I should have a post it on my computer that in 2023 nobody reads long articles anymore. People prefer to have the gist of any article in two lines and if they are interested get the three reasons why this is so below. Fine.

In other words, the complexity of our society has exceeded what the available input of energy allows and almost everything we do from now on will change nothing to this fact. We are going down to a simpler paradigm. Slower when we do the right things. Faster otherwise. Governments will redistribute the chairs on the deck of the Titanic by giving more to those they believe deserve it or more cynically those who have the power to get more and less to everybody else. At the macro level, over the last 30 years, those who have benefited most have been the jet set elites and China which amazingly got 80% of its population out of poverty over this short time frame.

Authored by Gail Tverberg via Our Finite World blog,

Most

people have a simple, but wrong, idea about how the world economy will

respond to “not enough energy to go around.” They expect that oil prices

will rise. With these higher prices, producers will be able to extract

more fossil fuels so the system can go on as before. They also believe

that wind turbines, solar panels and other so-called renewables can be

made with these fossil fuels, perhaps extending the life of the system

further.

The insight people tend to miss is the fact that the

world’s economy is a physics-based, self-organizing system. Such

economies grow for many years, but ultimately, they collapse. The

underlying problem is that the population tends to grow too rapidly relative to the energy supplies necessary to support that population.

History shows that such collapses take place over a period of years.

The question becomes: What happens to an economy beginning its path

toward full collapse?

One of the major uses for fossil fuel energy

is to add complexity to the system. For example, roads, electricity

transmission lines, and long-distance trade are forms of complexity that

can be added to the economy using fossil fuels.

When energy per capita falls, it

becomes increasingly difficult to maintain the complexity that has been

put in place. It becomes too expensive to properly maintain roads,

electrical services become increasingly intermittent, and trade is

reduced. Long waits for replacement parts become common. These little

problems build on one another to become bigger problems. Eventually,

major parts of the world’s economy start failing completely.

When

people forecast ever-rising energy prices, they miss the fact that

market fossil fuel prices consider both oil producers and consumers.

From the producer’s point of view, the price for oil needs to be high

enough that new oil fields can be profitably developed. From the

consumer’s point of view, the price of oil needs to be sufficiently low

that food and other goods manufactured using oil products are

affordable. In practice, oil prices tend to rise and fall, and rise

again. On average, they don’t satisfy either the oil producers or the

consumers. This dynamic tends to push the economy downward.

There

are many other changes, as well, as fossil fuel energy per capita falls.

Without enough energy products to go around, conflict tends to rise.

Economic growth slows and turns to economic contraction, creating huge

strains for the financial system. In this post, I will try to explain a

few of the issues involved.

[1] What is complexity?

Complexity is anything that gives structure or organization to

the overall economic system. It includes any form of government or

laws. The educational system is part of complexity. International trade

is part of complexity. The financial system, with its money and debt, is

part of complexity. The electrical system, with all its transmission

needs, is part of complexity. Roads, railroads, and pipelines are part

of complexity. The internet system and cloud storage are part of

complexity.

Wind turbines and solar panels are only possible

because of complexity and the availability of fossil fuels. Storage

systems for electricity, food, and fossil fuels are all part of

complexity.

With all this complexity, plus the energy needed to

support the complexity, the economy is structured in a very different

way than it would be without fossil fuels. For example, without fossil

fuels, a high percentage of workers would make a living by performing

subsistence agriculture. Complexity, together with fossil fuels, allows

the wide range of occupations that are available today.

[2]

The big danger, as energy consumption per capita falls, is that the

economy will start losing complexity. In fact, there is some evidence

that loss of complexity has already begun.

In my most recent post, I mentioned that Professor Joseph Tainter, author of the book, The Collapse of Complex Societies,

says that when energy supplies are inadequate, the resulting economic

system will need to simplify–in other words, lose some of its

complexity. In fact, we can see that such loss of complexity started

happening as early as the Great Recession in 2008-2009.

