A very interesting talk! NATO has made Ukraine existential and likewise it is for Russia. A hard stance against an unmovable position. What will give?

Making sense of the world through data The focus of this blog is #data #bigdata #dataanalytics #privacy #digitalmarketing #AI #artificialintelligence #ML #GIS #datavisualization and many other aspects, fields and applications of data

Thursday, April 25, 2024

Mark Sleboda: Russia has DESTROYED Ukraine's Army and Putin's Next Move has NATO Worried (Video - 31mn)

Cashless Society: WEF Boasts That 98% Of Central Banks Are Adopting CBDCs

Short of a nuclear war, CBDC is THE most dangerous tool lurking in our future. The digital part of it has nothing to do with "digital", 95% of our money is already digital and everything to do with the suppression of cash and the anonymity it offers. Once we have CBDC, we're all "naked". We cannot get make a move literally, without first the Central Bank Knowledge, then later their approval. This would be the fastest path to tyranny imaginable.

Whatever happened to the WEF? One minute they were everywhere in the media and now they have all but disappeared from public discourse. After the pandemic agenda was defeated and the plan to exploit public fear to create a perpetual medical autocracy was exposed, Klaus Schwab and his merry band of globalists slithered back into the woodwork. To be sure, we'll be seeing them again one day, but for now the WEF has relegated itself away from the spotlight and into the dark recesses of the Davos echo chamber.

Much of their discussions now focus on issues like climate change or DEI (Diversity, Equity, Inclusion), but one vital subject continues to pop up in the white papers of global think tanks and it's a program that was introduced very publicly during covid. Every person that cares about economic freedom should be wary of Central Bank Digital Currencies (CBDCs) as perhaps the biggest threat to human liberty since the attempted introduction of vaccine passports.

The WEF recently boasted in a new white paper that 98% of all central banks are now pursuing CBDC programs. The report, titled 'Modernizing Financial Markets With Wholesale Central Bank Digital Currency', notes:

“CeBM is ideal for systemically important transactions despite the emergence of alternative payment instruments...Wholesale central bank digital currency (wCBDC) is a form of CeBM that could unlock new economic models and integration points that are not possible today.”

The paper primarily focuses on the streamlining of crossborder transactions, an effort which the Bank for International Settlements (BIS) has been deeply involved in for the past few years. It also highlights an odd concept of differentiated CBDC mechanisms, each one specifically designed to be used by different institutions for different reasons. Wholesale CBDCs would be used only by banking institutions, governments and some global corporations, as opposed to Retail CBDCs which would be reserved for the regular population.

How the value and buying power of Wholesale CBDCs would differ is not clear, but it's easy to guess that these devices would give banking institutions a greater ability homogenize international currencies and transactions. In other words, it's the path to an eventual global currency model. By extension, the adoption of CBDCs by governments and global banks will ultimately lead to what the WEF calls "dematerialization" - The removal of physical securities and money. The WEF states:

"As with the Bank of England’s (BOE) RTGS modernization programme, the intention is to introduce a fully digitized securities system that is future-proofed for incremental adoption of DLT (Distributed Ledger Technology). The tokenization of assets involves creating digital tokens representing underlying assets like real estate, equities, digital art, intellectual property and even cash. Tokenization is a key use case for blockchain, with some estimates pointing towards $4-5 trillion in tokenized securities on DLTa by 2030."

Finally, they let the cat out of the bag:

"The BIS proposed two models for bringing tokenization into the monetary system: 1) Bring CBDCs, DTs and tokenized assets on to a common unified ledger, and 2) pursue incremental progress by creating interlinking systems.

They determined the latter option was more feasible given that the former requires a reimagination of financial systems. Experimentation with the unified ledger concept is ongoing."

To interpret this into decoded language - The unified ledger is essentially another term for a one world digital currency system completely centralized and under the control of global banks like the BIS and IMF. The WEF and BIS are acknowledging the difficulty of introducing such a system without opposition, so, they are recommending incremental introduction using "interlinking systems" (attaching CBDCs to paper currencies and physical contracts and then slowly but surely dematerializing those assets and making digital the new norm). It's the totalitarian tip-toe.

