An interesting philosophical article which can be resumed by: "Who are you going to believe? Me or your own eyes?

And in most case people indeed and especially since Covid choose to believe what they are being told.

Case in point, "The hottest May ever" in the UK under a cold pouring rain. Same in Japan, "Earliest 30C in Tokyo" yesterday although we're having a superb and amazingly cool Spring with temperatures often 5C to 10C below normal. But then again, who decides what normal is these days?

Previous generations used to know what reality was. They would go outside, see and experience the weather. Go to the countryside or live there, talk to farmers, see and enjoy animals, understand their needs and requirements. More generally understand that life is a complex balance between conflicting realities and necessities. They would argue with other people, confront ideas and slowly form their own.

Not anymore. Now, most people are hooked on screens most of the time. Their computers at home and at work. Their mobile phones everywhere else, monitoring and adapting to their needs. But more fundamentally "shaping" their opinions like never before by locking people in a "reality" bubble from which it is quasi impossible to escape.

Worse, most people crave this artificial and reassuring "reality" and more and more reject dissenting opinions and conflicting ideas. You just need to nudge them a little more everyday in the right direction and slowly you end up shaping public opinion like never before.

I find this very tragic but what do I know? Isn't it what an iconoclast dissident, a person we would have called a heretic not so long ago and who are now dismissed as conspiracy theorist, would say? And soon enough they switch off returning to their screens and reassuring artificial reality. A tragedy, certainly, but for whom? The lone non conforming individual asking forbidden questions, or the sheep walking swiftly towards the slaughterhouse reassured by the sheer numbers surrounding them?

Authored by Sinead Murphy via The Brownstone Institute,

The UK Meteorological Office has just reported that we have enjoyed the hottest May on record.

Meanwhile, those of us who have lived in the UK during May have endured unseasonal cold and rain, and have complained to one another constantly about it.

Welcome

to the age of abstraction, when lived experience is irrelevant and

theoretical constructions carry the day – when what is deemed right and

true is unmoored from what is actually happening here and now.

Over

four years ago, Covid lockdowns staged a dramatic confiscation of

present reality. The question is, did we ever get it back?

When

the UK government ordered its first lockdown at the end of March 2020,

the present reality was put on hold – businesses were shut, schools

closed, social activities banned, and human interactions restricted.

Chaos and suffering inevitably ensued. But in the midst of the misery, there arose a new possibility.

With

present reality in abeyance, we were freed of its reality check. And we

began to indulge in a new and joyous expectancy, of a wonderful future

to revive a glorious past.

‘We’ll meet again,’ Queen Elizabeth

assured us, reprising in her words and presence a fondly recalled

togetherness of the last world war and promising its restoration as if it had only just been paused –

as if the decades-long decimation of community and family and

individual had never happened, as if only a temporary order to Stay Home

stood between us and a lost world.

This new possibility

was tantalizing and quickly took hold of Middle England, the

BBC-believing bastion of British Values, bent ever more implausibly on

keeping calm and carrying on.

By 2020, this beleaguered

demographic had been all but spent from spotting certainties and

consolations on the horizon of Left and Right, to forestall a looming

vertigo at elite interests dashing its hopes from above and

state-reliant deplorables whose fate beckoned from below.

Middle England, front and centre of policy and institution, had long been demoralized by its present reality:

Consigned

to jobs made ever more bullshit by the erosion of ambition and

discipline; flip-flopping between debt and the dregs of old desires;

addled by precarity and the virtuosity that survives it; overseeing the

retreat of human sympathy everywhere and applying for relief to

anxiously awaited festivals that never failed to disappoint.

Lockdowns’ suspension of this reality was in itself a great boon.

But

greater still was what followed: unimpeded anticipation, of a happy

tomorrow to follow a happy yesterday, in which all we would do because

all we had done was Hug Granny and Play Whist and Toast Marshmallows and

Sing Carols.

This was not nostalgia. It was infinitely more potent.

In

nostalgia, the past is glorified as what is dead, as what is ‘vintage’

or ‘retro,’ as what can therefore only be remembered, however

wistfully.

In lockdown, the past was reanimated, suddenly reframed as what would be again once universal cocooning came to an end.

Lockdowns

relieved us of the one thing that had stood between us and fantastic

recollections of Digging For Victory and Winning At Cribbage: present

reality.

We were free now to regret the past, not

hopelessly as what was lost and gone, but hopefully as what had just

been put on hold and would soon resume once things got back to normal.

Yes,

we still went through the present realities of 2020 and 2021. We ate

food and washed clothes and logged on, and drank too much and fought too

hard and lost our sense of purpose. But suddenly, all of that was in

parentheses – not real at all, just for now.

Lockdowns achieved a

transfer of the reality-effect from an inglorious present, sodden with

disappointment, to a host of abstract ideas plundered from an invented

past and projected to an inflated future.

Over four years

on, we are no longer supported in our exemption from present reality by

government orders to Shelter In Place. Present reality is returned to

us, after a fashion.

It appears, however, that we do not want it back, that the lockdown mode continues to tantalize.

The

reluctance with which many have relinquished their facemask has surely

warned of this. As has the ongoing normalization of work-from-home.

But

there is another and more insidious aspect to our cleaving to

lockdowns’ suspension of present reality: our growing enthusiasm for

theoretical constructions for which present reality is irrelevant.