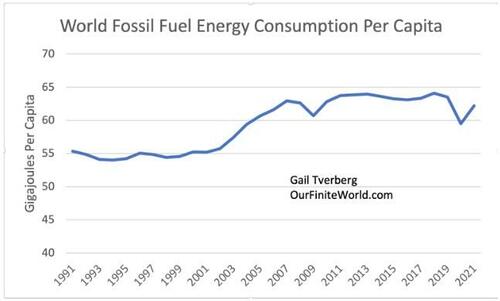

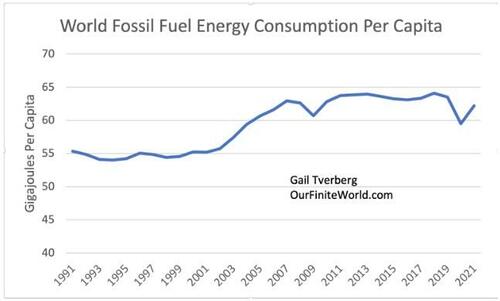

The world

was on a fossil fuel energy consumption per capita plateau between 2007

and 2019. It now seems to be in danger of falling below this level. It

fell in 2020, and only partially rebounded in 2021. When it tried to

rebound further in 2022, it hit high price limits, reducing demand.

Figure 2. Fossil fuel energy consumption per capita based on data of BP’s 2022 Statistical Review of World Energy.

There

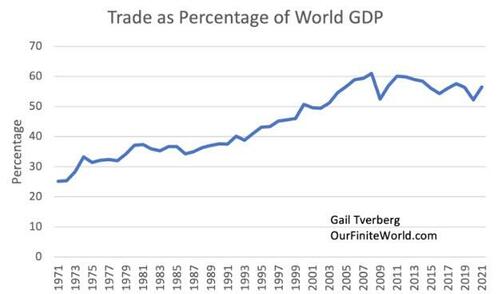

was a big dip in energy consumption per capita in 2008-2009 when the

economy encountered the Great Recession. If we compare Figure 2 and

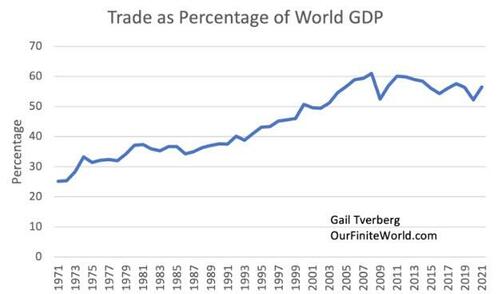

Figure 3, we see that the big drop in energy consumption is matched by a

big drop in trade as a percentage of GDP. In fact, the drop in trade

after the 2008-2009 recession never rebounded to the former level.

Figure 3. Trade as a percentage of world GDP, based on data of the World Bank.

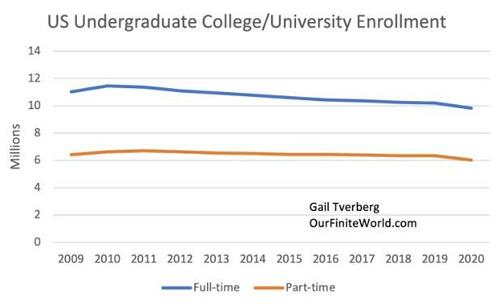

Another

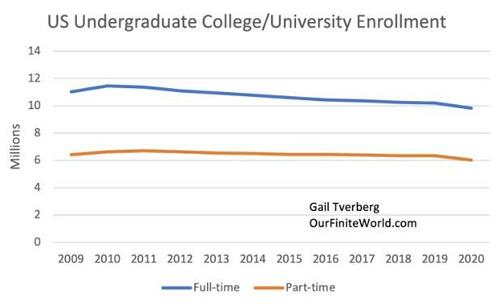

type of loss of complexity involves the drop in the recent number of

college students. The number of students was rising rapidly between 1950

and 2010, so the downward trend represents a significant shift.