The BIS predicts there will be at least 9 major CBDCs in circulation by the year 2030; this is likely an understatement of the intended plan. Globalists have hinted in the past that they prefer total digitization by 2030.

A cashless society would be the end game for economic anonymity and freedom in trade. Unless alternative physical currencies are widely adopted in protest, CBDCs would make all transactions traceable and easily interrupted by governments and banks. Imagine a world in which all trade is monitored, all revenues are monitored and transactions can be blocked if they are found to offend the mandates of the system. Yes, these things do happen today, but with physical cash they can be circumvented.

Imagine a world where your ability to spend money

can be limited to certain retailers, certain services, certain products

and chosen regions based on your politics, your social credit score and

your background. The control that comes with CBDCs is immense and

allows for complete micromanagement of the population. The fact that

98% of central banks are already adopting this technology should be one

of the biggest news stories of the decade, yet, it goes almost

completely ignored.

Wednesday, April 24, 2024

"They Think There Are Too Many Of Us On The Planet" - Alex Newman Warns Of Tyrannical UN Plans For Our Future

I just post this as food for thought, but clearly we are approaching a critical mass of over-population. Can we solve it?

Via Greg Hunter’s USAWatchdog.com,

Award-winning journalist Alex Newman, author of the popular book “Deep State” and the new best-selling book called “Indoctrinating Our Children to Death,” says the UN’s quest for total tyrannical control of your life is coming sooner than you could imagine.

Newman explains, “The bigger story here that people are not paying attention to is the UN is coming together in September... and they are having ‘The Summit of the Future.’ "

"They are telling us they are going to bring out radical drastic reforms in the structure of the UN... and the power of the UN. Think of it as the biggest power grab ever at the global level. The Secretary General of the UN (António Guterres) has put out briefs where he is calling for the UN to be the one world global dictatorship with him at the helm. In emergencies, the UN would have all power in emergencies and have all power to oversee emergency response...

They say the crisis could be a climate crisis, an economic crisis, environmental crisis, pandemic crisis, black swan crisis or maybe something from outer space. So, basically, anything could be a crisis, and when the Secretary General declares a crisis, all power and authority would go to the UN. This is like a blank check on the wealth and liberty on every person on the planet, and this is coming soon. It is imminent. This is coming in September at the UN, and it is a power grab of historic proportions.

They know their time is short, and they are going for the big enchilada here. This is really a summit for a tyrannical future...

They want control of every aspect of your life.”

If you think the “depopulation” or murder program by the Deep State is some sort of conspiracy theory or myth, think again. Newman says:

“One of the interesting things about going to the UN conferences is they are totally open and totally transparent about the fact that they think there are way too many of us on this planet.

We are taking up their space and consuming their resources. They say this openly.

They say there are way too many people having way too many babies, and we have to drastically cut back on the number of people on the planet. They have a whole agency dedicated to this called the UN Population Fund.”

One sure fire way to kill a lot of people in a short amount of time is war. Newman says:

“They have understood, the globalists, the Deep State, the evil doers and the sick cabal, have understood for a very long time that war was the best mechanism for bringing about their totalitarian one world government.

This is not speculation on my part. This is what they say. Their game plan is war, famine, energy crisis and economic crisis. These are all tools and catalysts for accelerating this agenda.

If millions of people die in a third world war, and it does not matter if it is Iran and Israel, or China and Tiawan, or Ukraine and Russia, it really does not matter, they want millions and millions of people dead so people will give up their attachment to the nation state, self-government and individual liberty and give up anything, money or freedom, anything to make it stop.”

Don’t lose hope because Newman also talks about all the things you can do to not comply with tyranny.

Newman also points out what state and local governments can do and are doing to resist this UN total control of everything. Newman says, “We are at war, and everyone needs to put on the full armor of God.”

Germany Arrests EU Parliament Aide On China Espionage Charges

Poor Olaf, he is not back from China from his extremely successful trip and that!

