearly complete. One can only hope the Italians find their voice between now and then.

Hungry, Hungary Hypocrites

Putin’s most obvious victory was in Hungary, where Viktor Orban just won a major election. Orban has already leveraged that victory into frustrating the EU’s plans to sever energy ties with Russia and steadfastly refusing to up the military pressure on Russia, which I talked about on the eve of the election.

For this reason Hungary will be in the EU’s crosshairs going forward. It will be marginalized, if not kicked out eventually, over these issues. There are ideologues at the helm in Brussels and they will not be stopped in their quest to bring Europe to its knees under their control.

If Hungary say no to this, they will be punished for it. But punishing Hungary at this point is like trying to punish Russia. It’s actually a blessing for them.

For Hungary, once it is freed from the EU, will be the destination for foreign capital in a way that it is cannot be today. These are Orban’s hole cards, and they are powerful ones. In the meantime, he will stay in the EU to be a thorn in their side until they get rid of him.

The biggest embarrassment for Brussels would be for Hungary to thrive outside of the EU framework, the same fear that was on the table during Brexit negotiations. The difference, of course, is that the UK political establishment is all in on the Brussels agenda, it’s the people outside of London who aren’t.

Hungarians just proved that Orban doesn’t have that problem.

So, the benefits of ending its future relationship with the EU will be much more immediately apparent, when it happens.

European Unionicide

No matter what happens in the long run, however, the reality is that a new Europe is on the horizon. And it isn’t a pretty sight. The EU will, at best, muddle through without a couple of current pieces — Hungary, Bulgaria and Romania — and at worst break back apart as the common currency experiment reaches an ignominious end broken on the shores of a new energy-based reserve standard which it simply cannot compete against.

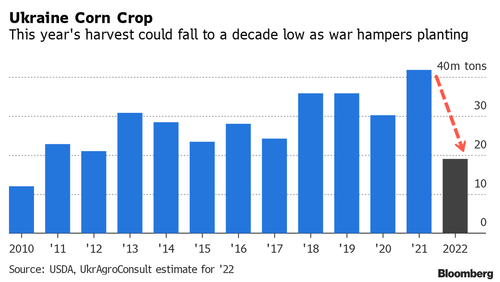

Just like Ukraine is quickly being carved up by Russia into a smaller pieces, so too will Europe balkanize over the EU’s failures to secure a reliable energy future for its people.

Russia’s demands that Europe pay for Russian exports through the unsanctioned Gazprombank, who will process the currency conversion (at the importer’s expense) into rubles, now give it the upper hand in all future trade dealings with the EU.

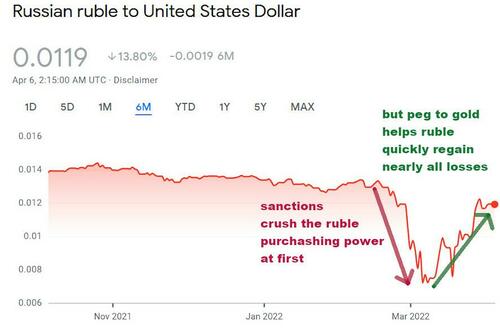

And since the ruble is now loosely tied to physical gold this means the possibility of the euro ever challenging the US dollar as a reserve currency is now officially over. That fate was sealed with Draghi’s move to negative interest rates back in 2014, turning it into the ultimate carry currency.

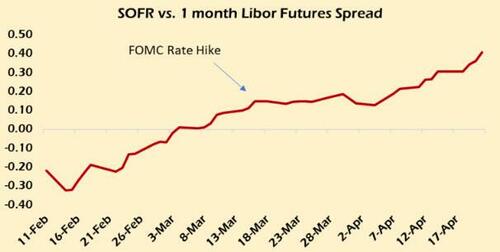

That status is quickly unwinding to the detriment of the Japanese Yen which is now grabbing the headlines caught in the middle between the war between the Fed and the ECB.

At the same time, the Eurodollar system has come under existential threat thanks to the coming end of LIBOR blunting the desires of a hawkish Fed. Because of this, the ECB is trapped in a maze where the exits have all been blocked off.

There is no reason now for anyone to hold euros or convert euros into European sovereign debt. The Russians are no longer going to support the eurodollar market by recycling its trade surplus into the European banking system, exactly as was predicted when the EU followed the US by seizing Russia’s foreign exchange reserves.

Who in their right mind would hold euros on your balance sheet beyond what you need to pay for goods is a losing proposition if Ursula Von der Leyen has deemed you an Untermensch?

Gazprombank will simply flip those euros into physical gold and add them to the country’s balance sheet, making it even stronger. This will ensure that the euro itself becomes a pariah currency and force the ECB to continue the path towards hyperinflation.

The birth of a new Europe is one where the currency risk is now all on the importer of commodities, not the exporter of commodities. I’ve been saying for years that Europe always thought that its huge share of Russian energy exports would give it monopsony power over Russia. That, they thought, without Europe as a buyer, Russia would be at their mercy.

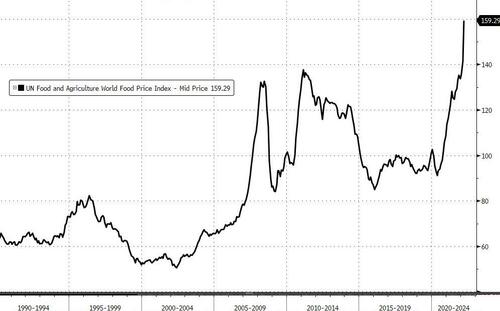

In a hyper-financialized world, that assumption had always held true. But, in a new monetary regime, where the world is beyond debt saturation, the bills are due and there’s no more road to kick the can down, it simply isn’t true anymore.

By Russia tying the ruble to gold and both the US and EU weaponizing offshore dollar markets, that misperception of buying power is being laid bare. Sure, the EU has euros to offer but it does so into the revaluation of commodities versus fiat currencies which have ever-shrinking use cases.

This only feeds the downward spiral of the euro and the eurodollar system into the vortex that is physical gold and the demand for commodities on which all of its value is derived.

The mouse in Hungary has roared loud enough to finally get the apparatchiks in Brussels to listen to the tune the Russian bear has been quietly humming to itself for years.