Figure 4. Total number of US full-time and part-time undergraduate college and university students, according to the National Center for Education Statistics.

The

shutdowns of 2020 added further shifts toward less complexity. Broken

supply lines became more of a problem. Empty shelves in stores became

common, as did long waits for newly ordered appliances and replacement

parts for cars. People stopped buying as many fancy clothes. Brick and

mortar stores did less well financially. In person conferences became

less popular.

We know that, in the past, economies that collapsed

lost complexity. In some cases, tax revenue fell too low for governments

to maintain their programs. Citizens became terribly unhappy with the

poor level of government services being provided, and they overthrew the

governmental system.

The US Department of Energy states that it will be necessary to double or triple the

size of the US electric grid to accommodate the proposed level of clean

energy, including EVs, by 2050. This is, of course, a kind of

complexity. If we are already having difficulty with maintaining

complexity, how do we expect to double or triple the size of the US

electric grid? The rest of the world would likely need such an upgrade,

as well. A huge increase in fossil fuel energy, as well as complexity,

would be required.

[3] The world’s economy is a physics-based system, called a dissipative structure.

Energy

products of the right kinds are needed to make goods and services. With

shrinking per capita energy, there will likely not be enough goods and

services produced to maintain consumption at the level citizens are used

to. Without enough goods and services to go around, conflict tends to

grow.

Instead of growing and experiencing economies of scale,

businesses will find that they need to shrink back. This makes it

difficult to repay debt with interest, among other things. Governments

will likely need to cut back on programs. Some governmental

organizations may fail completely.

To a significant extent, how these changes happen is related to the maximum power principle,

postulated by ecologist Howard T. Odum. Even when some inputs are

inadequate, self-organizing ecosystems try to maintain themselves, as

best possible, with the reduced supplies. Odum said, “During

self-organization, system designs develop and prevail that maximize

power intake, energy transformation, and those uses that reinforce

production and efficiency.” As I see the situation, the self-organizing

economy tends to favor the parts of the economy that can best handle the

energy shortfall that will be taking place.

In Sections [4], [5],

and [6], we will see that this methodology seems to lead to a situation

in which competition leads to different parts of the economy (energy

producers and energy consumers) being alternately disadvantaged. This

approach leads to a situation in which the human population declines

more slowly than in either of the other possible outcomes:

Energy

producers win, and high energy prices prevail – The real outcome would

be that high prices for food and heat for homes would quickly kill off

much of the world’s population because of lack of affordability.

Energy

consumers always win, and low energy prices prevail – The real outcome

would be that energy supplies would fall very rapidly because of

inadequate prices. Population would fall quickly because of a lack of

energy supplies (particularly diesel fuel) needed to maintain food

supplies.

[4] Prices: Competition

between producers and customers will lead to fossil fuel energy prices

that alternately rise and fall as extraction limits are hit. In time,

this pattern can be expected to lead to falling fossil fuel energy

production.

Energy prices are set through competition between:

[a] The prices that consumers can afford to pay for end products whose

costs are indirectly determined by fossil fuel prices. Food,

transportation, and home heating costs are especially fossil fuel price

sensitive. Poor people are the most quickly affected by rising fossil

fuel prices.

[b] The prices that producers require to

profitably produce these fuels. These prices have been rising rapidly

because the easy-to-extract portions were removed earlier. For example,

the Wall Street Journal is reporting, “Frackers Increase Spending but See Limited Gains.”

If

fossil fuel prices rise, the indirect result is inflation in the cost

of many goods and services. Consumers become unhappy when inflation

affects their lifestyles. They may demand that politicians put price

caps in place to somehow stop this inflation. They may encourage

politicians to find ways to subsidize costs, so that the higher costs

are transferred to a different part of the economy. At the same time,

the producers need the high prices, to be able to fund the greater

reinvestment necessary to maintain, and even raise, future fossil fuel

energy production.