His trip to go to China where he was sent to ask the Chinese if they wouldn't like to slow down their growth among other absurdities reminded me of one of my very first mission when I was sent by my employer, Nomura Securities at the time, to the Japan Ministry of Finance to submit a new idea to issue Long term (2 years) commercial paper. "You little Sh*t are coming here to tell us what we should do?" Most certainly a good lesson but at least nobody sent an insulting letter after the meeting and I enjoyed good relations with the MoF thereafter. I am less sure about Olaf Scholz.

Spying is not a good thing but everybody does it and normally you settle these cases discretely by sending a spy to prison and a couple of diplomats back to their country. Now, in the footstep of the US, Europe is trying to get tough with China expecting the same action (as for Russia) will have a different result. Isn't it the definition of stupidity?

It is the proof that the people behind the curtain want to raise tensions which in any case China was already well aware of. We're slowly getting closer to the stage when China will have to take counter measures. A complete crash of the Ukrainian army which could happen in the coming months could very well be the trigger.

A staffer who worked for a high profile German member of European Parliament for years has been arrested on charges of spying for Chinese intelligence, Germany’s federal prosecutor’s office announced on Tuesday.

Identified only as Jian G., he had reportedly been a staff member for German MEP Maximilian Krah going back to 2019. Krah is with what mainstream media commonly dubs the "far-right" AfD (Alternative for Germany party).

"In January 2024 the accused repeatedly shared information about negotiations and decisions in the European Parliament with his intelligence service employer," the prosecutors office said.

The suspect has also been accused of spying on and monitoring Chinese opposition communities inside Germany. Beijing has long been suspected in the West, including the US, of keeping close tabs on the political leanings and activism of expat enclaves via a network of spies connected to consulates.

German interior minister Nancy Faeser subsequently announced on X, "If it is confirmed that there was espionage for Chinese intelligence services from within the European Parliament, then that would be an attack on European democracy from within. Whoever employs such a person carries responsibility."

The investigation into "Jian G", who was detained Monday, was led by German domestic intelligence services. Recent days and weeks have seen other arrests in Europe of suspected Chinese spies, including a couple in the UK in recent days.

On Tuesday China's foreign minister reacted by denouncing the "hype" surrounding such cases, describing it as more anti-China propaganda aimed at political manipulation and to ratchet pressure on Beijing.

According to Politico, "The bombshell arrest, which rocks the AfD while it polls in second place nationally, sparked calls from one top European lawmaker for a tougher crackdown on Chinese and Russian infiltrators attempting to influence EU democracy."

Tuesday, April 23, 2024

A $250 Million War Game And Its Shocking Outcome

War is the ultimate game theory application: Very easy to see the outcome after, almost impossible before.

The coming war should not happen. It is a war of choice entirely due to economic factors. Still, at this stage, it is very hard to see what will prevent it. Not to prepare for it would be foolish. Most world leaders are fools, but not for war, they either are or will soon prepare making the outcome all the more certain.

The Greeks were right: If they are any deity up there, they must be amused by our struggles and tribulations. It cannot be otherwise!

Authored by Nick Giambruno via InternationalMan.com,

At a cost of $250 million, Millennium Challenge 2002 was the largest and most expensive war game in Pentagon history.

With over 13,500 participants, the US government took over two years to design it.

The exercise pitted Iran against the US military. Washington intended to show how the US military could defeat Iran with ease.

Paul Van Riper, a three-star general and 41-year veteran of the Marine Corps, led Iranian forces in the war game. His mission was to take on the full force of the US military, led by an aircraft carrier battle group and a large amphibious landing force in the Persian Gulf.

The results shocked everyone…

Van Riper waited for the US Navy to pass through the shallow and narrow Strait of Hormuz, which made them sitting ducks for Iran’s unconventional and asymmetric warfare techniques.

The idea is to level the playing field against a superior enemy with swarms of explosive-laden suicide speedboats, low-flying planes carrying anti-ship missiles, naval mines, and land-based anti-ship ballistic missiles, among other low-cost but highly effective measures.