During

lockdowns, we plundered the almost-dead stock of yesteryear for content

for the new mode of fond expectancy – abstract ideas of Dunkirk Spirit

and Oh! What A Lovely War were hastily put abroad, adorned with Union

Jack bunting, mugs of builders’ tea, allotment lemonade, and royal

memorabilia.

But already before lockdowns ended, the stock of abstract ideas began updating.

The

widely disseminated death of George Floyd launched a Black Lives Matter

theme complete with its cartoon fist, and the rainbow of Gender was a

seamless segway from the I Heart NHS refrain that had played ad nauseam

for Covid.

As lockdowns receded, we were encouraged to extend our

exemption from present reality by a growing fund of available

abstractions: Climate, Health, Equity, Security, Safety, Identity…

These

abstractions come with ready-made, insertable symbols: Black Lives

Matter fists and Gender rainbows have been joined by Ukraine flags,

Greta hastags, syringe icons, and wildfire emojis.

We

trade these ideas as if they are old friends – unobjectionable,

universally liked. We pin their cutesy signals to our messages and our

lapels.

But these ideas are not our friends. They are quite the opposite. Because these ideas are not only theoretical, they are necessarily theoretical – by definition inapplicable to our lives and therefore indifferent to our flourishing.

The

idea of ‘Environment’ is no more relevant to the rubbish blowing around

our street than the idea of ‘Climate’ refers to the weather outside or

the idea of ‘Health’ is concerned about how we feel or the idea of

‘Gender’ maps onto our biology.

Nothing about these ideas touches

down in present reality. By trading them between ourselves – by posting

them and tweeting them and dropping them into our casual conversations –

we perform a contempt for present reality and a will to exempt

ourselves from it, perpetuating the effect of lockdowns long after the

lockdowns have ended.

Early Covid scepticism often argued

that they invented Covid so they could have lockdowns. In retrospect,

this was wrong. They invented lockdowns so they could have Covid. Not

the disease of course, which was a concoction. The idea. Or rather, the kind of idea.

Covid is not just an abstract idea. It is an essentially abstract

idea. It refers to something never heard of before – an asymptomatic

disease, a disease for which present reality is necessarily irrelevant.

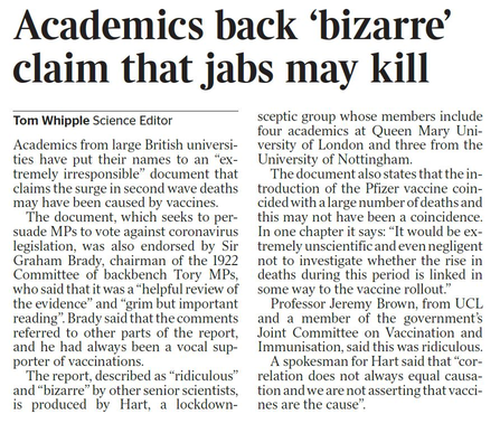

The Vaccine, which followed fast upon Covid and with great eclat, is another essentially abstract idea. With no significant effect on either transmission or infection, it is among us only as scorn for lived experience.

But

Lockdown too is such an idea, describing a degree of distancing of

people from one another and of cessation of the activities of life that

could never be achieved in reality.

It is in this sense that

lockdowns have defined our societies, escorting us from a time when

present reality was relevant and required to be manipulated to a time

when present reality is irrelevant and can be vetoed at will.

Lockdowns

both launched an assault upon present reality by physically removing us

from it and piloted, through the impossible idea of Lockdown, the cycle

of abstraction that continues to transfer the reality effect from lived

experiences to theoretical constructions.

In the end

of it all, perhaps they invented lockdowns just to get Lockdown,

imposing abstention from present reality to kickstart abstraction from

present reality.

Of course, we still live out the realities

obscured by their abstractions – beneath the pristine idea of Lockdown,

there arose material conditions from which millions continue to suffer,

not to mention the physical devastation unfolding under the idea of the

Vaccine.

But somehow, all of that is in parentheses. The fallout

from lockdowns is revealed in public inquiries and injuries from

vaccines are reported in the media. Yet, it produces little effect – as

if none of reality is real, but only a series of aberrations.

Exemption from present reality, begun so theatrically by lockdowns, continues unabated. What

counts as vital circulates in the abstract, and lived experiences are

sidelined as mere happenstance, hardly worth our notice at all.

Foucault’s

most important insight is that you do not need to enslave people first

in order then to exploit them. There are ways of exploiting people that

also enslave them.

The disciplinary techniques of

industrial production, with their unerring distribution of people in

spaces and times, made people at once docile and useful.

In 1990,

Deleuze updated Foucault’s insight to explain that you do not need to

pacify people first in order to steal from them. There are ways of

pacifying people by stealing from them.

The debt-based consumerism of post-industrial societies at once made people complacent with gratification and transferred their wealth to elite corporations.

By

2020, we had moved beyond the paradigms of production and consumption,

even reproaching ourselves for overproducing and overconsuming.

By 2020, it was the age abstraction.

Lockdowns officially launched this new age in spectacular style. But quickly, lockdowns became unnecessary.

For, it emerged that you do not need to lock people away from present reality first in order to circulate unbelievable ideas.

If reality is sufficiently hostile and the ideas are sufficiently abstract, you can lock people away from present reality by the circulation of unbelievable ideas.

When

we shake our heads to one another about Climate, or submit to screening

for the good of our Health, or question our Identity, we exempt

ourselves from present reality as effectively as if we were under orders

to Stay Home.

And the powers that should not be can tell us anything they like, even that it’s sunny outside.