The conflict between the high price producers

need and the low prices that many consumers can afford is what leads to

temporarily spiking energy prices. In fact, food prices tend to spike,

too, since food is a kind of energy product for humans, and fossil fuel

energy products (oil, especially) are used in growing and transporting

the food products. In their book, Secular Cycles,

researchers Peter Turchin and Sergey Nefedov report a pattern of

spiking prices in their analysis of historical economies that eventually

collapsed.

With oil prices spiking only temporarily, energy

prices are, on average, too low for fossil fuel producers to afford

adequate funds for reinvestment. Without adequate funds for

reinvestment, production begins to fall. This is especially a problem as

fields deplete, and funds needed for reinvestment rise to very high

levels.

[5] Demand for Discretionary Goods and Services:

Indirectly, demand for goods and services, especially in discretionary

sectors of the economy, will also tend to get squeezed back by the

rounds of inflation caused by spiking energy prices described in Item

[4].

When customers are faced with higher prices because

of spiking inflation rates, they will tend to reduce spending on

discretionary items. For example, they will go out to eat less and spend

less money at hair salons. They may travel less on vacation. Multiple

generation families may move in together to save money. People will

continue to buy food and beverages since these are essential.

Businesses

in discretionary areas of the economy will be affected by this lower

demand. They will buy fewer raw materials, including energy products,

reducing the overall demand for energy products, and tending to pull

energy prices down. These businesses may need to lay off workers and/or

default on their debt. Laying off workers may further reduce demand for

goods and services, pushing the economy toward recession, debt defaults,

and thus lower energy prices.

We find that in some historical accounts of collapses, demand ultimately falls to close to zero. For example, see Revelation 18:11-13 regarding the fall of Babylon, and the lack of demand for goods, including the energy product of the day: slaves.

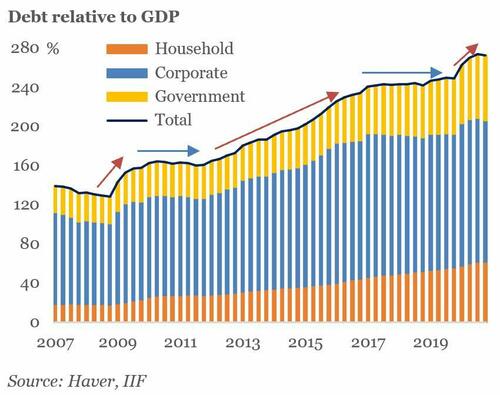

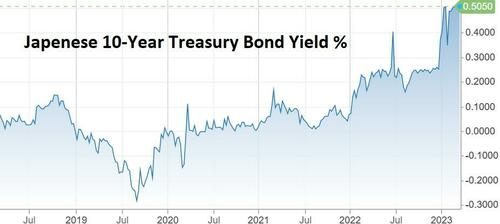

[6] Higher Interest Rates:

Banks will respond to rounds of inflation described in Item [4] by

demanding higher interest rates to offset the loss of buying power and

the greater likelihood of default. These higher interest rates will have

adverse impacts of their own on the economy.

If

inflation becomes a problem, banks will want higher interest rates to

try to offset the adverse impact of inflation on buying power. These

higher interest rates will tend to reduce demand for goods that are

often bought with debt, such as homes, cars, and new factories. As a

result, the sale prices of these assets are likely to fall. Higher

interest rates will tend to produce the same effect for many types of

assets, including stocks and bonds. To make matters worse, defaults on

loans may also rise, leading to write-offs for the organizations

carrying these loans on their balance sheets. For example, the used car

dealer Caravan is reported to be near bankruptcy because of issues related to falling used car prices, higher interest rates, and higher default rates on debt.