In minutes, Van Riper emerged victorious over his superior opponent and sank all 19 ships. Had it been real life, 20,000 US sailors and marines would have died.

Millennium Challenge 2002 was a complete disaster for the Pentagon, which had spent a quarter of a billion dollars to set up the extensive war game. It produced the exact opposite outcome they wanted.

So what did the Pentagon do with these humbling results?

Like a child playing a video game, they hit the reset button. They then rigged and scripted the game so that the US was guaranteed to win.

After realizing the integrity of the war game had been compromised, a disgusted Van Riper walked out mid-game. He then said:

“Nothing was learned from this. And a culture not willing to think hard and test itself does not augur well for the future.”

The main lesson of Millennium Challenge 2002 is that aircraft carriers—the biggest and most expensive ships ever built—wouldn’t last a single day in combat against even a regional power like Iran. Russia and China would have an even easier time dispatching them. They are overpriced toys.

That means the US has wasted untold trillions on military hardware that could prove to be worthless in a serious conflict.

Nonetheless, the US government still parades aircraft carriers around the world from time to time to try to intimidate its enemies.

However, it’s a flawed strategy prone to catastrophic results if someone calls their bluff.

While Millennium Challenge 2002 occurred more than 20 years ago, it is of paramount importance today.

Iran has substantially improved its asymmetric and unconventional warfare capabilities. It’s doubtful the US military would fare much better today than 20 years ago.

In short, war with Iran today could be even more disastrous than the Millennium Challenge 2002 simulation.

Unfortunately, war with Iran is an increasingly probable outcome as tensions in the Middle East are at their highest point in generations and are trending higher.

Previously, I lived in Beirut, Lebanon, for several years while working for an investment bank. The experience was effectively an advanced training course in Middle East geopolitics. Today, it helps me see the big picture in the region… and unfortunately, it isn’t pretty.

I think the next big war in the Middle East is coming soon and could be the biggest one ever. It will focus on Iran.

The market doesn’t appreciate how close we are to a big war and the implications of it.

But this distortion in the market is a blessing. It’s handing us a golden opportunity.

First and foremost, I think there’s a huge opportunity to profit in the oil market right now.

I’m certainly not cheering for war. I despise war, which is the health of the State.

Regardless, a big war is highly likely, with significant investment implications that would be foolish to ignore.

In short, we are only one escalation away from potentially the biggest oil shock in history as the Middle East is on the verge of the largest regional war in generations.

IT'S COMING... They Just Signed Off THIRD WORLD WAR! by Russell Brand (Video - 12mn)

Difficult to disagree at this stage! But as Alexander Mercouris argued in our previous video, isn't the US biting more than it can chew? So they want war in Ukraine, the Middle East and the China Sea? Really?

Haven't these fools learned anything from history? China today has, relatively to other countries, the industrial power the US had just before the Second World War. Wouldn't that be argument enough to pose and think twice? This is exactly the mistake the Japanese military government made in 1941 in spite of the warning of Admiral Yamamoto.

And then there is the silent majority of the World population. Will 6 billion people really support the Western Hegemony?

Think harder, fools!

Bad cop Blinken to deliver ultimatum to China (Video - 19mn)

The analysis of Alexander Mercouris is excellent. I recently listened to a speech about the Ukraine war where he linked spectacularly the tactical and strategic levels of the war. This requires knowledge and understanding, the two basic elements fundamentally missing from the soundbites we get from Western leaders.

Here likewise, he gives an interesting perspective on the US China relations and why they are heading towards rather choppy waters.

Monday, April 22, 2024

World No.1 Biohacking Expert: I Tested 100,000 People's DNA. This Diet Will Kill You - Gary Brecka (Video - 1h44mn)

This is a long, very long video but one with the potential to change your life for the better as there is more health information in this video than in many other such documentaries.

In particular and to be specific, some very basic and simple techniques should be tested as they are rather simple: Grounding, having your bare feet on the ground (means Natural ground) Breath work, breathing deeply, with or without exercise (although it is of course better with) and Taking the Sun The advise here is to get sunlight on your skin first thing in the morning. (Although any time you can is probably good enough.)

Here's the motivation: How much would you pay to extend your life? For most people the answer is quite a lot especially if it comes with good health. Then why won't you do it if it's free? Quackery? Maybe so but then again, why not try the free part of it? What is the risk?

When Will The Yen Carry Trade End?

A better question is: Can the Yen carry trade end?

A clear answer is: "No!" At $20 trillion the carry trade market if it blows is just big enough to crash the whole financial system. The monetary authorities know that of course and will therefore not let it happen. And so interest rates in Japan cannot go up and the Yen will continue weakening against other currencies. The Bank of Japan (BoJ) is stuck. They will buy some Euros and dollars to slow down the slide but they cannot raise interest rates. Everybody knows this and therefore can invest in this huge market safely knowing that when it blows, everyone's book, not just theirs, is toast.

The best analogy to this market is a pile of sand. It is impossible to know which grain of sand will crumble the pile although you can be certain that eventually one will!

Decades of negative interest rate policy in Japan have ended.

That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy.

The yen carry trade is when investors borrow yen to buy assets denominated in higher-yielding foreign currencies, like the USD, where interest rates are higher.

Even now that the BoJ is hiking rates, interest rates in Japan are still low, and will remain as such - the economy can’t handle too high of an uptick too fast after becoming dependent on NIRP. But the moment rates were raised above zero, the yen carry trade instantly became a far riskier gamble.

The yen has recently weakened against the dollar, keeping the carry trade attractive for now.

But if the BoJ starts dumping US Treasurys, sending yields up, and sacrificing stocks, a vicious cycle begins where the dollar strengthens against the yen to the point of the yen becoming practically worthless.

USD vs Yen, March 18 – April 17

Source: Bloomberg

Of course, it’s all relative. The yen is weak against the dollar, but with rampant inflation, the dollar is losing value too — just not as fast. When the media tells you the dollar is currently strong, what they’re really saying is that it’s strong compared to even weaker currencies. As Peter Schiff said on his podcast earlier this week:

“Part of what’s masking this problem is the relative strength of the dollar. And I say ‘relative’ because the dollar is actually weak. Gold tells you what’s actually happening: gold today hit a new all-time record high in every single currency…gold tells you the dollar is down. What the rising dollar index tells you in an environment of a rising gold price is that the dollar is losing value.”

As it is, foreign exchange markets make traders money without adding any real value. With a global monetary standard where each country’s currency is pegged to the price of gold, there wouldn’t be the same opportunity to trade on the short-term fluctuations across different currencies, the supply and borrowing cost of each one determined by a central authority. Foreign exchange markets could still exist, but their appeal would be drastically diminished.

Since they essentially allow traders to harvest profits without investing in or creating anything of actual material value, one is left wondering if all that capital would end up flowing into more productive ventures. Carry trades also rely on leveraged bets, which when they blow up, blow up hard.

Speaking of blowing up, the conflict in the Middle East just keeps getting worse, with a standoff between Iran and Israel threatening to go nuclear (perhaps literally) and drag in more foreign intervention. If oil spikes too hard against the yen, and the BoJ panics to save it, it could lead to a global margin call that begins a domino effect of imploding stock prices and a widespread economic collapse.

The BoJ has to let bond yields rise to counteract the weakening yen, bringing investors back to buying Japanese debt and pushing up bond yields in the US and EU. That means higher interest payments in the US and EU in the short term, which can only be paid with more borrowed money, creating a vicious feedback loop that stands to reveal the fundamental insolvency of major national economies.

Every action has an equal and opposite reaction — but when you’re leveraged to the gills, that reaction isn’t equal, it’s drastically magnified. Enough traders overcompensating at once can have disastrous effects in any market, but even more so when they’re trading with massive leverage.

With rate cuts still on the table (for now) in the US this year, the viability of the yen carry trade will be further eroded, narrowing the gap between interest rates on the two currencies.