An

even more serious problem with higher interest rates is the harm they

do to the balance sheets of banks, insurance companies, and pension

funds. If bonds were previously purchased at a lower interest rate, the

value of the bonds is less at a higher interest rate. Accounting for

these organizations can temporarily hide the problem if interest rates

quickly revert to the lower level at which they were purchased. The real

problem occurs if inflation is persistent, as it seems to be now, or if

interest rates keep rising.

[7] A second major conflict

(after the buyer/producer conflict in Item [4], [5], and [6]) is the

conflict in how the output of goods and services should be split between

returns to complexity and returns to basic production of necessary

goods including food, water, and mineral resources such as fossil fuels,

iron, nickel, copper, and lithium.

Growing complexity in

many forms is something that we have come to value. For example,

physicians now earn high wages in the US. People in top management

positions in companies often earn very high wages. The top people in

large companies that buy food from farmers earn high wages, but farmers

producing cattle or growing crops don’t fare nearly as well.

As

energy supply becomes more constrained, the huge chunks of output taken

by those with advanced degrees and high positions within the large

companies gets to be increasingly problematic. The high incomes of

citizens in major cities contrasts with the low incomes in rural areas.

Resentment among people living in rural areas grows when they compare

themselves to how well people in urbanized areas are doing. People in

rural areas talk about wanting to secede from the US and wanting to form their own country.

There

are also differences among countries in how well their economies get

rewarded for the goods and services they produce. The United States, the

EU, and Japan have been able to get better rewards for the complex

goods that they produce (such as banking services, high-tech medicine,

and high-tech agricultural products) compared to Russia and the oil

exporting countries of the Middle East. This is another source of

conflict.

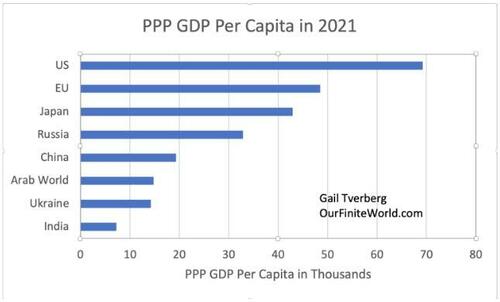

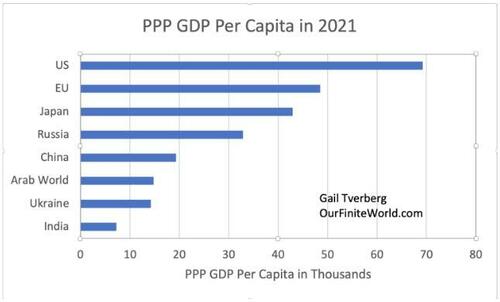

Comparing countries in terms of per capita GDP on a

Purchasing Power Parity (PPP) basis, we find that the countries that

focus on complexity have significantly higher PPP GDP per capita than

the other areas listed. This creates resentment among countries with

lower per-capita PPP GDP.

Figure 5. Average Purchasing Power Parity GDP Per Capita in 2021, in current US dollars, based on data from the World Bank.

Russia and the Arab World, with all their energy supplies, come out behind. Ukraine does particularly poorly.

The

conflict between Russia and Ukraine is between two countries that are

doing poorly on this metric. Ukraine is also much smaller than Russia.

It appears that Russia is in a conflict with a competitor that it is

likely to be able to defeat, unless NATO members, including the US, can

give immense support to Ukraine. As I discuss in the next section, the

industrial ability of the US and the EU is waning, making it difficult

for such support to be available.

[8] As conflict becomes a major issue, which economy is largest and is best able to defend itself becomes more important.

Figure 6. Total (not per capita) PPP GDP for the US, EU, and China, based on data of the World Bank.

Back

in 1990, the EU had a greater PPP GDP than did either the US or China.

Now, the US is a little ahead of the EU. More importantly, China has

come from way behind both the US and EU, and now is clearly ahead of

both in PPP GDP.