The yen is becoming more volatile, and choppy Forex markets make carry trades risky since they rely on a predictable gap on the value and cost of borrowing between currencies.

And if the yen carry trade fully unwinds, the blow-up could be spectacular enough to take other parts of the economy out with it.

Sunday, April 21, 2024

Tit-For-Tat Responses From Beijing To Trade Restrictions May Bring About A Full-Blown Trade War

This is a market article so the emphasis is of course "market" although this is by far the least important aspect of what is going on between the West and China.

The truth of the matter is that China has now become an existential threat for Europe and the US which will now use the full might of their economic power to reign in the rising giant.

Unfortunately what did work for Japan will not work for China as relegating the country forever to a "middle range" power status would condemn China to economic ruin. This is therefore existential for China too and the Chinese government can therefore not let it happen. This means full economic war in the months ahead and actual war soon after. At this stage, this is almost unavoidable.

This didn't have to happen. The integration of China in the Western sphere of influence could have been wide enough to make room for the country. The reality is that this was never the plan. Hegemony doesn't share, it rules. The role offered to Russia was that of a second rate "gas station" or more broadly, provider of cheap raw materials. Would the Russians become reluctant with this second fiddle role, the alternative was to break up the country using the Ukraine war as a wedge. As for China, the perpetual status of also-ran provider of cheap plastic goods was seen as good enough for another 50 years. Too bad that the Chinese worked harder for longer than expected and that they had the brainpower to transcend the figurative role the Western elites offered them in their woke Hollywood B movie!

Tit-For-Tat Responses From Beijing To Trade Restrictions May Bring About A Full-Blown Trade War

By John Liu, Zhu Lin and Abhishek Vishnoi, Bloomberg Markets Live reporters and strategists

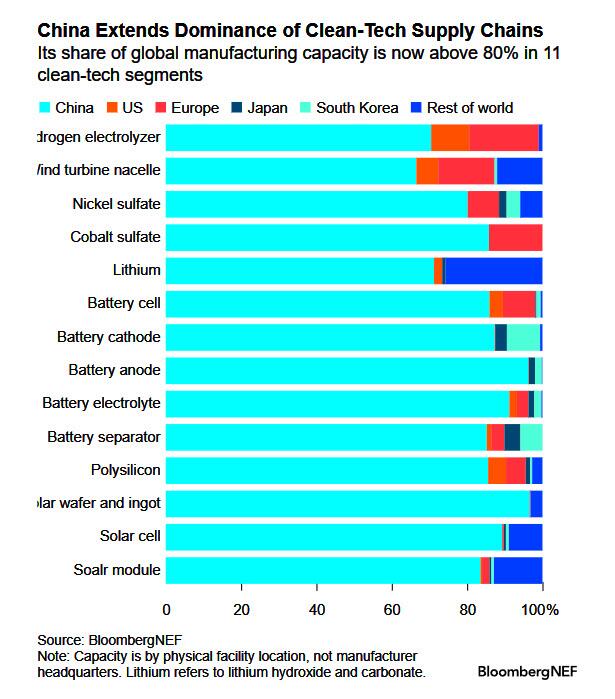

China’s most-promising industries are facing a growing threat of trade restrictions from Western governments, blurring the outlook for stocks that have the potential to fuel the nation’s market growth.

The sectors under scrutiny by Europe and the US are as wide-ranging as electric vehicles, wind and solar projects, medical devices and chips, but have one thing in common: they are of strategic importance to President Xi Jinping’s bid for leadership in the global race toward green transition and high-tech development.

The rising tensions come at an inopportune time. Stocks were starting to emerge from a multi-year slump as investors bought into China’s efforts to build new growth engines and achieve self-sufficiency along key supply chains. A materialization of those threats can hinder China’s global expansion, while tit-for-tat responses from Beijing may bring about a full-blown trade war that would drastically alter the investment landscape.

“Geopolitical pressures will only rise — any exports can be targeted since it’s no longer really about trade fairness,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “It dampens the export growth drivers for China’s economy.”

China’s CSI 300 Index has climbed about 3% this year, regaining some footing after a third-annual loss. Performances among leaders in the green and high-tech industry have been mixed as geopolitical risks add to concerns over oversupply and price competition.

Battery giant Contemporary Amperex Technology Co. Ltd has jumped nearly 17% onshore this year while EV leader BYD Co. has advanced 6%. Longi Green Energy Technology Co. and Semiconductor Manufacturing International Corp. have lost about 20% each.

The biggest Chinese firms that get at least a fifth of their revenue from exports command more than a 14% weight in the CSI 300, with many of them including CATL and BYD trading at a higher price-to-earnings ratio than the benchmark, according to data compiled by Bloomberg.

While trade spats have become a permanent feature in China-Western relations under Xi, recent months saw tensions worsen. The European Union has joined US-styled protectionist moves as a complex mix of national security concerns, economic and political considerations play out.

President Joe Biden’s call for tariffs as high as 25% on some Chinese steel and aluminum products shows how China-bashing will ratchet up in a presidential election year. In Europe, policymakers are responding to growing complaints from local manufacturers that China’s industrial overcapacity is crowding them out.

The range of targeted products largely overlap with Xi’s industrial priorities labeled “new productive forces.” Investors had been hunting for stock winners since the phrase was listed on Beijing’s top agenda in early March, triggering a brief rally in shares from robotics companies to chip makers.

“While the new productive forces may have policy tailwinds, these may be somewhat offset by rising geopolitical tensions, particularly in an election year where noise will likely increase,” said Marvin Chen, a strategist at Bloomberg Intelligence.

The focus is now on which sector will end up next in the crosshairs. EVs have so far been a key target, with Gavekal Research pointing to the EU’s worsening trade balance with China in the industry.

“The cyclical positioning of Europe and China points to the trade balance tipping in China’s favor,” Gavekal analysts Cedric Gemehl and Thomas Gatley wrote in a note dated April 15. European domestic demand is strengthening, which should spur more purchases of Chinese goods, while EU exports to China are likely to flat-line at best on weak demand, they said.

Shen Meng, director at Chanson & Co. in Beijing, expects lithium battery makers to face growing pressure. The industry falls under the category of clean tech and has been a top driver of China’s export growth in past years, he said. Key players include CATL, Eve Energy Co. and Gotion High-Tech Co.

In some sense, there’s a bright side to the tensions as they can help accelerate China’s industrial upgrade. A technical breakthrough by Huawei Technologies Co., which is not listed and faces US sanctions, has spurred a surge in the shares of its suppliers.

“While immediate impacts of such geopolitical tensions might constrain certain sectors temporarily, the long-term outcome could favor Chinese companies that innovate and adapt to changing regulatory and market dynamics,” said Tareck Horchani, head of prime brokerage dealing at Maybank Securities Pte.

The various restrictions mulled will also take time to deliver. A planned probe by Europe into Chinese medical devices procurement has sent stocks like Shenzhen Mindray Bio-Medical Electronics Co. plunging following the report, but most have since partially recovered their losses.

All things considered, the unpredictable nature of geopolitical tensions increases the risk of investing in Chinese stocks, an asset class that many were already avoiding due to regulatory uncertainties and a slowing economy.

“Any future EU protectionist moves against China will further impede trade and capital flows into the Chinese economy and add to the already heavy downward pressure on its stock market,” said Han Piow Liew, fund manager at Maitri Asset Management Pte. “What all these means is that investing in Chinese stocks in such an environment is an arduous endeavor requiring razor-like focus on stocks.”

Europe's Suicide Pact: Debt, War Economy, And The Climate Cult

What happens when your whole agenda is built around eco-madness? We are about to find out. Just as the Aztec's cosmology was built ar...

-

A rather interesting video with a long annoying advertising in the middle! I more or less agree with all his points. We are being ...

-

In a sad twist, from controlled news to assisted search and tunnel vision, it looks like intelligence is slipping away from humans alm...

-

A little less complete than the previous article but just as good and a little shorter. We are indeed entering a Covid dystopia. Guest Pos...