We often hear that the US is the largest economy,

but this is only true if GDP is measured in current US dollars. If

differences in actual purchasing power are reflected, China is

significantly ahead. China is also far ahead in total electricity

production and in many types of industrial output, including cement,

steel, and rare earth minerals.

The conflict in Ukraine is now

leading countries to take sides, with Russia and China on the same side,

and the United States together with the EU on Ukraine’s side. While the

US has many military bases around the world, its military capabilities

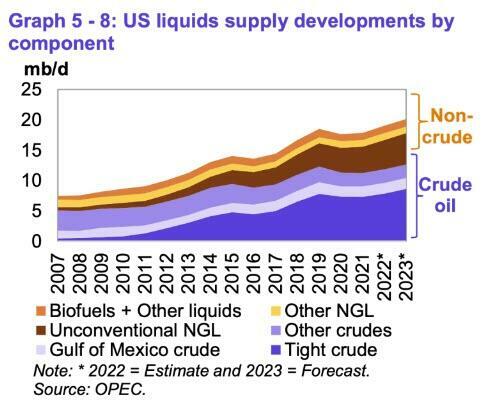

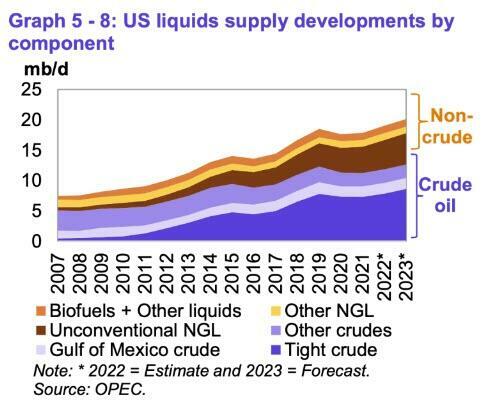

have increasingly been stretched thin. The US is a major oil producer,

but the mix of oil it produces is of lower and lower average quality,

especially if obtaining diesel and jet fuel from it are top priorities.

Figure

7. Chart by OPEC, showing the mix of liquids that now make up US

production. Even the “Tight crude” tends to be quite “light,” making it

less suitable for producing diesel and jet fuel than conventional crude

oil. Chart from OPEC’s February 2023 Monthly Oil Market Report.

Huge

pressure is building now for China and Russia to trade in their own

currencies, rather than the US dollar, putting pressure on the US

financial system and its status as the reserve currency. It is also not

clear whether the US would be able to fight on more than one front in a

conventional war. A conflict with Iran has been mentioned as a

possibility, as has a conflict with China over Taiwan. It is not at all

clear that a conflict between NATO and China-Russia is winnable by the

NATO forces, including the US.

It appears to me that, to save

fuel, more regionalization of trade is necessary with the Asian

countries being primary trading partners of each other, rather than the

rest of the world. If such a regionalization takes place, the US will be

at a disadvantage. It currently depends on supply lines stretching

around the world for computers, cell phones, and other high-tech

devices. Without these supply lines, the standards of living in the US

and the EU would likely decline quickly.

[9] Clearly, the

narratives that politicians and the news media tell citizens are under

pressure. Even if they understand the true situation, politicians need a

different narrative to tell voters and young people wondering about

what career to pursue.

Every politician would like a

“happily ever after” story to tell citizens. Fortunately, from the point

of view of politicians, there are lots of economists and scientists who

put together what I call “overly simple” models of the economy. With

these overly simple models of the economy, there is no problem ahead.

They believe the standard narrative about oil and other energy prices

rising indefinitely, so there is no energy problem. Instead, our only

problem is climate change and the need to transition to green energy.

The

catch is that our ability to scale up green energy is just an illusion,

built on the belief that complexity can scale up indefinitely without

the use of fossil fuels.

We are left with a major problem: Our

current complex economy is in danger of degrading remarkably in the next

few years, but we have no replacement available. Even before then, we

may need to do battle, in new ways, with other countries for the limited

resources that are available.